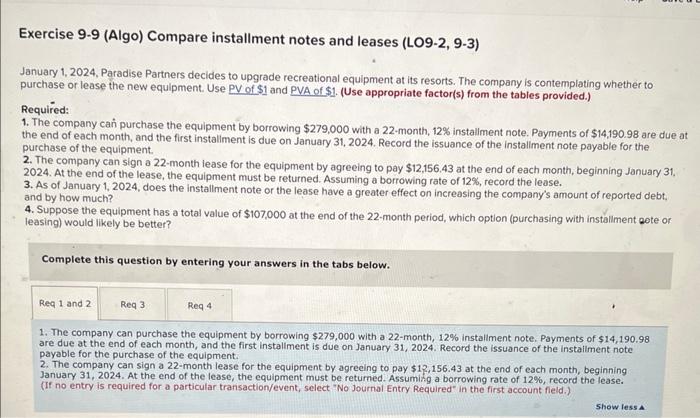

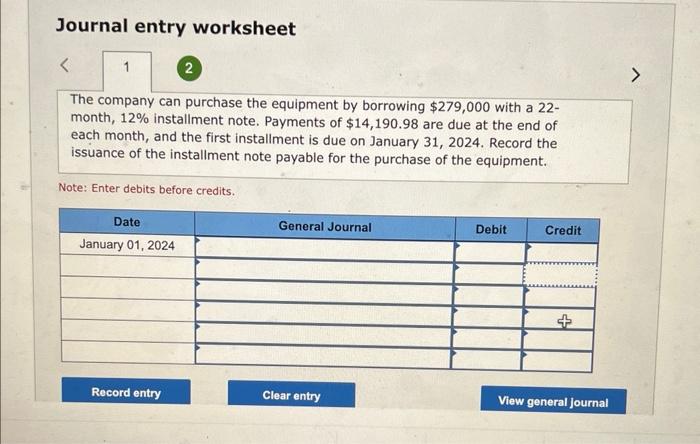

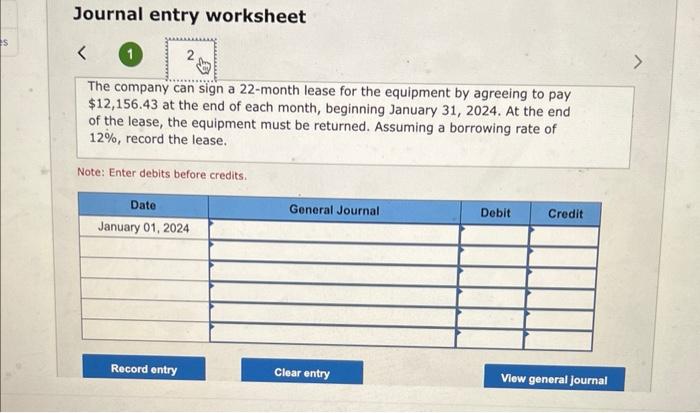

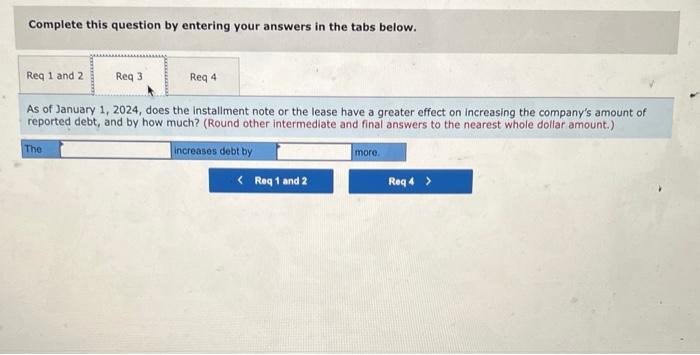

Exercise 9-9 (Algo) Compare installment notes and leases (LO9-2, 9-3) January 1, 2024, Paradise Partners decides to upgrade recreational equipment at its resorts. The company is contemplating whether to purchase or lease the new equipment. Use PV of \$1 and PVA of \$1. (Use appropriate factor(s) from the tables provided.) Required: 1. The company can purchase the equipment by borrowing $279,000 with a 22 -month, 12% installment note. Payments of $14,190.98 are due at the end of each month, and the first installment is due on January 31, 2024. Record the issuance of the instaliment note payable for the purchase of the equipment. 2. The company can sign a 22-month lease for the equipment by agreeing to pay $12,156.43 at the end of each month, beginning January 31 . 2024. At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12%, record the lease. 3. As of January 1, 2024, does the installment note or the lease have a greater effect on increasing the company's amount of reported debt, and by how much? 4. Suppose the equipment has a total value of $107,000 at the end of the 22 -month period, which option (purchasing with installment gote or leasing) would likely be better? Complete this question by entering your answers in the tabs below. 1. The company can purchase the equipment by borrowing $279,000 with a 22 -month, 12% instaliment note. Payments of $14,190.98 are due at the end of each month, and the first instaliment is due on January 31, 2024. Record the issuance of the instaliment note payable for the purchase of the equipment. 2. The company can sign a 22-month lease for the equipment by agreeing to pay $12,156.43 at the end of each month, beginning January 31,2024 . At the end of the lease, the equipment must be returned. Assumifg a borrowing rate of 12%, record the lease. (If no entry is required for a particular tranisaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet The company can purchase the equipment by borrowing $279,000 with a 22month, 12% installment note. Payments of $14,190.98 are due at the end of each month, and the first installment is due on January 31,2024 . Record the issuance of the installment note payable for the purchase of the equipment. Note: Enter debits before credits. Journal entry worksheet The company can sign a 22-month lease for the equipment by agreeing to pay $12,156.43 at the end of each month, beginning January 31,2024 . At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12%, record the lease. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. As of January 1, 2024, does the instaliment note or the lease have a greater effect on increasing the company's amount of reported debt, and by how much? (Round other intermediate and final answers to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. Suppose the equipment has a total value of $107,000 at the end of the 22 -month period, which option (purchasing with installment note or leasing) would likely be better