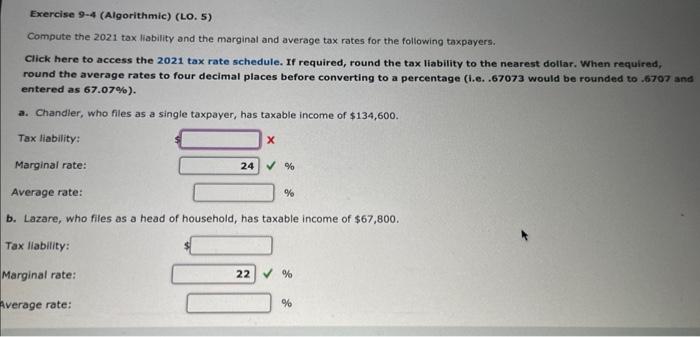

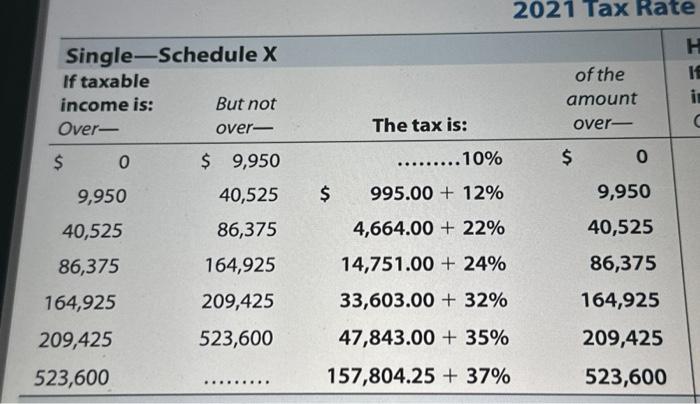

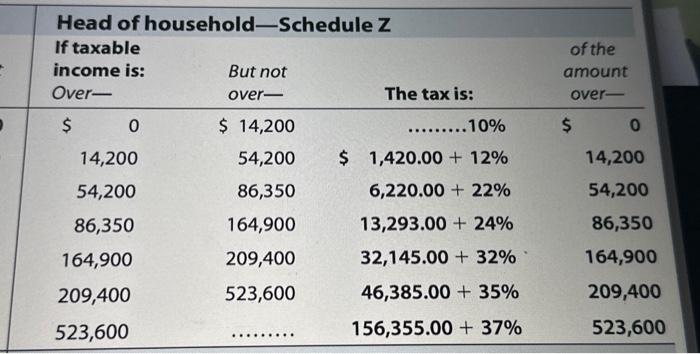

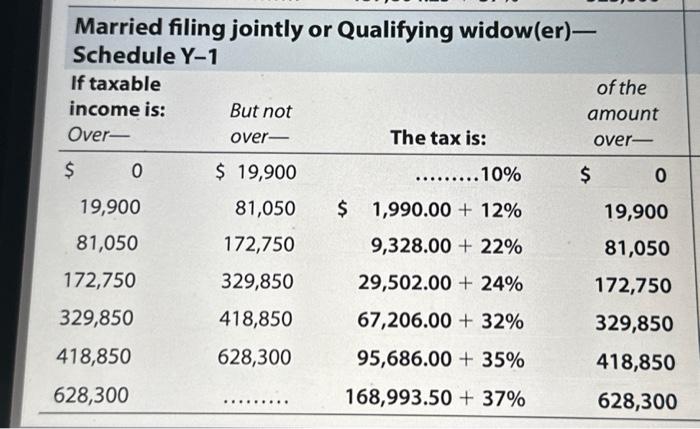

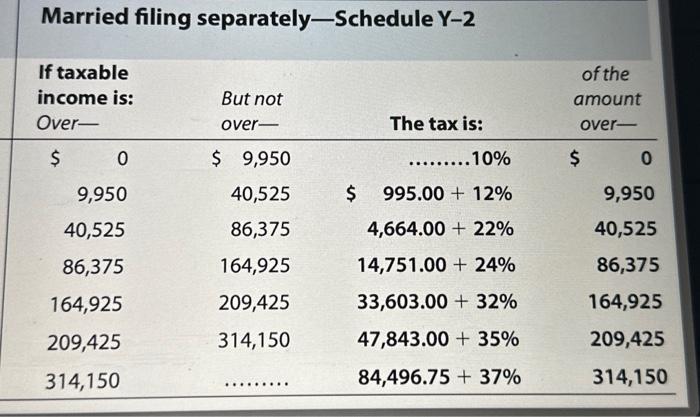

Exercise 9-4 (Algorithmic) (LO. 5) Compute the 2021 tax liability and the marginal and average tax rates for the following taxpayers. Click here to access the 2021 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (1.e. .67073 would be rounded to. 6707 and entered as 67.07% ). a. Chandler, who files as a single taxpayer, has taxable income of $134,600. b. Lazare, who files as a head of household, has taxable income of $67,800. 2021 Tax Rate \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Head of household-Schedule Z } \\ \hline Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- \\ \hline 0 & $14,200 & ..........10\% & 0 \\ \hline 14,200 & 54,200 & $1,420.00+12% & 14,200 \\ \hline 54,200 & 86,350 & 6,220.00+22% & 54,200 \\ \hline 86,350 & 164,900 & 13,293.00+24% & 86,350 \\ \hline 164,900 & 209,400 & 32,145.00+32% & 164,900 \\ \hline 209,400 & 523,600 & 46,385.00+35% & 209,400 \\ \hline 523,600 & ......... & 156,355.00+37% & 523,600 \\ \hline \end{tabular} Married filing separately-Schedule Y-2 \begin{tabular}{|c|c|c|c|} \hline Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- \\ \hline 0 & $9,950 & .........10\% & $ \\ \hline 9,950 & 40,525 & $995.00+12% & 9,950 \\ \hline 40,525 & 86,375 & 4,664.00+22% & 40,525 \\ \hline 86,375 & 164,925 & 14,751.00+24% & 86,375 \\ \hline 164,925 & 209,425 & 33,603.00+32% & 164,925 \\ \hline 209,425 & 314,150 & 47,843.00+35% & 209,425 \\ \hline 314,150 & & 84,496.75+37% & 314,150 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{MarriedfilingjointlyorQualifyingwidow(er)-ScheduleY-1} \\ \hline Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- \\ \hline$ & $19,900 & .........10\% & $ \\ \hline 19,900 & 81,050 & $1,990.00+12% & 19,900 \\ \hline 81,050 & 172,750 & 9,328.00+22% & 81,050 \\ \hline 172,750 & 329,850 & 29,502.00+24% & 172,750 \\ \hline 329,850 & 418,850 & 67,206.00+32% & 329,850 \\ \hline 418,850 & 628,300 & 95,686.00+35% & 418,850 \\ \hline 628,300 & & 168,993.50+37% & 628,300 \\ \hline \end{tabular}