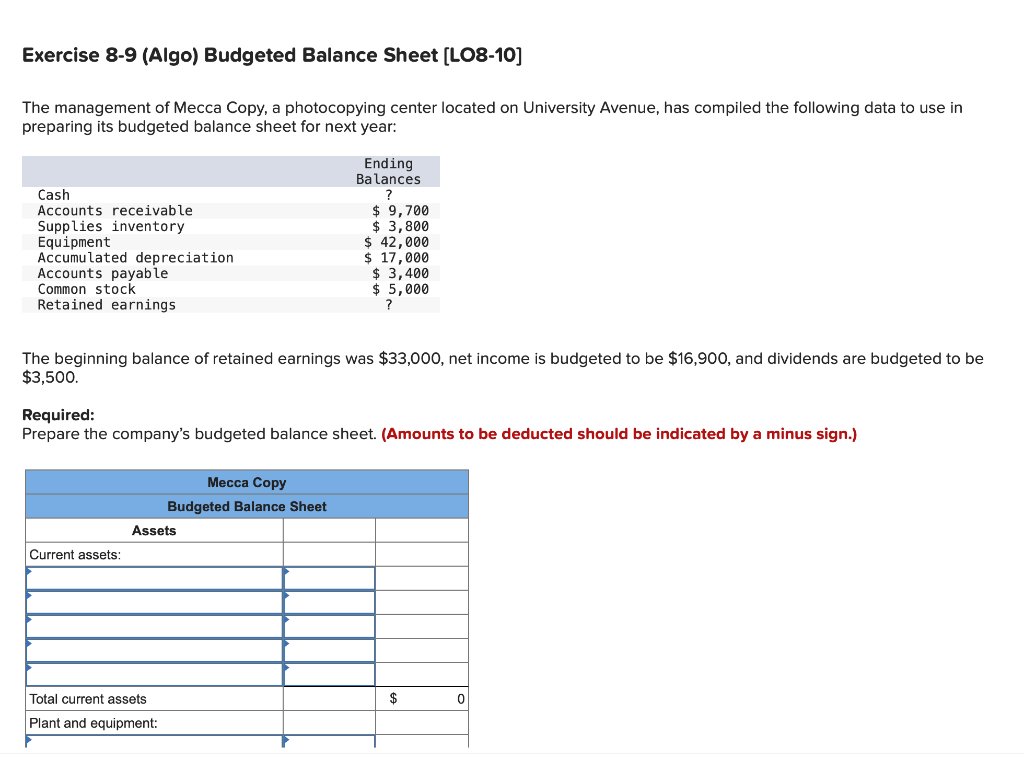

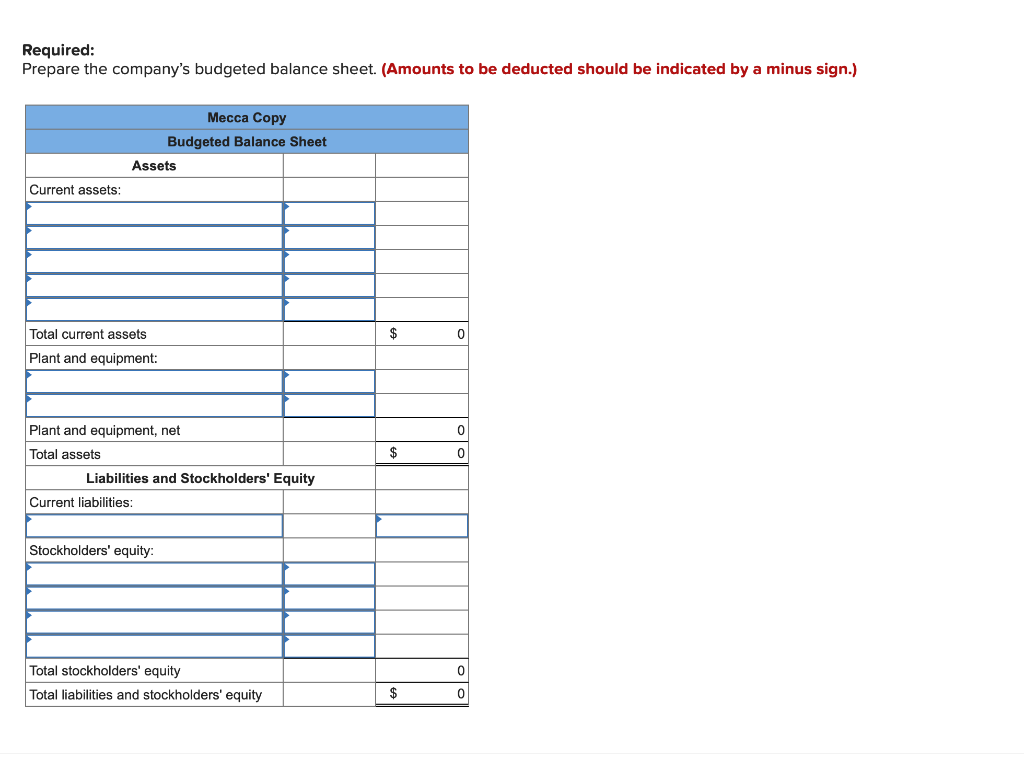

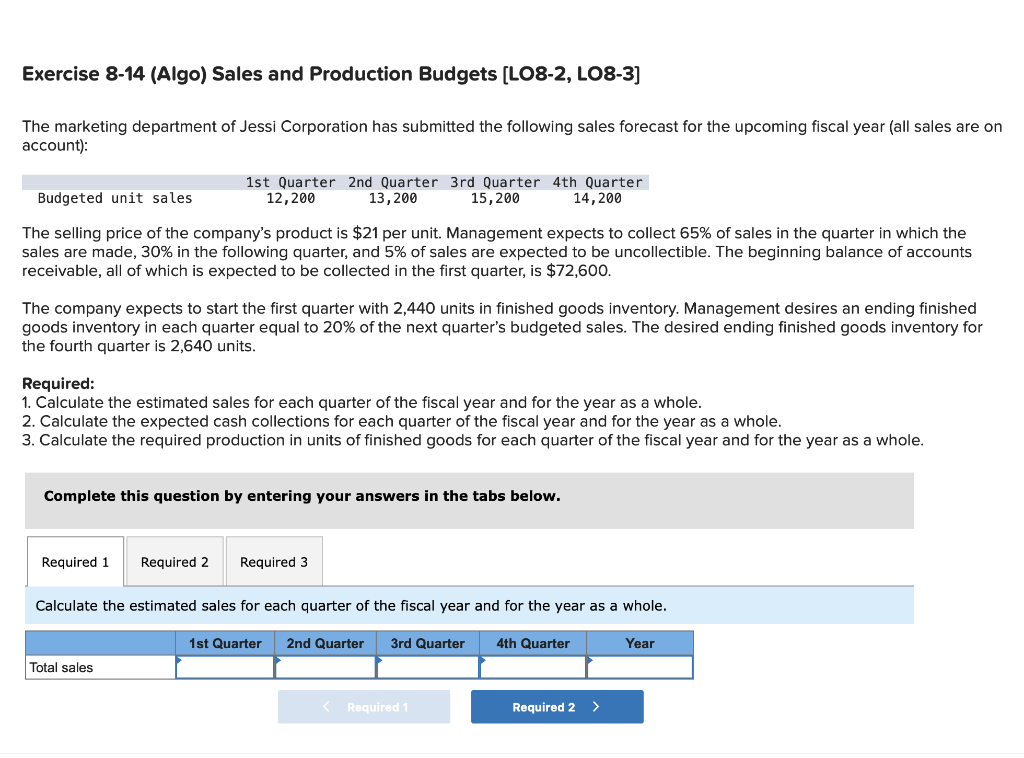

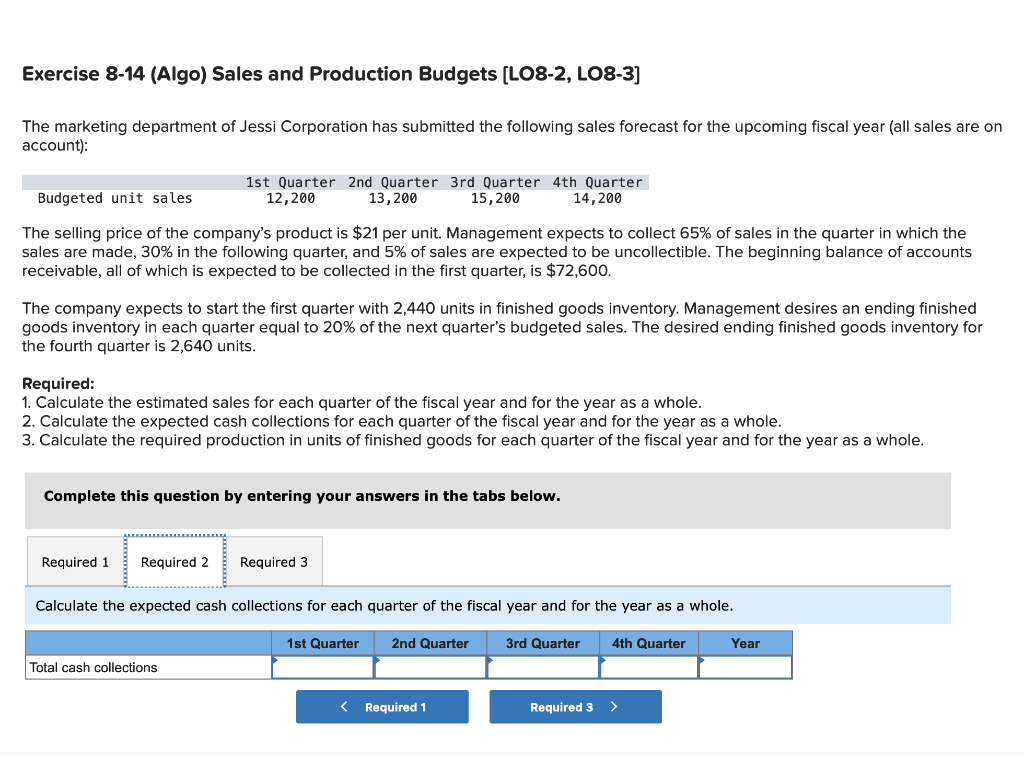

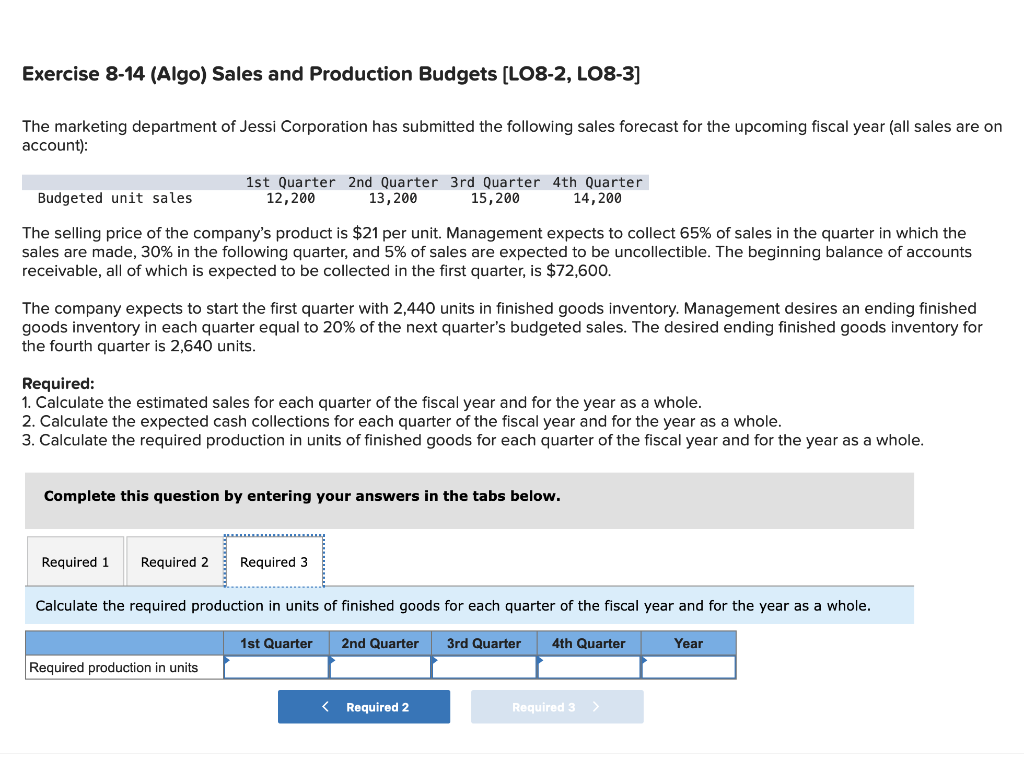

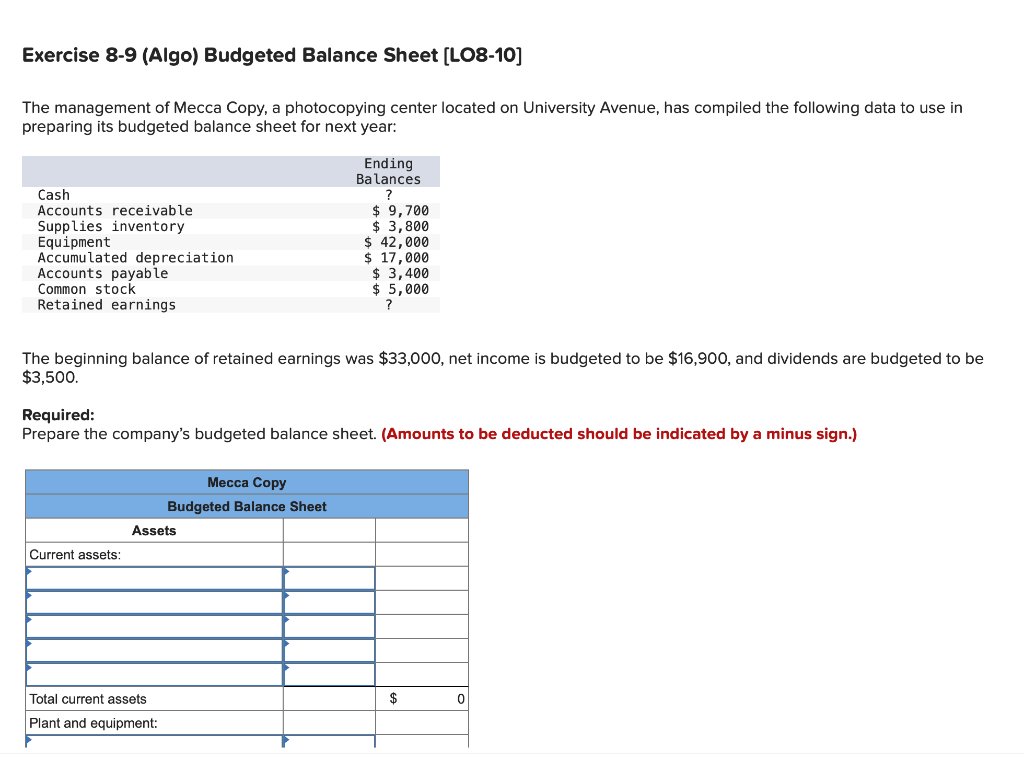

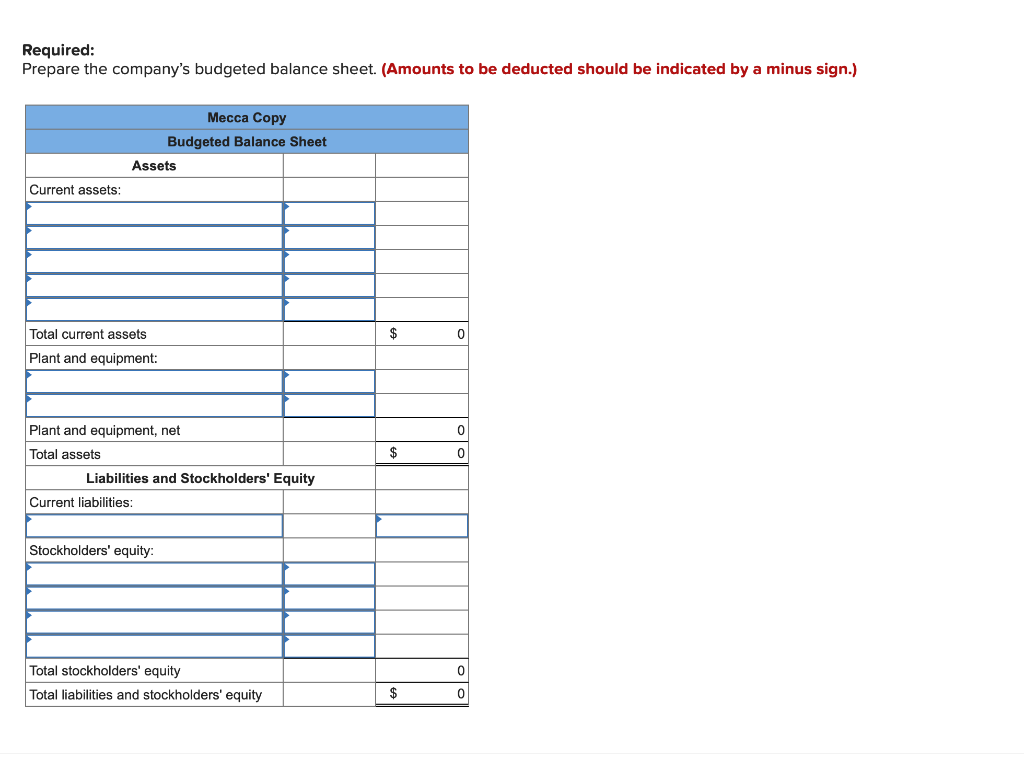

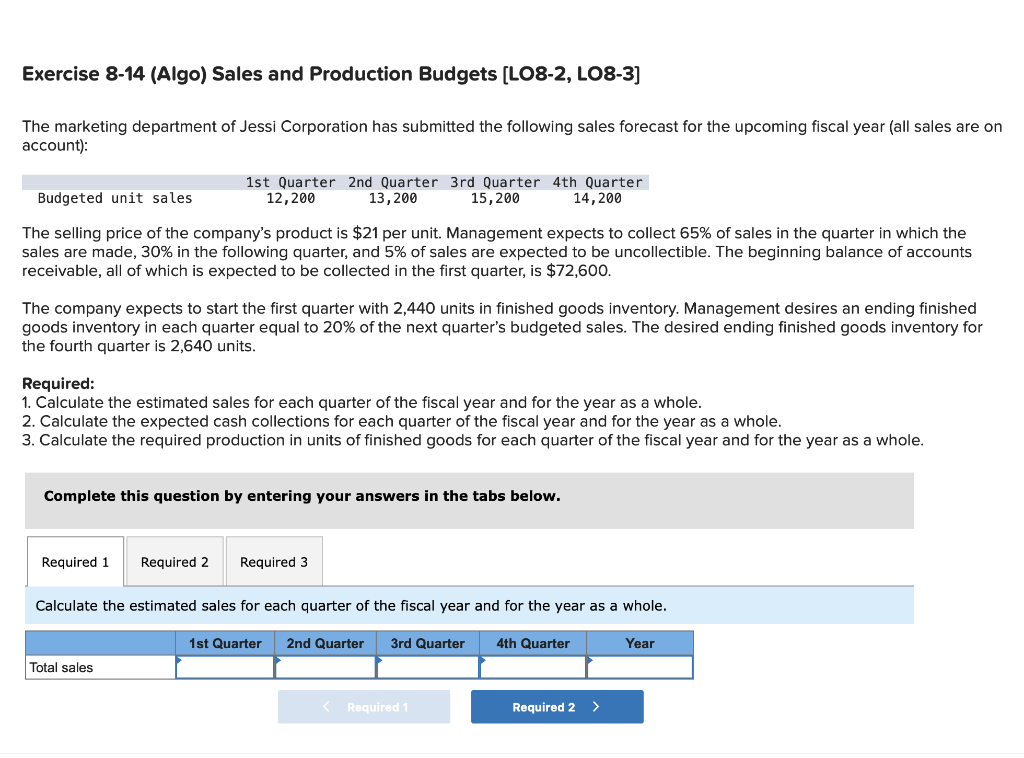

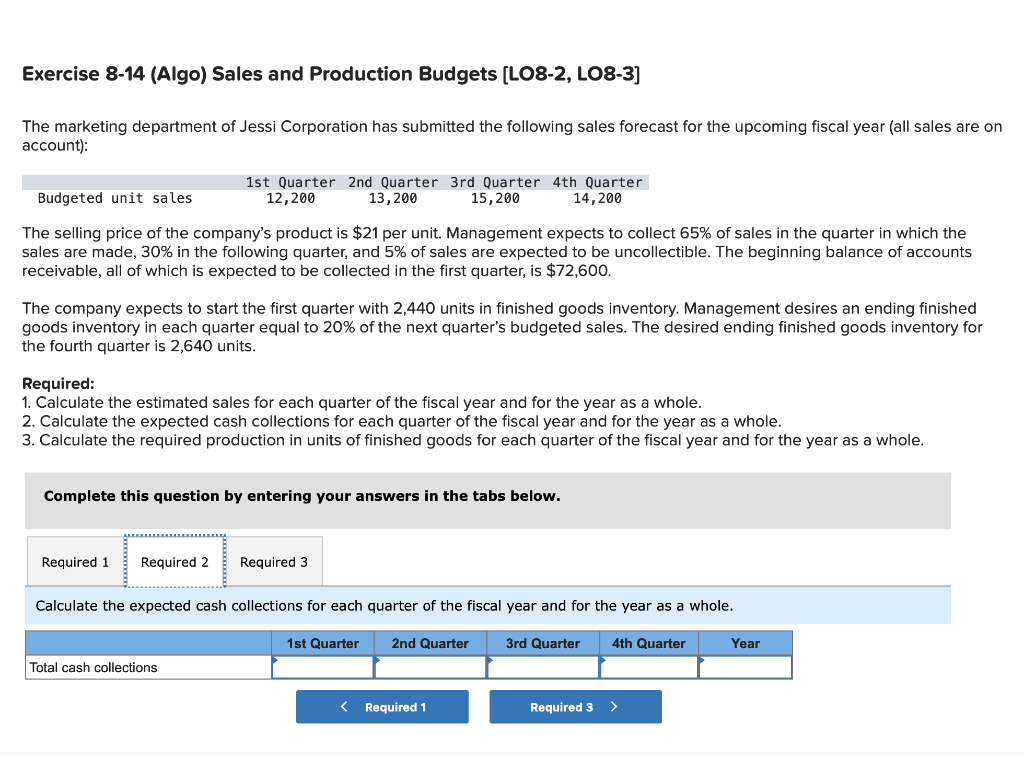

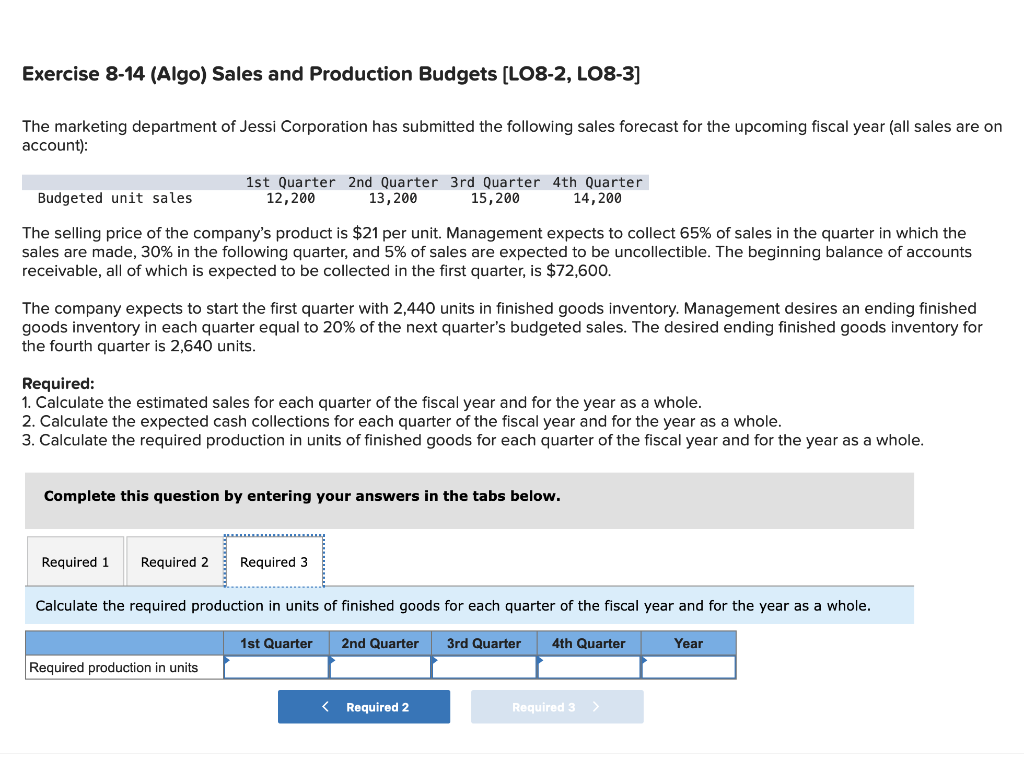

Exercise 8-9 (Algo) Budgeted Balance Sheet (L08-10] The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year: Cash Accounts receivable Supplies inventory Equipment Accumulated depreciation Accounts payable Common stock Retained earnings Ending Balances ? $ 9,700 $ 3,800 $ 42,000 $ 17,000 $ 3,400 $ 5,000 2 The beginning balance of retained earnings was $33,000, net income is budgeted to be $16,900, and dividends are budgeted to be $3,500. Required: Prepare the company's budgeted balance sheet. (Amounts to be deducted should be indicated by a minus sign.) Mecca Copy Budgeted Balance Sheet Assets Current assets: $ 0 Total current assets Plant and equipment: Required: Prepare the company's budgeted balance sheet. (Amounts to be deducted should be indicated by a minus sign.) Mecca Copy Budgeted Balance Sheet Assets Current assets: $ 0 Total current assets Plant and equipment: 0 $ 0 Plant and equipment, net Total assets Liabilities and Stockholders' Equity Current liabilities: Stockholders' equity: 0 Total stockholders' equity Total liabilities and stockholders' equity $ 0 Exercise 8-14 (Algo) Sales and Production Budgets (LO8-2, LO8-3] The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 12,200 13,200 15,200 14,200 Budgeted unit sales The selling price of the company's product is $21 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $72,600. The company expects to start the first quarter with 2,440 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2,640 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total sales Exercise 8-14 (Algo) Sales and Production Budgets (LO8-2, LO8-3] The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 12,200 13,200 15,200 14,200 Budgeted unit sales The selling price of the company's product is $21 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $72,600. The company expects to start the first quarter with 2,440 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2,640 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total cash collections Exercise 8-14 (Algo) Sales and Production Budgets (LO8-2, LO8-3] The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 12,200 13,200 15,200 14,200 Budgeted unit sales The selling price of the company's product is $21 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $72,600. The company expects to start the first quarter with 2,440 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2,640 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Required production in units