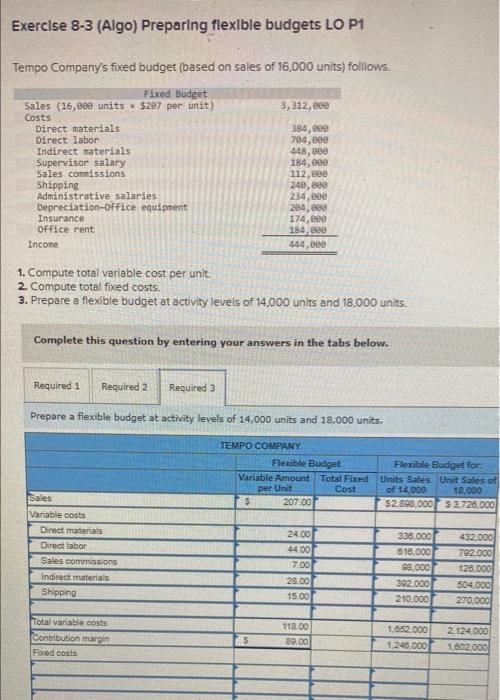

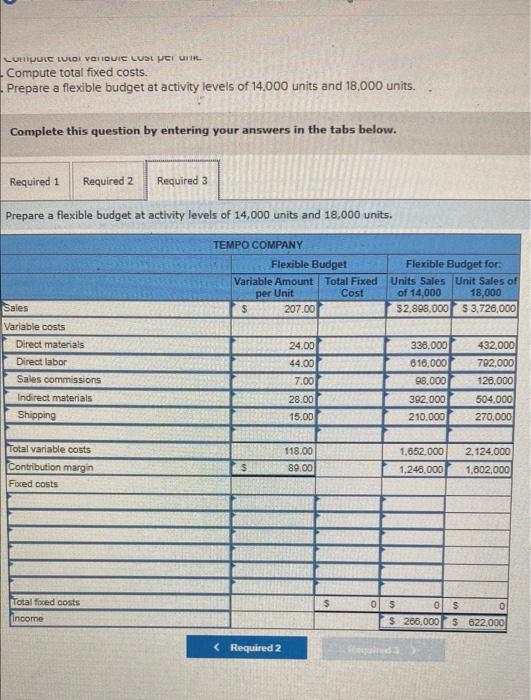

Exercise 8-3 (Algo) Preparing flexible budgets LO P1 Tempo Company's fixed budget (based on sales of 16,000 units) folllows. 3,312,800 Fixed Budget Sales (16,888 units * $207 per unit) Costs Direct materials Direct labor Indirect materials Supervisor salary Sales commissions Shipping Administrative salaries Depreciation-office equipment Insurance Office rent Income 384, Bee 784,800 448,888 184,00 112, Bee 248, see 234, Bee 284, Bee 174, eee 184, Bee 444, Bee 1. Compute total variable cost per unit 2. Compute total fixed costs. 3. Prepare a flexible budget at activity levels of 14.000 units and 18,000 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a flexible budget at activity levels of 14,000 units and 18,000 units. TEMPO COMPANY Flexible Budget Variable Amount Total Fixed Cost $ 207.00 per Unit Flexible Budget for Units Sales Unit Sales of of 14 000 18,000 52.890.000 $ 3.725,000 Sales Variable costs Direct materials Direct labor Sales commissions Indirect materials Shipping 24.00 44.00 7.00 338.000 510.000 98,000 292.000 210,000 432.000 792.000 125.000 504.000 270.000 28.00 15.00 Total variable costs Contribution margin Foxed costs 118.00 89.00 15 1.652.000 1.245.000 2.124.000 1.002.000 LUPUL LULOI VOITOVIC LUDLUCI UIR. Compute total fixed costs. Prepare a flexible budget at activity levels of 14.000 units and 18,000 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a flexible budget at activity levels of 14,000 units and 18,000 units. TEMPO COMPANY Flexible Budget Flexible Budget for Variable Amount Total Fixed Units Sales Unit Sales of Cost of 14,000 18,000 $ 207.00 $2.893,000 $ 3.726,000 per Unit 338,000 Sales Variable costs Direct materials Direct labor Sales commissions Indirect materials Shipping 24.00 44.00 7.00 816,000 98.000 432,000 792,000 120,000 504.000 270,000 28.00 15.00 392.000 210.000 1.652.000 Total variable costs Contribution margin Forced costs 118.00 89.00 2,124.000 1,602,000 $ 1.245.000 $ 0 Total foed costs Income $ $ 0 $ 200.000 $ 622.000