Answered step by step

Verified Expert Solution

Question

1 Approved Answer

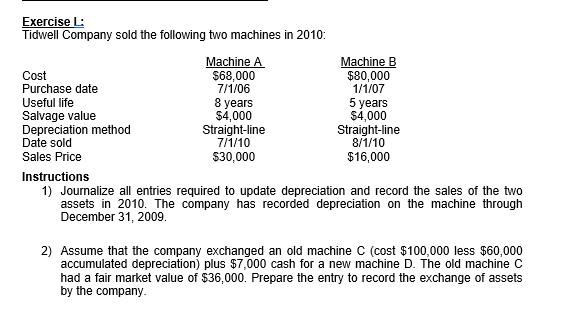

Exercise L: Tidwell Company sold the following two machines in 2010: Cost Purchase date Useful life Salvage value Depreciation method Date sold Sales Price

Exercise L: Tidwell Company sold the following two machines in 2010: Cost Purchase date Useful life Salvage value Depreciation method Date sold Sales Price Machine A $68,000 7/1/06 8 years $4,000 Straight-line 7/1/10 $30,000 Machine B $80,000 1/1/07 5 years $4,000 Straight-line 8/1/10 $16,000 Instructions 1) Journalize all entries required to update depreciation and record the sales of the two assets in 2010. The company has recorded depreciation on the machine through December 31, 2009. 2) Assume that the company exchanged an old machine C (cost $100,000 less $60,000 accumulated depreciation) plus $7,000 cash for a new machine D. The old machine C had a fair market value of $36,000. Prepare the entry to record the exchange of assets by the company.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Date 7110 7110 Cash Accumulated Depreciation Machine A Loss on sale of Machine A Machine A To re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started