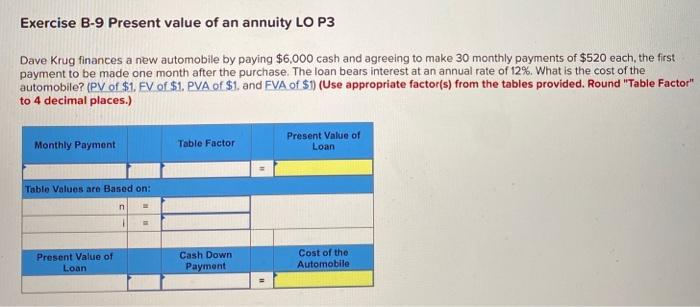

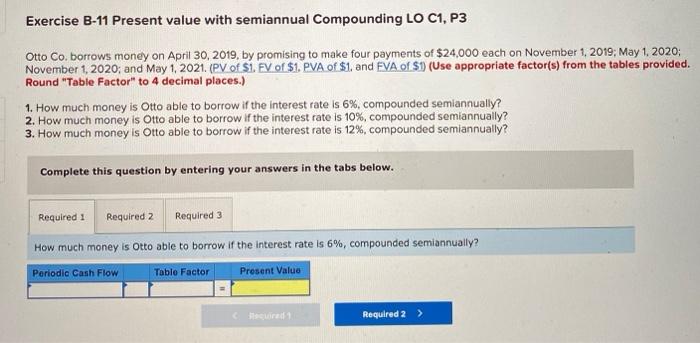

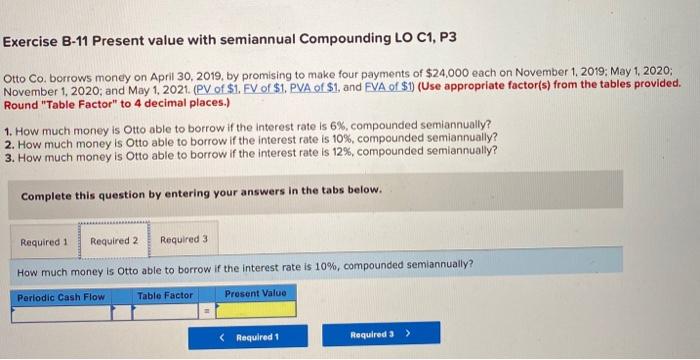

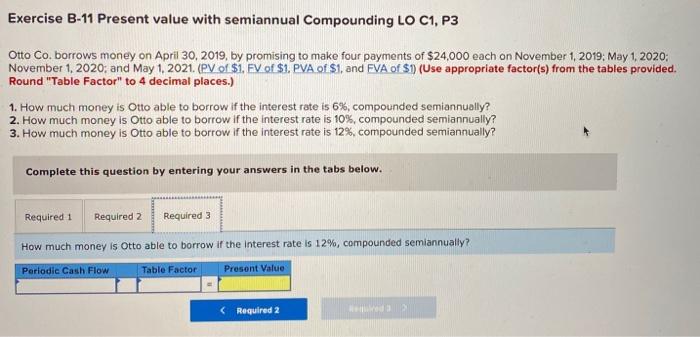

Exercise B-9 Present value of an annuity LO P3 Dave Krug finances a new automobile by paying $6,000 cash and agreeing to make 30 monthly payments of $520 each, the first payment to be made one month after the purchase. The loan bears interest at an annual rate of 12%. What is the cost of the automobile? (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Monthly Payment Table Factor Present Value of Loan Table Values are Based on: Present Value of Loan Cash Down Payment Cost of the Automobile Exercise B-11 Present value with semiannual Compounding LO C1, P3 Otto Co. borrows money on April 30, 2019, by promising to make four payments of $24,000 each on November 1, 2019; May 1, 2020; November 1, 2020; and May 1, 2021. (PV of $1. FV of $1. PVA of $1, and EVA of $1 (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) 1. How much money is Otto able to borrow if the interest rate is 6%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 10%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 12%, compounded semiannually? Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 How much money is Otto able to borrow if the interest rate is 6%, compounded semiannually? Periodic Cash Flow Table Factor Present Value Required 2 > Exercise B-11 Present value with semiannual Compounding LO C1, P3 Otto Co, borrows money on April 30, 2019, by promising to make four payments of $24.000 each on November 1, 2019: May 1, 2020; November 1, 2020; and May 1, 2021. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) 1. How much money is Otto able to borrow if the interest rate is 6%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 10%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 12%, compounded semiannually? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much money is Otto able to borrow if the interest rate is 10%, compounded semiannually? Periodic Cash Flow Table Factor Present Value