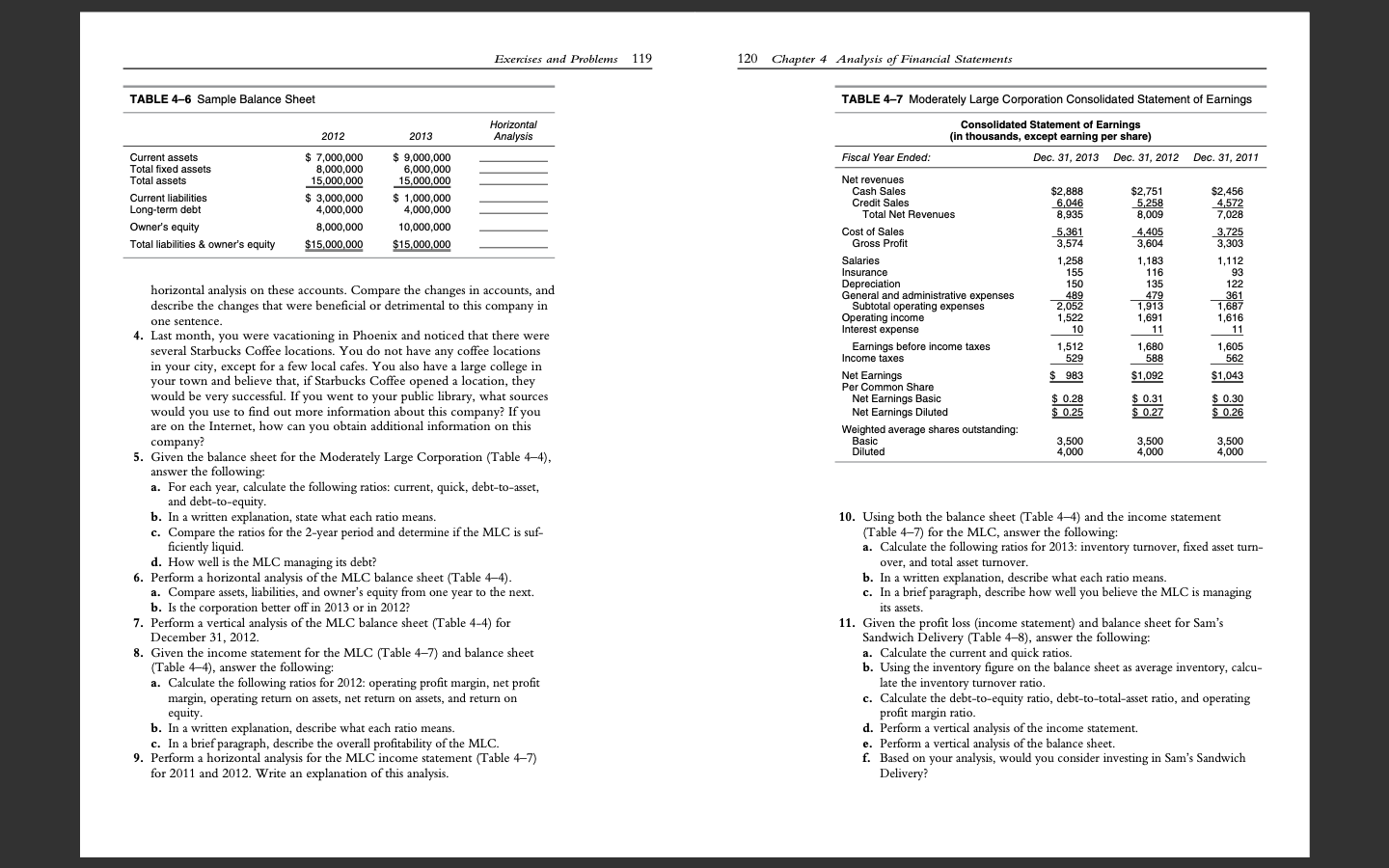

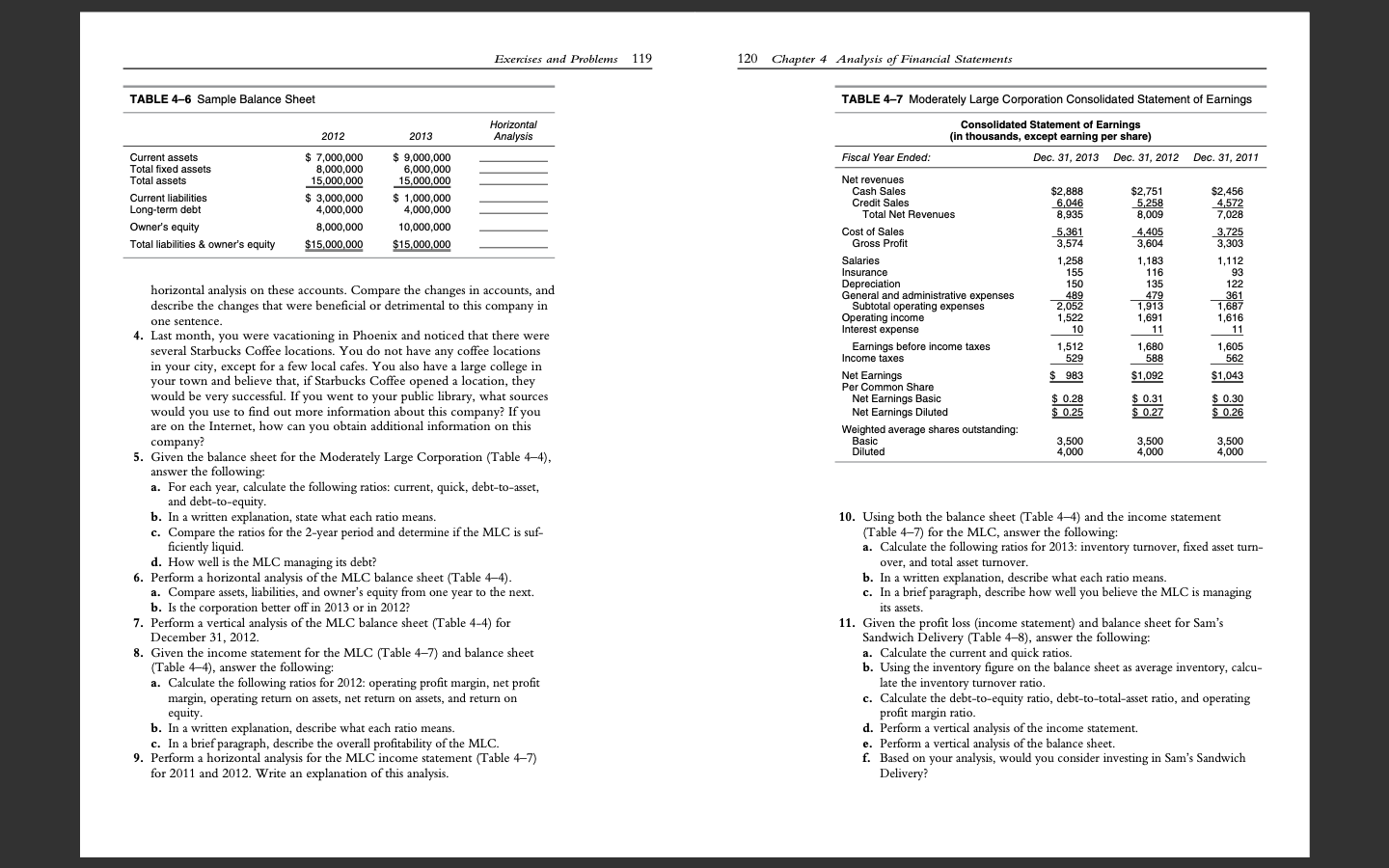

Exercises and Problems 119 120 Chapter 4 Analysis of Financial Statements TABLE 4-6 Sample Balance Sheet 2012 2013 Horizontal Analysis Current assets Total fixed assets Total assets Current liabilities Long-term debt Owner's equity Total liabilities & owner's equity $ 7,000,000 8,000,000 15,000,000 $ 3,000,000 4,000,000 8,000,000 $15,000,000 $ 9,000,000 6,000,000 15,000,000 $ 1,000,000 4,000,000 10,000,000 $15,000,000 TABLE 4-7 Moderately Large Corporation Consolidated Statement of Earnings Consolidated Statement of Earnings (in thousands, except earning per share) Fiscal Year Ended: Dec. 31, 2013 Dec. 31, 2012 Dec. 31, 2011 , Net revenues Cash Sales $2,888 $ $2,751 $2,456 Credit Sales 6,046 5,258 4,572 Total Net Revenues 8,935 8,009 7,028 Cost of Sales 5,361 4,405 3,725 Gross Profit 3,574 3,604 3,303 Salaries 1,258 1,183 1,112 Insurance 155 116 93 Depreciation 150 135 122 General and administrative expenses 489 479 361 Subtotal operating expenses 2,052 1,913 1,687 Operating income 1,522 1,691 1,616 Interest expense 10 1 11 Earnings before income taxes 1,512 1,680 1,605 Income taxes 529 588 562 Net Earnings $ 983 $1,092 $1,043 Per Common Share Net Earnings Basic $ 0.28 $ 0.31 $ 0.30 Net Earnings Diluted $ 0.25 $ 0.27 $ 0.26 Weighted average shares outstanding: Basic 3,500 3,500 3,500 Diluted 4,000 4,000 4,000 horizontal analysis on these accounts. Compare the changes in accounts, and describe the changes that were beneficial or detrimental to this company in one sentence. . 4. Last month, you were vacationing in Phoenix and noticed that there were several Starbucks Coffee locations. You do not have any coffee locations in your city, except for a few local cafes. You also have a large college in your town and believe that, if Starbucks Coffee opened a location, they would be very successful. If you went to your public library, what sources would you use to find out more information about this company? If you are on the Internet, how can you obtain additional information on this company? 5. Given the balance sheet for the Moderately Large Corporation (Table 4-4), answer the following: a. For each year, calculate the following ratios: current, quick, debt-to-asset, and debt-to-equity. b. In a written explanation, state what each ratio means. c. Compare the ratios for the 2-year period and determine if the MLC is suf- ficiently liquid. d. How well is the MLC managing its debt? 6. Perform a horizontal analysis of the MLC balance sheet (Table 44). a. Compare assets, liabilities, and owner's equity from one year to the next. b. Is the corporation better off in 2013 or in 2012? 7. Perform a vertical analysis of the MLC balance sheet (Table 4-4) for December 31, 2012. 8. Given the income statement for the MLC (Table 4-7) and balance sheet (Table 44), answer the following: a. Calculate the following ratios for 2012: operating profit margin, net profit margin, operating return on assets, net return on assets, and return on equity. b. In a written explanation, describe what each ratio means. c. In a brief paragraph, describe the overall profitability of the MLC. 9. Perform a horizontal analysis for the MLC income statement (Table 4-7) for 2011 and 2012. Write an explanation of this analysis. 10. Using both the balance sheet (Table 4-4) and the income statement (Table 4-7) for the MLC, answer the following: a. Calculate the following ratios for 2013: inventory turnover, fixed asset tur- over, and total asset turnover. b. In a written explanation, describe what each ratio means. c. In a brief paragraph, describe how well you believe the MLC is managing its assets. . 11. Given the profit loss (income statement) and balance sheet for Sam's Sandwich Delivery (Table 4-8), answer the following: a. Calculate the current and quick ratios. b. Using the inventory figure on the balance sheet as average inventory, calcu- late the inventory turnover ratio. c. Calculate the debt-to-equity ratio, debt-to-total-asset ratio, and operating profit margin ratio. d. Perform a vertical analysis of the income statement. e. Perform a vertical analysis of the balance sheet. f. Based on your analysis, would you consider investing in Sam's Sandwich Delivery? Exercises and Problems 119 120 Chapter 4 Analysis of Financial Statements TABLE 4-6 Sample Balance Sheet 2012 2013 Horizontal Analysis Current assets Total fixed assets Total assets Current liabilities Long-term debt Owner's equity Total liabilities & owner's equity $ 7,000,000 8,000,000 15,000,000 $ 3,000,000 4,000,000 8,000,000 $15,000,000 $ 9,000,000 6,000,000 15,000,000 $ 1,000,000 4,000,000 10,000,000 $15,000,000 TABLE 4-7 Moderately Large Corporation Consolidated Statement of Earnings Consolidated Statement of Earnings (in thousands, except earning per share) Fiscal Year Ended: Dec. 31, 2013 Dec. 31, 2012 Dec. 31, 2011 , Net revenues Cash Sales $2,888 $ $2,751 $2,456 Credit Sales 6,046 5,258 4,572 Total Net Revenues 8,935 8,009 7,028 Cost of Sales 5,361 4,405 3,725 Gross Profit 3,574 3,604 3,303 Salaries 1,258 1,183 1,112 Insurance 155 116 93 Depreciation 150 135 122 General and administrative expenses 489 479 361 Subtotal operating expenses 2,052 1,913 1,687 Operating income 1,522 1,691 1,616 Interest expense 10 1 11 Earnings before income taxes 1,512 1,680 1,605 Income taxes 529 588 562 Net Earnings $ 983 $1,092 $1,043 Per Common Share Net Earnings Basic $ 0.28 $ 0.31 $ 0.30 Net Earnings Diluted $ 0.25 $ 0.27 $ 0.26 Weighted average shares outstanding: Basic 3,500 3,500 3,500 Diluted 4,000 4,000 4,000 horizontal analysis on these accounts. Compare the changes in accounts, and describe the changes that were beneficial or detrimental to this company in one sentence. . 4. Last month, you were vacationing in Phoenix and noticed that there were several Starbucks Coffee locations. You do not have any coffee locations in your city, except for a few local cafes. You also have a large college in your town and believe that, if Starbucks Coffee opened a location, they would be very successful. If you went to your public library, what sources would you use to find out more information about this company? If you are on the Internet, how can you obtain additional information on this company? 5. Given the balance sheet for the Moderately Large Corporation (Table 4-4), answer the following: a. For each year, calculate the following ratios: current, quick, debt-to-asset, and debt-to-equity. b. In a written explanation, state what each ratio means. c. Compare the ratios for the 2-year period and determine if the MLC is suf- ficiently liquid. d. How well is the MLC managing its debt? 6. Perform a horizontal analysis of the MLC balance sheet (Table 44). a. Compare assets, liabilities, and owner's equity from one year to the next. b. Is the corporation better off in 2013 or in 2012? 7. Perform a vertical analysis of the MLC balance sheet (Table 4-4) for December 31, 2012. 8. Given the income statement for the MLC (Table 4-7) and balance sheet (Table 44), answer the following: a. Calculate the following ratios for 2012: operating profit margin, net profit margin, operating return on assets, net return on assets, and return on equity. b. In a written explanation, describe what each ratio means. c. In a brief paragraph, describe the overall profitability of the MLC. 9. Perform a horizontal analysis for the MLC income statement (Table 4-7) for 2011 and 2012. Write an explanation of this analysis. 10. Using both the balance sheet (Table 4-4) and the income statement (Table 4-7) for the MLC, answer the following: a. Calculate the following ratios for 2013: inventory turnover, fixed asset tur- over, and total asset turnover. b. In a written explanation, describe what each ratio means. c. In a brief paragraph, describe how well you believe the MLC is managing its assets. . 11. Given the profit loss (income statement) and balance sheet for Sam's Sandwich Delivery (Table 4-8), answer the following: a. Calculate the current and quick ratios. b. Using the inventory figure on the balance sheet as average inventory, calcu- late the inventory turnover ratio. c. Calculate the debt-to-equity ratio, debt-to-total-asset ratio, and operating profit margin ratio. d. Perform a vertical analysis of the income statement. e. Perform a vertical analysis of the balance sheet. f. Based on your analysis, would you consider investing in Sam's Sandwich Delivery