Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 8-24 (Algorithmic) (LO. 3) McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $330,700 in 2023 . The taxable

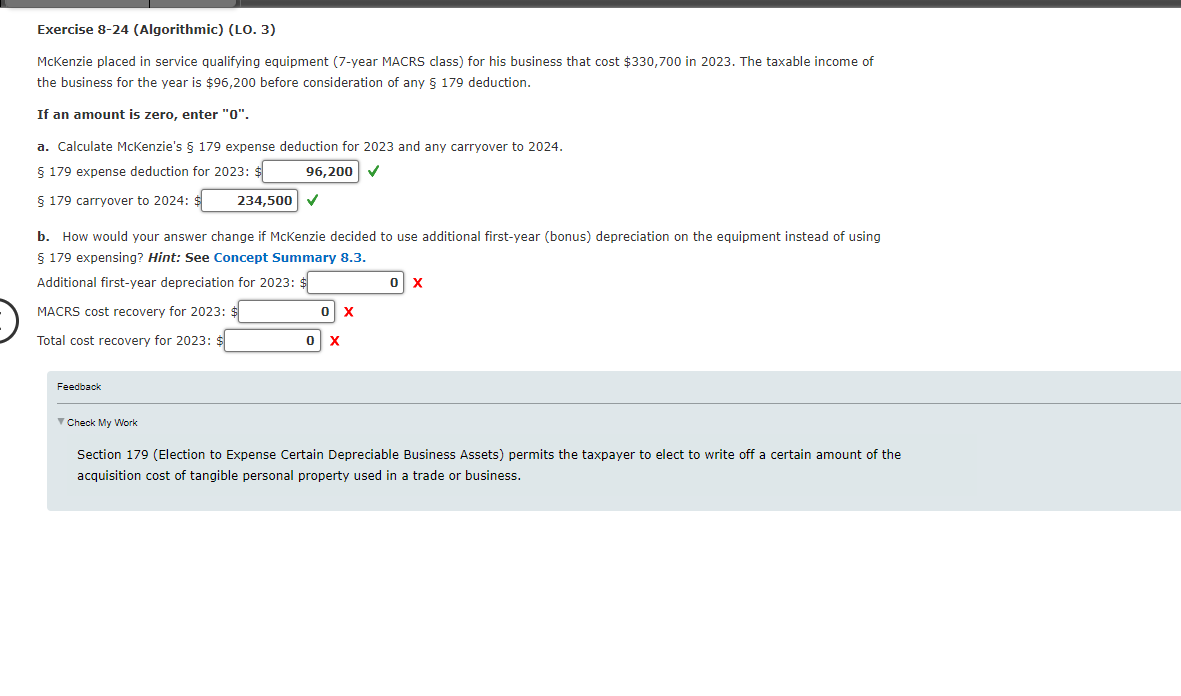

Exercise 8-24 (Algorithmic) (LO. 3) McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $330,700 in 2023 . The taxable income of the business for the year is $96,200 before consideration of any 179 deduction. If an amount is zero, enter " 0 ". a. Calculate McKenzie's 179 expense deduction for 2023 and any carryover to 2024 . 179 expense deduction for 2023: \$ 179 carryover to 2024:$ b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment instead of using 179 expensing? Hint: See Concept Summary 8.3. Additional first-year depreciation for 2023: $ X MACRS cost recovery for 2023: $ X Total cost recovery for 2023: $ X Feedback Check My Work Section 179 (Election to Expense Certain Depreciable Business Assets) permits the taxpayer to elect to write off a certain amount of the acquisition cost of tangible personal property used in a trade or business

Exercise 8-24 (Algorithmic) (LO. 3) McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $330,700 in 2023 . The taxable income of the business for the year is $96,200 before consideration of any 179 deduction. If an amount is zero, enter " 0 ". a. Calculate McKenzie's 179 expense deduction for 2023 and any carryover to 2024 . 179 expense deduction for 2023: \$ 179 carryover to 2024:$ b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment instead of using 179 expensing? Hint: See Concept Summary 8.3. Additional first-year depreciation for 2023: $ X MACRS cost recovery for 2023: $ X Total cost recovery for 2023: $ X Feedback Check My Work Section 179 (Election to Expense Certain Depreciable Business Assets) permits the taxpayer to elect to write off a certain amount of the acquisition cost of tangible personal property used in a trade or business Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started