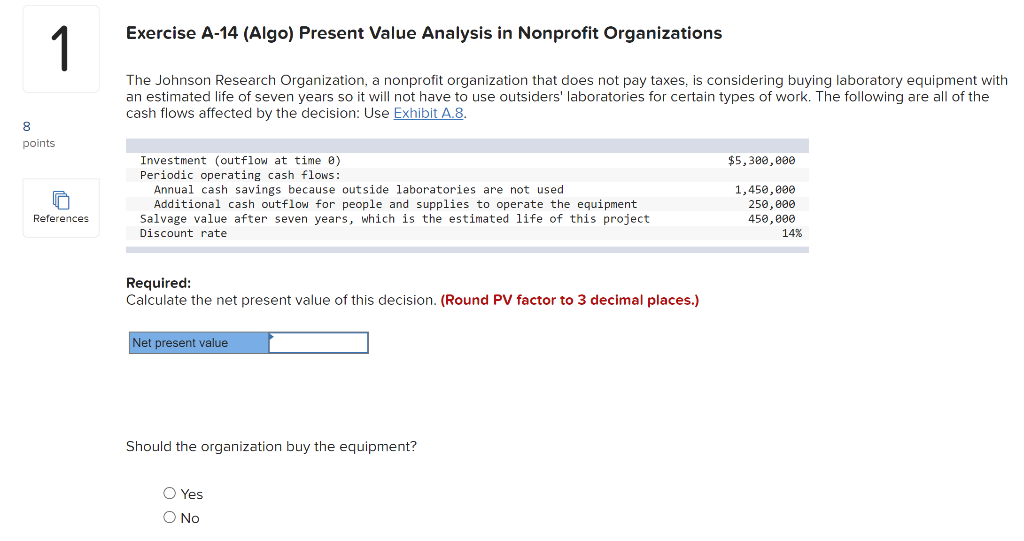

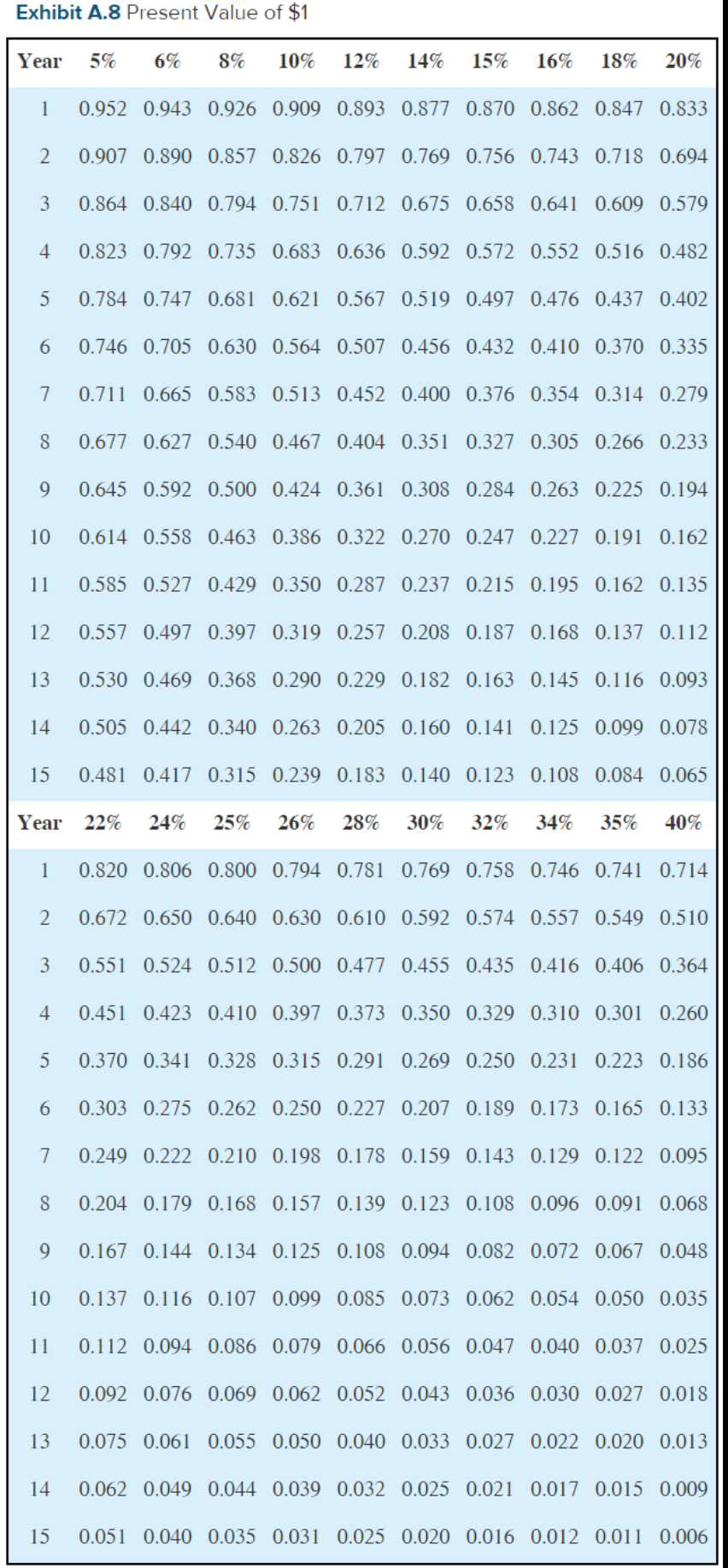

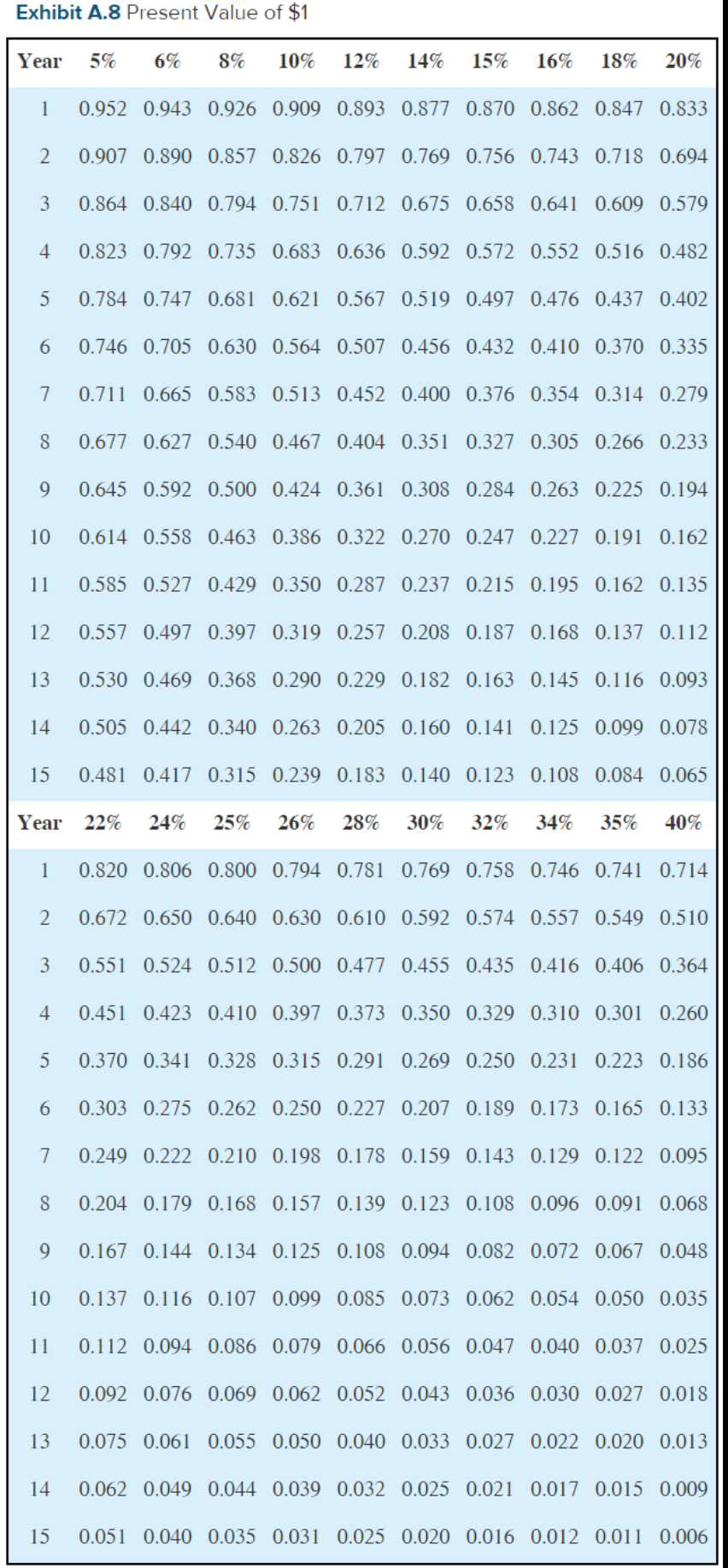

Exercise A-14 (Algo) Present Value Analysis in Nonprofit Organizations 1 The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so it will not have to use outsiders' laboratories for certain types of work. The following are all of the cash flows affected by the decision: Use Exhibit A.8. 8 points $5,300,000 Investment (outflow at time ) Periodic operating cash flows: Annual cash savings because outside laboratories are not used Additional cash outflow for people and supplies to operate the equipment Salvage value after seven years, which is the estimated life of this project Discount rate 1,450,000 250.000 450,000 14% References Required: Calculate the net present value of this decision. (Round PV factor to 3 decimal places.) Net present value Should the organization buy the equipment? O Yes No Exhibit A.8 Present Value of $1 Year 5% 6% 8% 10% 12% 14% 15% 16% 18% 20% 1 0.952 0.943 0.926 0.909 0.893 0.877 0.870 0.862 0.847 0.833 2 0.907 0.890 0.857 0.826 0.797 0.769 0.756 0.743 0.718 0.694 3 0.864 0.840 0.794 0.751 0.712 0.675 0.658 0.641 0.609 0.579 4. 0.823 0.792 0.735 0.683 0.636 0.592 0.572 0.552 0.516 0.482 5 0.784 0.747 0.681 0.621 0.567 0.519 0.497 0.476 0.437 0.402 6 0.746 0.705 0.630 0.564 0.507 0.456 0.432 0.410 0.370 0.335 7 0.711 0.665 0.583 0.513 0.452 0.400 0.376 0.354 0.314 0.279 8 0.677 0.627 0.540 0.467 0.404 0.351 0.327 0.305 0.266 0.233 9 0.645 0.592 0.500 0.424 0.361 0.308 0.284 0.263 0.225 0.194 10 0.614 0.558 0.463 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.585 0.527 0.429 0.350 0.287 0.237 0.215 0.195 0.162 0.135 11 12 0.557 0.497 0.397 0.319 0.257 0.208 0.187 0.168 0.137 0.112 13 0.530 0.469 0.368 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.505 0.442 0.340 0.263 0.205 0.160 0.141 0.125 0.099 0.078 14 15 0.481 0.417 0.315 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Year 22% 24% 25% 26% 28% 30% 32% 34% 35% 40% 1 0.820 0.806 0.800 0.794 0.781 0.769 0.758 0.746 0.741 0.714 2 0.672 0.650 0.640 0.630 0.610 0.592 0.574 0.557 0.549 0.510 3 0.551 0.524 0.512 0.500 0.477 0.455 0.435 0.416 0.406 0.364 4 0.451 0.423 0.410 0.397 0.373 0.350 0.329 0.310 0.301 0.260 5 0.370 0.341 0.328 0.315 0.291 0.269 0.250 0.231 0.223 0.186 6 0.303 0.275 0.262 0.250 0.227 0.207 0.189 0.173 0.165 0.133 7 0.249 0.222 0.210 0.198 0.178 0.159 0.143 0.129 0.122 0.095 8 0.204 0.179 0.168 0.157 0.139 0.123 0.108 0.096 0.091 0.068 9 0.167 0.144 0.134 0.125 0.108 0.094 0.082 0.072 0.067 0.048 10 0.137 0.116 0.107 0.099 0.085 0.073 0.062 0.054 0.050 0.035 11 0.112 0.094 0.086 0.079 0.066 0.056 0.047 0.040 0.037 0.025 12 0.092 0.076 0.069 0.062 0.052 0.043 0.036 0.030 0.027 0.018 13 0.075 0.061 0.055 0.050 0.040 0.033 0.027 0.022 0.020 0.013 14 0.062 0.049 0.044 0.039 0.032 0.025 0.021 0.017 0.015 0.009 15 0.051 0.040 0.035 0.031 0.025 0.020 0.016 0.012 0.011 0.006