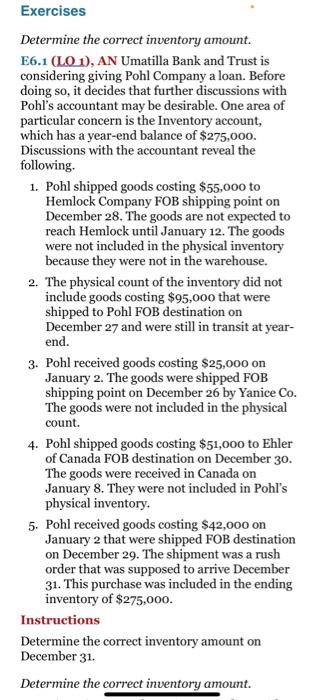

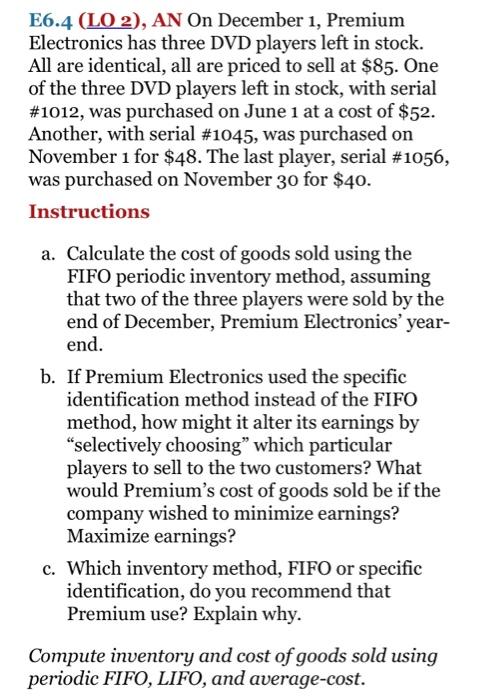

Exercises Determine the correct inventory amount. E6.1 (LO 1), AN Umatilla Bank and Trust is considering giving Pohl Company a loan. Before doing so, it decides that further discussions with Pohl's accountant may be desirable. One area of particular concern is the Inventory account, which has a year-end balance of $275,000. Discussions with the accountant reveal the following 1. Pohl shipped goods costing $55,000 to Hemlock Company FOB shipping point on December 28. The goods are not expected to reach Hemlock until January 12. The goods were not included in the physical inventory because they were not in the warehouse. 2. The physical count of the inventory did not include goods costing $95,000 that were shipped to Pohl FOB destination on December 27 and were still in transit at year- end. 3. Pohl received goods costing $25,000 on January 2. The goods were shipped FOB shipping point on December 26 by Yanice Co. The goods were not included in the physical count. 4. Pohl shipped goods costing $51,000 to Ehler of Canada FOB destination on December 30. The goods were received in Canada on January 8. They were not included in Pohl's physical inventory. 5. Pohl received goods costing $42,000 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrive December 31. This purchase was included in the ending inventory of $275,000. Instructions Determine the correct inventory amount on December 31. Determine the correct inventory amount. E6.4 (LO 2), AN On December 1, Premium Electronics has three DVD players left in stock. All are identical, all are priced to sell at $85. One of the three DVD players left in stock, with serial #1012, was purchased on June 1 at a cost of $52. Another, with serial #1045, was purchased on November 1 for $48. The last player, serial #1056, was purchased on November 30 for $40. Instructions a. Calculate the cost of goods sold using the FIFO periodic inventory method, assuming that two of the three players were sold by the end of December, Premium Electronics' year- end. b. If Premium Electronics used the specific identification method instead of the FIFO method, how might it alter its earnings by "selectively choosing" which particular players to sell to the two customers? What would Premium's cost of goods sold be if the company wished to minimize earnings? Maximize earnings? c. Which inventory method, FIFO or specific identification, do you recommend that Premium use? Explain why. Compute inventory and cost of goods sold using periodic FIFO, LIFO, and average-cost