Answered step by step

Verified Expert Solution

Question

1 Approved Answer

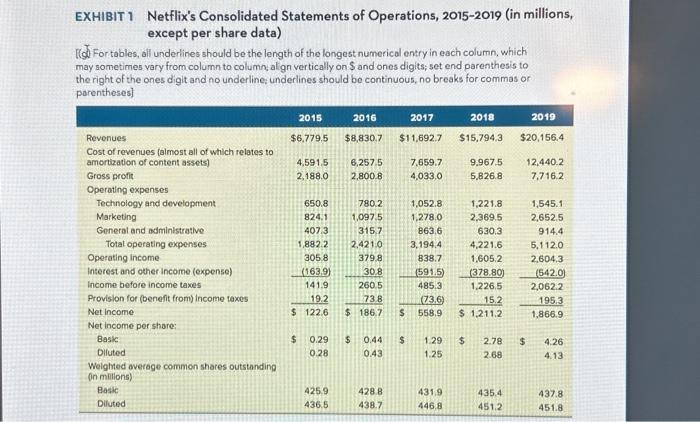

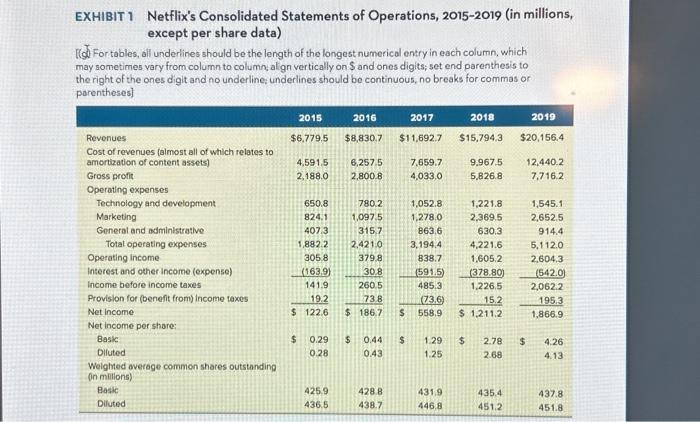

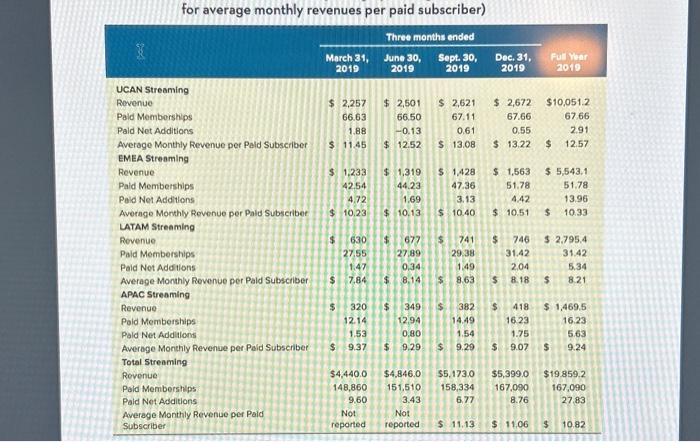

EXHIBIT 1 Netflix's Consolidated Statements of Operations, 2015-2019 (in millions, except per share data) [(d) For tables, all underlines should be the length of the

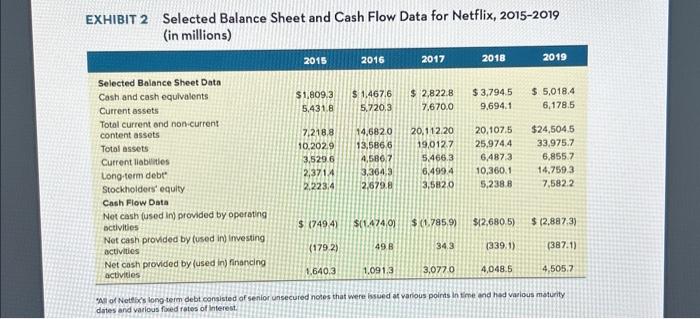

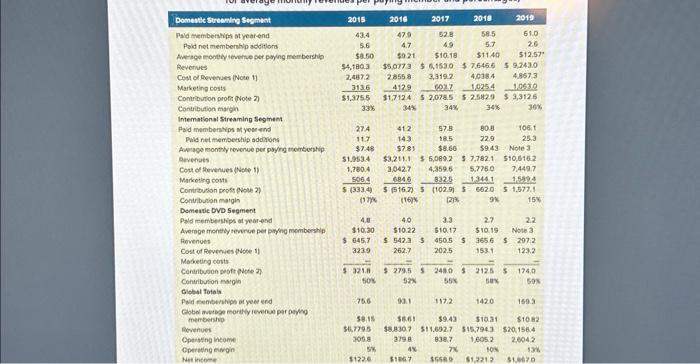

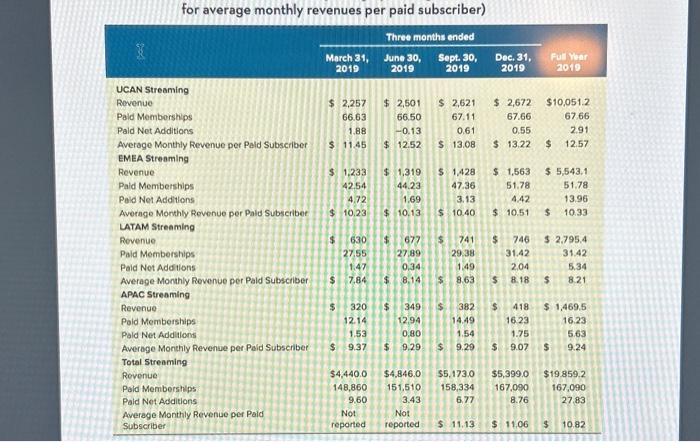

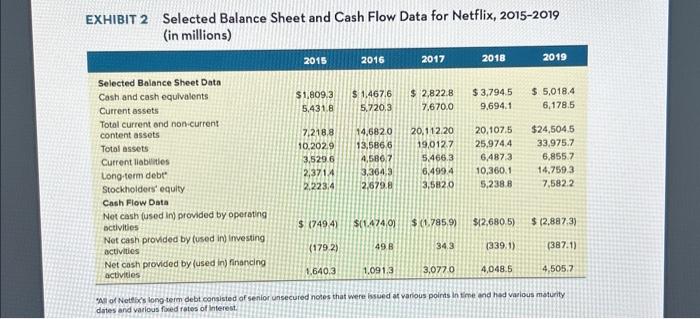

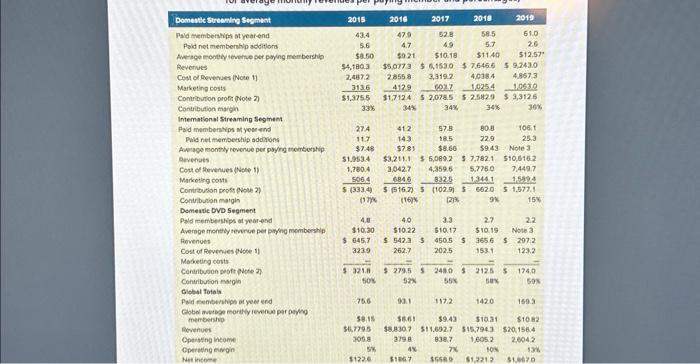

EXHIBIT 1 Netflix's Consolidated Statements of Operations, 2015-2019 (in millions, except per share data) [(d) For tables, all underlines should be the length of the longest numerical entry in each column, which may sometimes vary from column to column; align vertically on $ and ones digits; set end parenthesis to the right of the ones digit and no underline; underlines should be continuous, no breaks for commas or parentheses] EXHIBIT 2 Selected Balance Sheet and Cash Flow Data for Netflix, 2015-2019 (in millions) "A of Netelix's long term debt consisted of senior unsecured notes that were hsued at various poirts in time and hud vaious maturity dates and various foed retes of Interest. for averace monthlv revenues ber paid subscriber) EXHIBIT 7 The Growing Financial Strain of Netflix's Strategic Emphasis on Producing Original Content In-House, 2015-2019 (in millions of dollars) 4. What is your appraisal of Netflix's operating and financial performance based on the data in 4 case Exhibits 1,2,5,6, and 7? What positives and negatives do you see in Netflix's performance? Do a financial analysis to support your answer. Calculate at least six financial ratios -2 profit ratios, 2 liquidity/leverage ratios, and 2 activity ratios and show trends over at least three years. 5. How does Netflix's competitive strength compare against that of 2-3 streaming rivals you deem most likely to challenge Netflix's current leadership position as of mid-2020? Create a weighted competitive strength assessment table using the methodology presented in Table 4.4 in Chapter 4 to support your answer. Based on your assessment and calculations, does

EXHIBIT 1 Netflix's Consolidated Statements of Operations, 2015-2019 (in millions, except per share data) [(d) For tables, all underlines should be the length of the longest numerical entry in each column, which may sometimes vary from column to column; align vertically on $ and ones digits; set end parenthesis to the right of the ones digit and no underline; underlines should be continuous, no breaks for commas or parentheses] EXHIBIT 2 Selected Balance Sheet and Cash Flow Data for Netflix, 2015-2019 (in millions) "A of Netelix's long term debt consisted of senior unsecured notes that were hsued at various poirts in time and hud vaious maturity dates and various foed retes of Interest. for averace monthlv revenues ber paid subscriber) EXHIBIT 7 The Growing Financial Strain of Netflix's Strategic Emphasis on Producing Original Content In-House, 2015-2019 (in millions of dollars) 4. What is your appraisal of Netflix's operating and financial performance based on the data in 4 case Exhibits 1,2,5,6, and 7? What positives and negatives do you see in Netflix's performance? Do a financial analysis to support your answer. Calculate at least six financial ratios -2 profit ratios, 2 liquidity/leverage ratios, and 2 activity ratios and show trends over at least three years. 5. How does Netflix's competitive strength compare against that of 2-3 streaming rivals you deem most likely to challenge Netflix's current leadership position as of mid-2020? Create a weighted competitive strength assessment table using the methodology presented in Table 4.4 in Chapter 4 to support your answer. Based on your assessment and calculations, does

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started