Question

Exercise 9-17 (Algo) Conventional and average cost retail methods; employee discounts [LO9-3, 9-4] LeMay Department Store uses the retail inventory method to estimate ending inventory

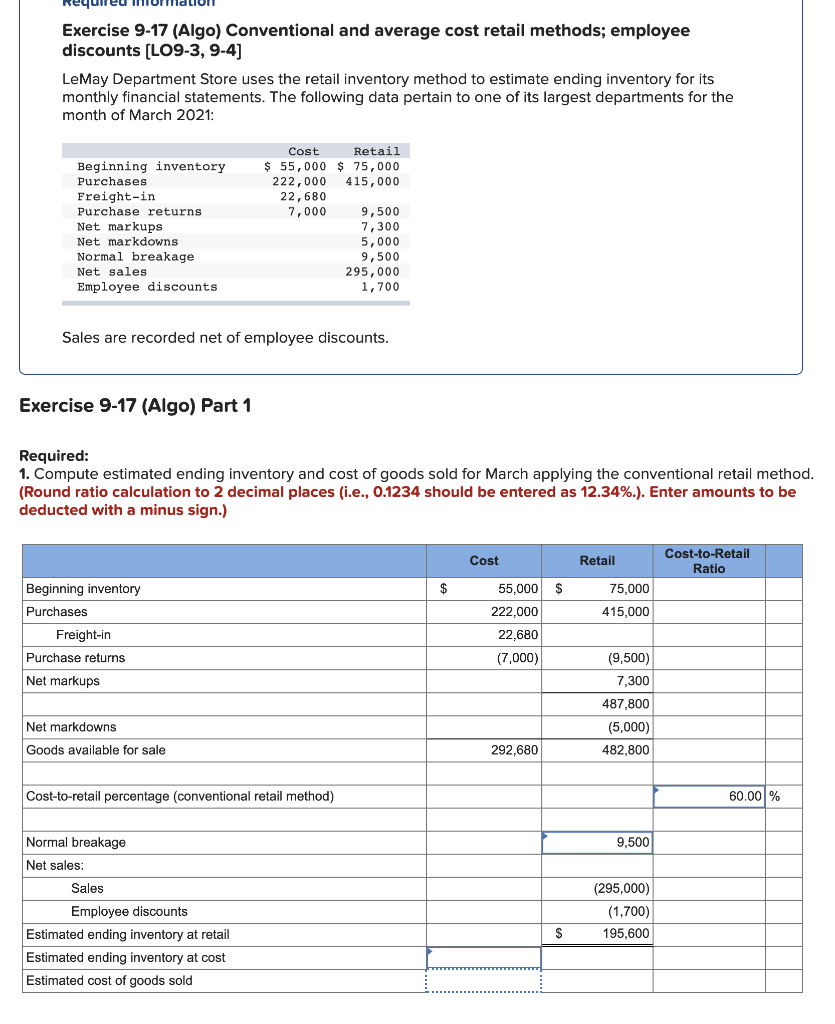

Exercise 9-17 (Algo) Conventional and average cost retail methods; employee discounts [LO9-3, 9-4]

LeMay Department Store uses the retail inventory method to estimate ending inventory for its monthly financial statements. The following data pertain to one of its largest departments for the month of March 2021:

| Cost | Retail | |||

| Beginning inventory | $ | 55,000 | $ | 75,000 |

| Purchases | 222,000 | 415,000 | ||

| Freight-in | 22,680 | |||

| Purchase returns | 7,000 | 9,500 | ||

| Net markups | 7,300 | |||

| Net markdowns | 5,000 | |||

| Normal breakage | 9,500 | |||

| Net sales | 295,000 | |||

| Employee discounts | 1,700 | |||

Sales are recorded net of employee discounts.

Exercise 9-17 (Algo) Part 1

Required: 1. Compute estimated ending inventory and cost of goods sold for March applying the conventional retail method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started