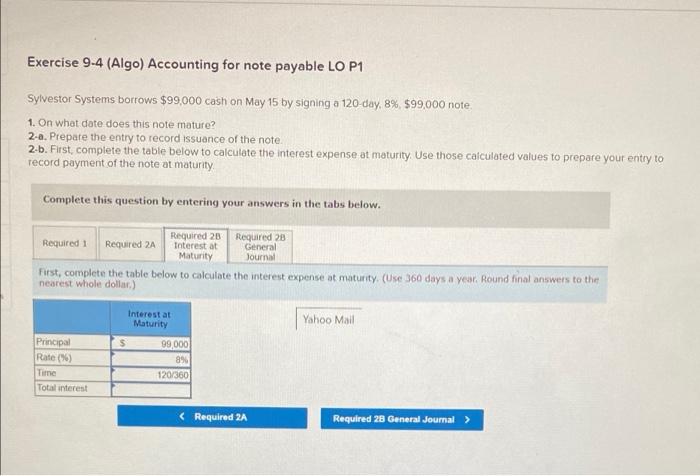

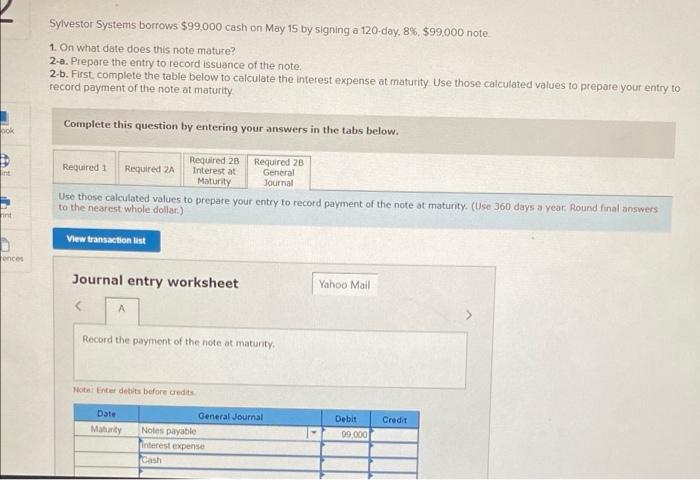

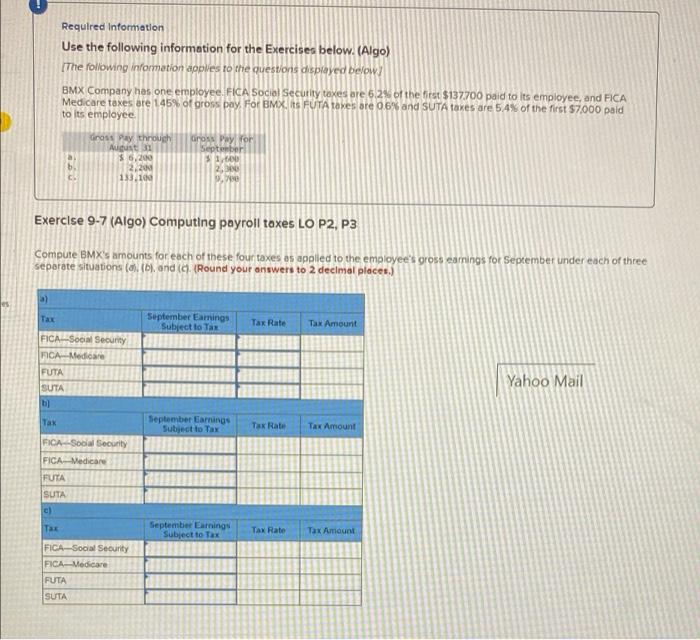

Exercise 9-4 (Algo) Accounting for note payable LO P1 Sylvestor Systems borrows $99,000 cash on May 15 by signing a 120 day, 8% $99,000 note 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note 2.b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity Complete this question by entering your answers in the tabs below. Required 20 Required 28 Required 1 Required 2A Interest at General Maturity Journa First, complete the table below to calculate the interest expense at maturity (Use 360 days a year. Round hinal answers to the nearest whole dollar) Interest at Maturity Yahoo Mail Principal Rate() Time 99 000 890 120/360 Total interest Sylvestor Systems borrows $99,000 cash on May 15 by signing a 120-day, 8%, $99,000 note 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note 2-b. First complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity Complete this question by entering your answers in the tabs below. Dok int Required 2B Required 28 Required 1 Required 2A Interest at General Maturity Journal Use those calculated values to prepare your entry to record payment of the note at maturity. (Use 360 days a year round final answers to the nearest whole dollar) View transaction list oncer Journal entry worksheet Yahoo Mail A Record the payment of the note at maturity. N Enter debits before credits Date Maturity Credit General Journal Notes payable Interest expense Debit 00,000 Required Information Use the following information for the Exercises below. (Algo) The following information woves to the questions displayed below! BMX Company has one employee, FICA Social Security taxes are 62% of the first $137700 paid to its employee, and FICA Medicare taxes are 145% of gross pay For BMX. Its PUTA taxes ore 06% and SUTA taxes are 54% of the first $7,000 pald to its employee Gross Pay for Gross Pay through August 31 $6.200 2,200 133.10 1 20 . Exercise 9-7 (Algo) Computing payroll taxes LO P2, P3 Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for Septembet under each of three separate situations (1) and (4. (Round your answers to 2 decimal places. a) September Earnings Subject to Tax Tax Rate Tax Amount Tax FICA-Soal Security RCA Medio FUTA SUTA b Yahoo Mail Tax September Earnings Subject to Tax Tax Rate Tax Amount FICA Social Security FICA Medicare FUTA SUTA c) Tax September Earnings Subject to Tax Tax Rate Tax Amount FICA-Social Security FICA-Medicare FUTA SUTA