Answered step by step

Verified Expert Solution

Question

1 Approved Answer

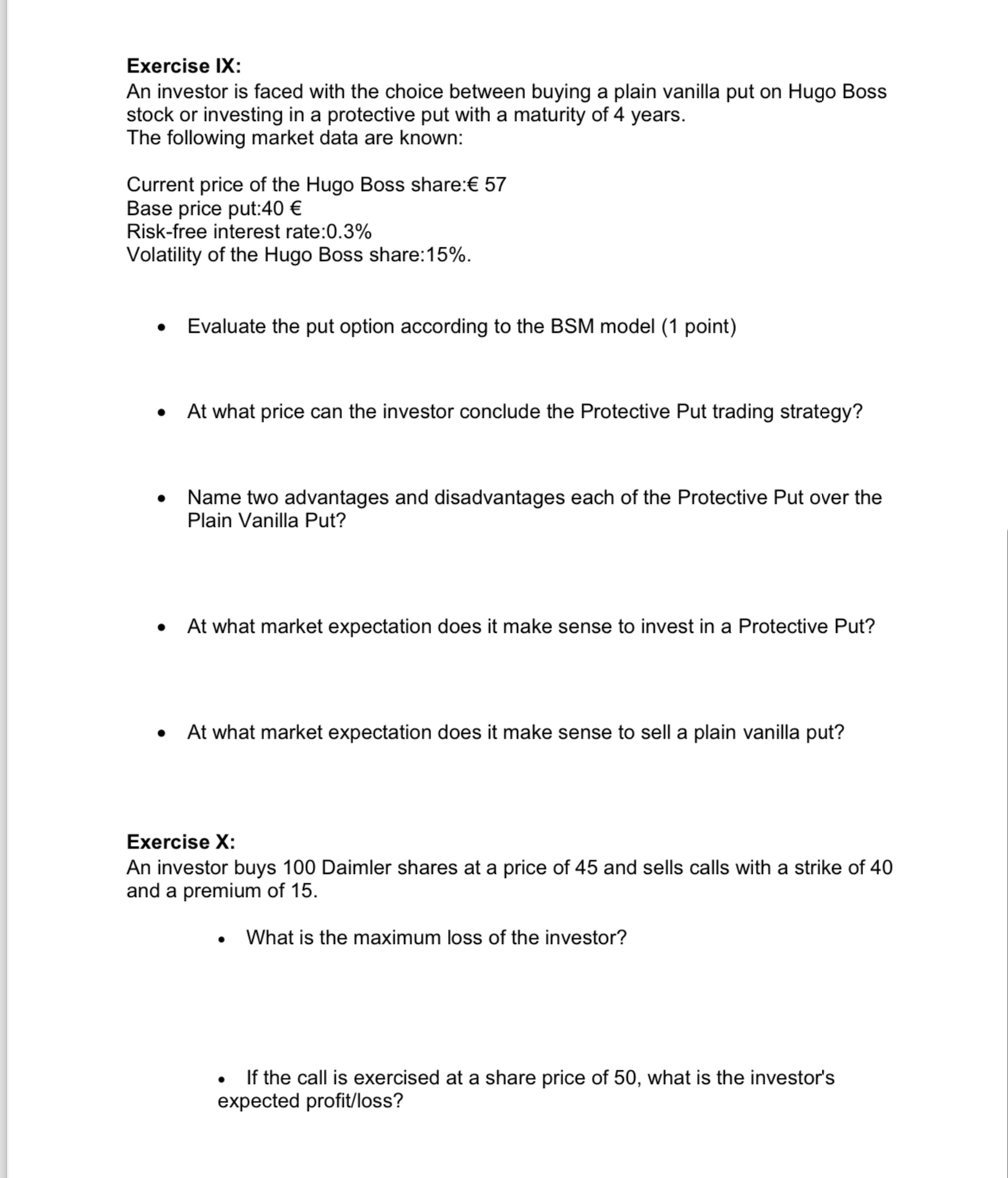

Exercise IX: An investor is faced with the choice between buying a plain vanilla put on Hugo Boss stock or investing in a protective put

Exercise IX:

An investor is faced with the choice between buying a plain vanilla put on Hugo Boss stock or investing in a protective put with a maturity of years.

The following market data are known:

Current price of the Hugo Boss share:

Base price put:

Riskfree interest rate:

Volatility of the Hugo Boss share:

Evaluate the put option according to the BSM model point

At what price can the investor conclude the Protective Put trading strategy?

Name two advantages and disadvantages each of the Protective Put over the Plain Vanilla Put?

At what market expectation does it make sense to invest in a Protective Put?

At what market expectation does it make sense to sell a plain vanilla put?

Exercise X:

An investor buys Daimler shares at a price of and sells calls with a strike of and a premium of

What is the maximum loss of the investor?

If the call is exercised at a share price of what is the investor's expected profitloss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started