Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise - Time Value of Money Question 1-5, your answer will be TRUE of FALSE. 1. The time value of money is the opportunity cost

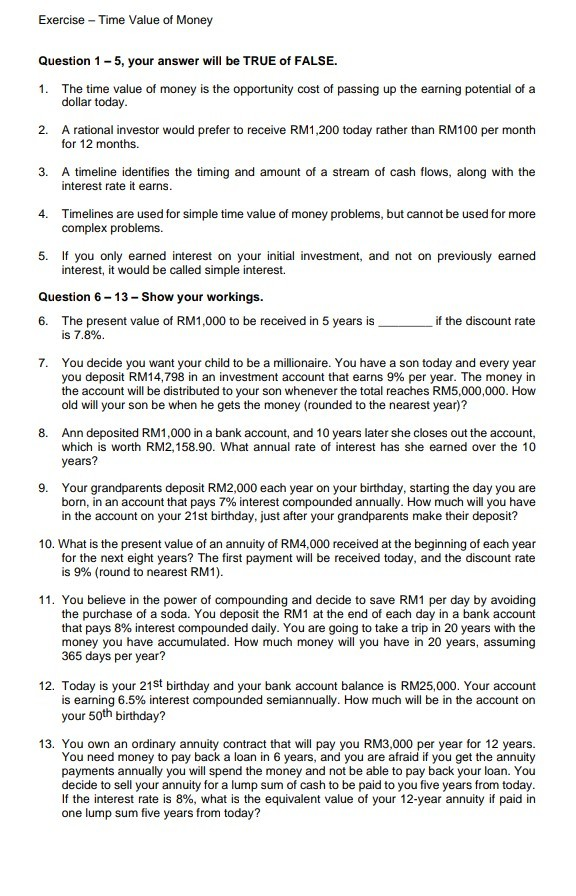

Exercise - Time Value of Money Question 1-5, your answer will be TRUE of FALSE. 1. The time value of money is the opportunity cost of passing up the earning potential of a dollar today. 2. A rational investor would prefer to receive RM1,200 today rather than RM100 per month for 12 months. 3. A timeline identifies the timing and amount of a stream of cash flows, along with the interest rate it earns. 4. Timelines are used for simple time value of money problems, but cannot be used for more complex problems. 5. If you only earned interest on your initial investment, and not on previously earned interest, it would be called simple interest. Question 6-13 - Show your workings. 6. The present value of RM1,000 to be received in 5 years is if the discount rate is 7.8% 7. You decide you want your child to be a millionaire. You have a son today and every year you deposit RM14,798 in an investment account that earns 9% per year. The money in the account will be distributed to your son whenever the total reaches RM5,000,000. How old will your son be when he gets the money (rounded to the nearest year)? 8. Ann deposited RM1,000 in a bank account, and 10 years later she closes out the account, which is worth RM2,158.90. What annual rate of interest has she earned over the 10 years? 9. Your grandparents deposit RM2,000 each year on your birthday, starting the day you are born, in an account that pays 7% interest compounded annually. How much will you have in the account on your 21st birthday, just after your grandparents make their deposit? 10. What is the present value of an annuity of RM4,000 received at the beginning of each year for the next eight years? The first payment will be received today, and the discount rate is 9% (round to nearest RM1). 11. You believe in the power of compounding and decide to save RM1 per day by avoiding the purchase of a soda. You deposit the RM1 at the end of each day in a bank account that pays 8% interest compounded daily. You are going to take a trip in 20 years with the money you have accumulated. How much money will you have in 20 years, assuming 365 days per year? 12. Today is your 21st birthday and your bank account balance is RM25,000. Your account is earning 6.5% interest compounded semiannually. How much will be in the account on your 50th birthday? 13. You own an ordinary annuity contract that will pay you RM3,000 per year for 12 years. You need money to pay back a loan in 6 years, and you are afraid if you get the annuity payments annually you will spend the money and not be able to pay back your loan. You decide to sell your annuity for a lump sum of cash to be paid to you five years from today. If the interest rate is 8%, what is the equivalent value of your 12-year annuity if paid in one lump sum five years from today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started