Answered step by step

Verified Expert Solution

Question

1 Approved Answer

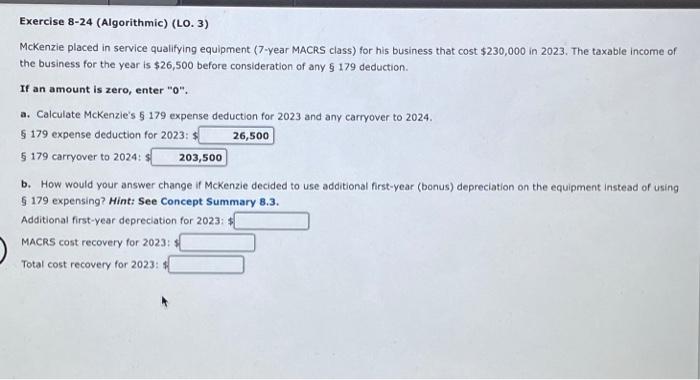

Exercise 8-24 (Algorithmic) (LO. 3) McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $230,000 in 2023. The taxable income

Exercise 8-24 (Algorithmic) (LO. 3) McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $230,000 in 2023. The taxable income of the business for the year is $26,500 before consideration of any 179 deduction. If an amount is zero, enter "0". a. Calculate McKenzie's 179 expense deduction for 2023 and any carryover to 2024. 179 expense deduction for 2023: $ 26,500 179 carryover to 2024: 203,500 b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment instead of using 179 expensing? Hint: See Concept Summary 8.3. Additional first-year depreciation for 2023: $ MACRS cost recovery for 2023: $ Total cost recovery for 2023: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started