Answered step by step

Verified Expert Solution

Question

1 Approved Answer

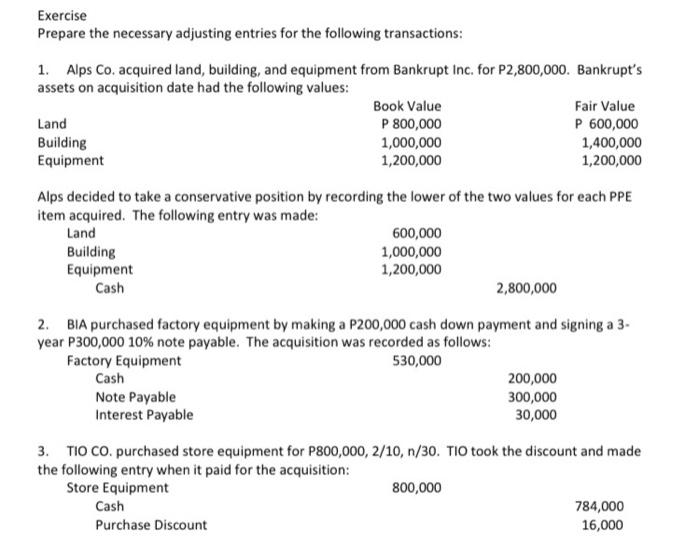

Exercise Prepare the necessary adjusting entries for the following transactions: 1. Alps Co. acquired land, building, and equipment from Bankrupt Inc. for P2,800,000. Bankrupt's

Exercise Prepare the necessary adjusting entries for the following transactions: 1. Alps Co. acquired land, building, and equipment from Bankrupt Inc. for P2,800,000. Bankrupt's assets on acquisition date had the following values: Land Building Equipment Land Building Equipment Cash Alps decided to take a conservative position by recording the lower of the two values for each PPE item acquired. The following entry was made: Book Value P 800,000 1,000,000 1,200,000 Cash Note Payable Interest Payable 600,000 1,000,000 1,200,000 Cash Purchase Discount 2,800,000 2. BIA purchased factory equipment by making a P200,000 cash down payment and signing a 3- year P300,000 10% note payable. The acquisition was recorded as follows: Factory Equipment 530,000 Fair Value P 600,000 1,400,000 1,200,000 200,000 300,000 30,000 3. TIO CO. purchased store equipment for P800,000, 2/10, n/30. TIO took the discount and made the following entry when it paid for the acquisition: Store Equipment 800,000 784,000 16,000

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started