Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 9-43 (Static) Activity-Based Costing in a Service Environment (LO 9-3, 4, 5) Heldt Cleaning Services (HCS) is a local custodial service company serving

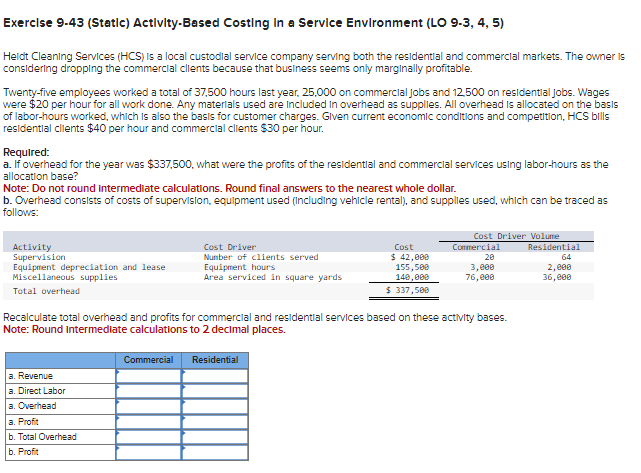

Exercise 9-43 (Static) Activity-Based Costing in a Service Environment (LO 9-3, 4, 5) Heldt Cleaning Services (HCS) is a local custodial service company serving both the residential and commercial markets. The owner is considering dropping the commercial clients because that business seems only marginally profitable. Twenty-five employees worked a total of 37,500 hours last year, 25,000 on commercial jobs and 12.500 on residential jobs. Wages were $20 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of labor-hours worked, which is also the basis for customer charges. Given current economic conditions and competition, HCS bills residential clients $40 per hour and commercial clients $30 per hour. Required: a. If overhead for the year was $337,500, what were the profits of the residential and commercial services using labor-hours as the allocation base? Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. b. Overhead consists of costs of supervision, equipment used (including vehicle rental), and supplies used, which can be traced as follows: Activity Supervision Equipment depreciation and lease Miscellaneous supplies Total overhead Cost Driver Number of clients served Equipment hours Area serviced in square yards Cost $ 42,000 155,500 140,000 Cost Driver Volume Commercial Residential 20 64 3,000 2,000 76,000 36,000 $ 337,500 Recalculate total overhead and profits for commercial and residential services based on these activity bases. Note: Round Intermediate calculations to 2 decimal places. a. Revenue a. Direct Labor a. Overhead a. Profit b. Total Overhead b. Profit Commercial Residential

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started