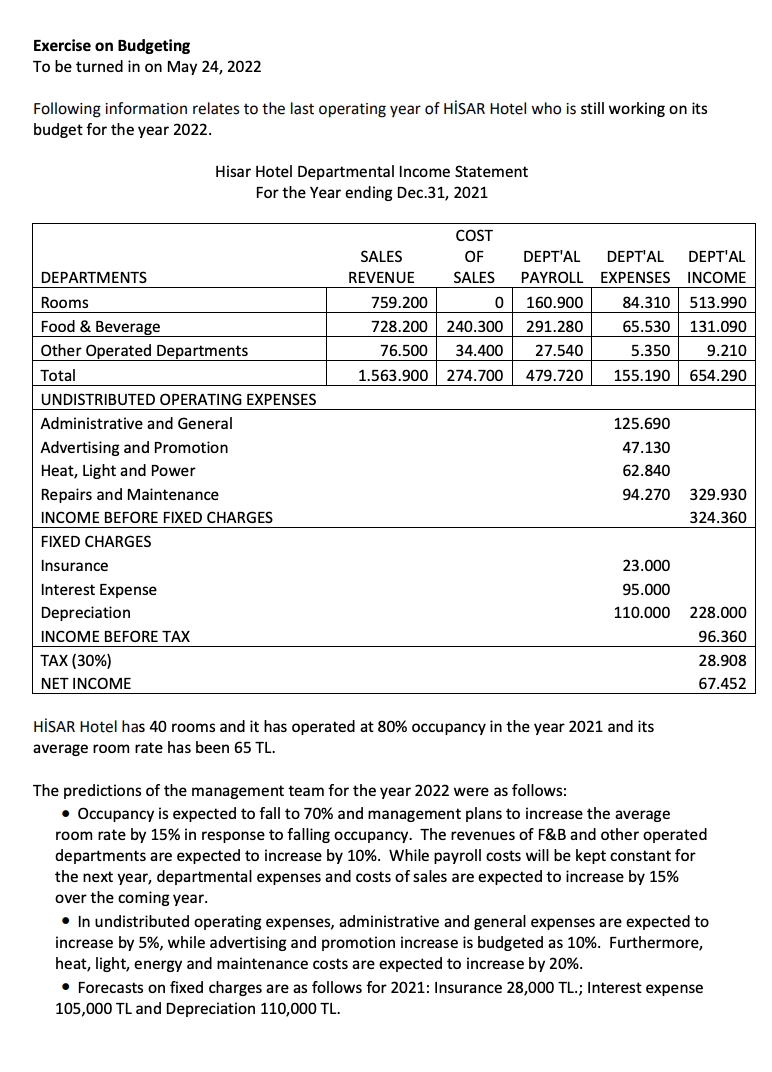

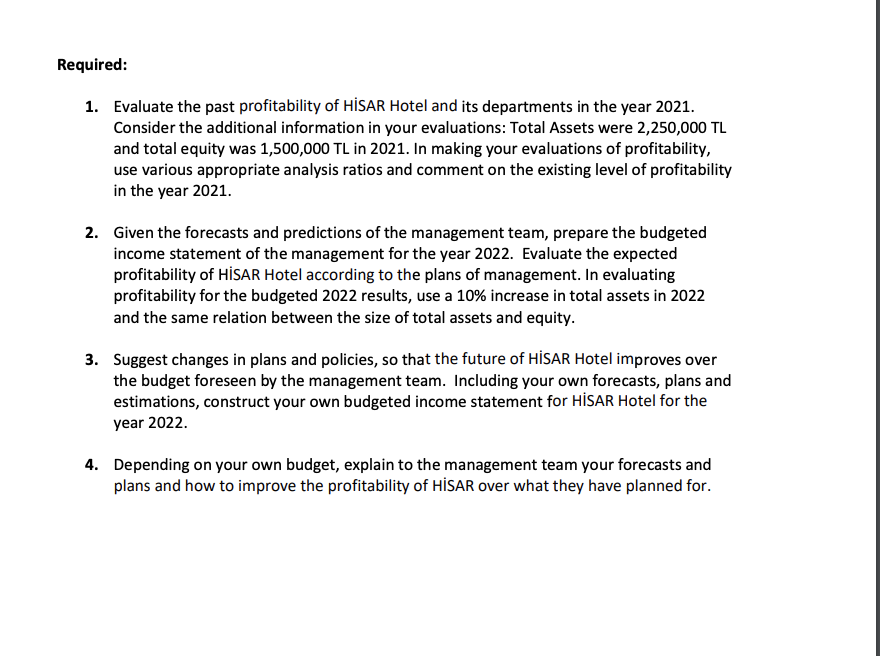

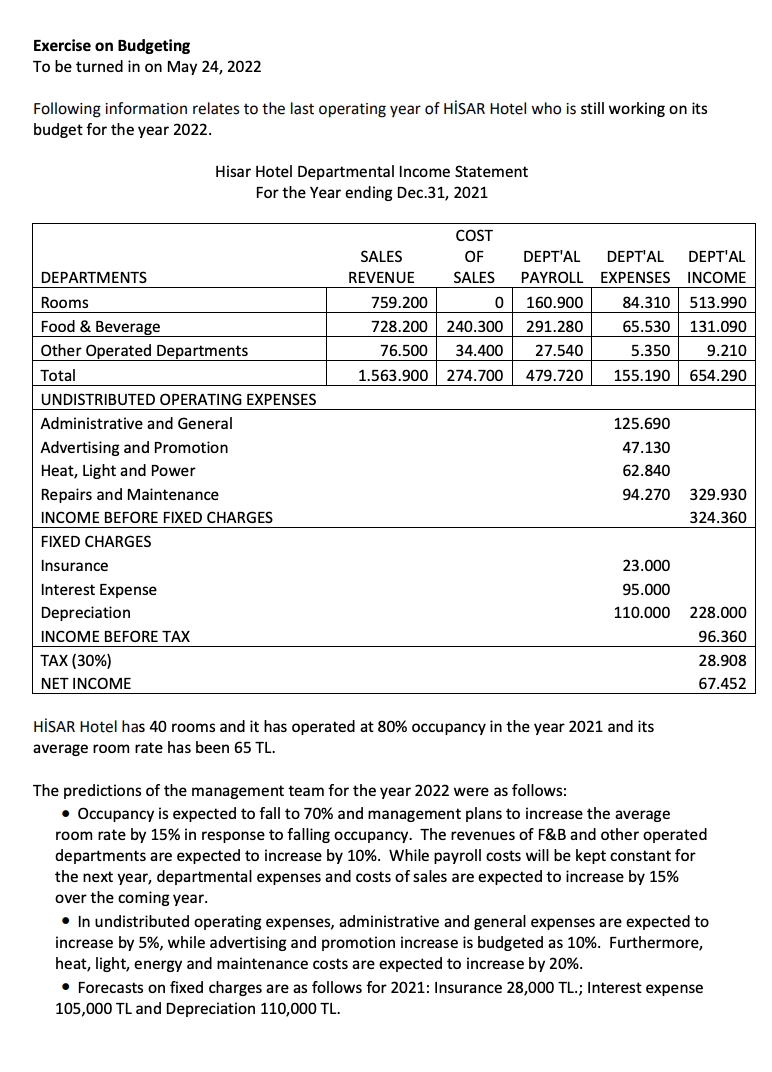

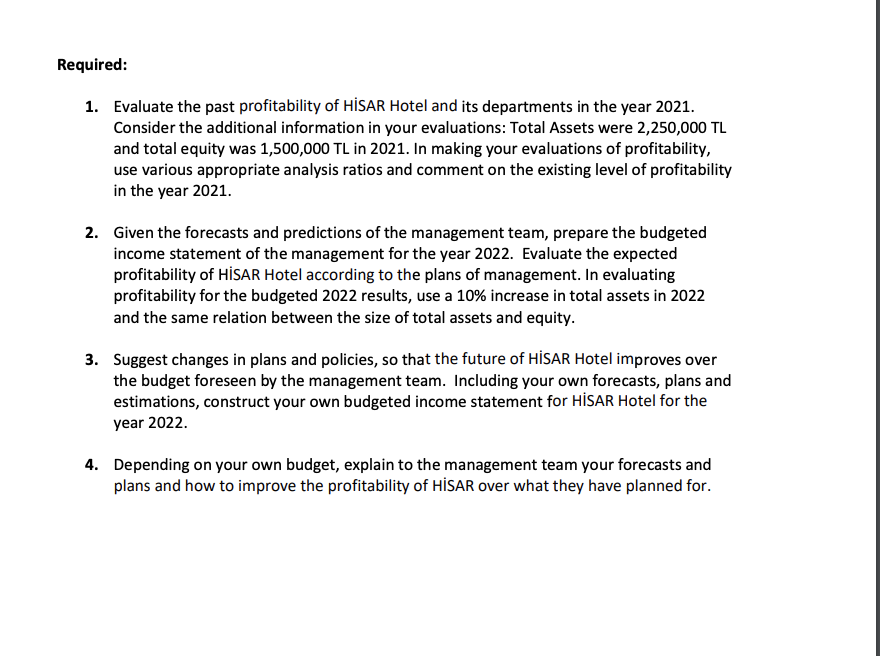

Exercise on Budgeting To be turned in on May 24, 2022 Following information relates to the last operating year of HISAR Hotel who is still working on its budget for the year 2022. Hisar Hotel Departmental Income Statement For the Year ending Dec.31, 2021 COST SALES OF DEPARTMENTS REVENUE DEPT'AL DEPT'AL DEPT'AL SALES PAYROLL EXPENSES INCOME 0 160.900 84.310 513.990 728.200 240.300 291.280 Rooms 759.200 Food & Beverage 65.530 131.090 Other Operated Departments 76.500 34.400 27.540 5.350 9.210 Total 1.563.900 274.700 479.720 155.190 654.290 UNDISTRIBUTED OPERATING EXPENSES Administrative and General 125.690 Advertising and Promotion 47.130 Heat, Light and Power 62.840 Repairs and Maintenance 94.270 329.930 INCOME BEFORE FIXED CHARGES 324.360 FIXED CHARGES Insurance 23.000 Interest Expense 95.000 Depreciation 110.000 228.000 INCOME BEFORE TAX 96.360 TAX (30%) 28.908 NET INCOME 67.452 HSAR Hotel has 40 rooms and it has operated at 80% occupancy in the year 2021 and its average room rate has been 65 TL. The predictions of the management team for the year 2022 were as follows: Occupancy is expected to fall to 70% and management plans to increase the average room rate by 15% in response to falling occupancy. The revenues of F&B and other operated departments are expected to increase by 10%. While payroll costs will be kept constant for the next year, departmental expenses and costs of sales are expected to increase by 15% over the coming year. In undistributed operating expenses, administrative and general expenses are expected to increase by 5%, while advertising and promotion increase is budgeted as 10%. Furthermore, heat, light, energy and maintenance costs are expected to increase by 20%. Forecasts on fixed charges are as follows for 2021: Insurance 28,000 TL.; Interest expense 105,000 TL and Depreciation 110,000 TL. Required: 1. Evaluate the past profitability of HSAR Hotel and its departments in the year 2021. Consider the additional information in your evaluations: Total Assets were 2,250,000 TL and total equity was 1,500,000 TL in 2021. In making your evaluations of profitability, use various appropriate analysis ratios and comment on the existing level of profitability in the year 2021. 2. Given the forecasts and predictions of the management team, prepare the budgeted income statement of the management for the year 2022. Evaluate the expected profitability of HSAR Hotel according to the plans of management. In evaluating profitability for the budgeted 2022 results, use a 10% increase in total assets in 2022 and the same relation between the size of total assets and equity. 3. Suggest changes in plans and policies, so that the future of HISAR Hotel improves over the budget foreseen by the management team. Including your own forecasts, plans and estimations, construct your own budgeted income statement for HISAR Hotel for the year 2022. 4. Depending on your own budget, explain to the management team your forecasts and plans and how to improve the profitability of HISAR over what they have planned for. Exercise on Budgeting To be turned in on May 24, 2022 Following information relates to the last operating year of HISAR Hotel who is still working on its budget for the year 2022. Hisar Hotel Departmental Income Statement For the Year ending Dec.31, 2021 COST SALES OF DEPARTMENTS REVENUE DEPT'AL DEPT'AL DEPT'AL SALES PAYROLL EXPENSES INCOME 0 160.900 84.310 513.990 728.200 240.300 291.280 Rooms 759.200 Food & Beverage 65.530 131.090 Other Operated Departments 76.500 34.400 27.540 5.350 9.210 Total 1.563.900 274.700 479.720 155.190 654.290 UNDISTRIBUTED OPERATING EXPENSES Administrative and General 125.690 Advertising and Promotion 47.130 Heat, Light and Power 62.840 Repairs and Maintenance 94.270 329.930 INCOME BEFORE FIXED CHARGES 324.360 FIXED CHARGES Insurance 23.000 Interest Expense 95.000 Depreciation 110.000 228.000 INCOME BEFORE TAX 96.360 TAX (30%) 28.908 NET INCOME 67.452 HSAR Hotel has 40 rooms and it has operated at 80% occupancy in the year 2021 and its average room rate has been 65 TL. The predictions of the management team for the year 2022 were as follows: Occupancy is expected to fall to 70% and management plans to increase the average room rate by 15% in response to falling occupancy. The revenues of F&B and other operated departments are expected to increase by 10%. While payroll costs will be kept constant for the next year, departmental expenses and costs of sales are expected to increase by 15% over the coming year. In undistributed operating expenses, administrative and general expenses are expected to increase by 5%, while advertising and promotion increase is budgeted as 10%. Furthermore, heat, light, energy and maintenance costs are expected to increase by 20%. Forecasts on fixed charges are as follows for 2021: Insurance 28,000 TL.; Interest expense 105,000 TL and Depreciation 110,000 TL. Required: 1. Evaluate the past profitability of HSAR Hotel and its departments in the year 2021. Consider the additional information in your evaluations: Total Assets were 2,250,000 TL and total equity was 1,500,000 TL in 2021. In making your evaluations of profitability, use various appropriate analysis ratios and comment on the existing level of profitability in the year 2021. 2. Given the forecasts and predictions of the management team, prepare the budgeted income statement of the management for the year 2022. Evaluate the expected profitability of HSAR Hotel according to the plans of management. In evaluating profitability for the budgeted 2022 results, use a 10% increase in total assets in 2022 and the same relation between the size of total assets and equity. 3. Suggest changes in plans and policies, so that the future of HISAR Hotel improves over the budget foreseen by the management team. Including your own forecasts, plans and estimations, construct your own budgeted income statement for HISAR Hotel for the year 2022. 4. Depending on your own budget, explain to the management team your forecasts and plans and how to improve the profitability of HISAR over what they have planned for