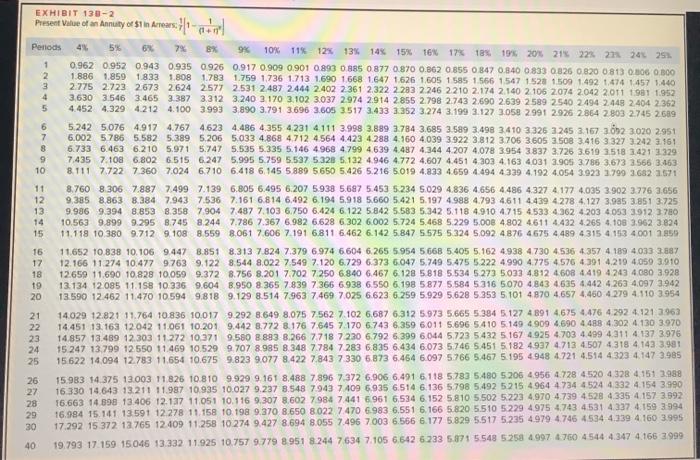

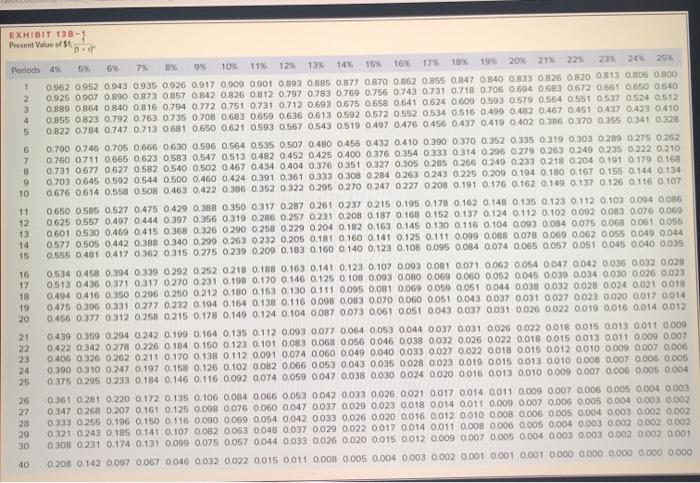

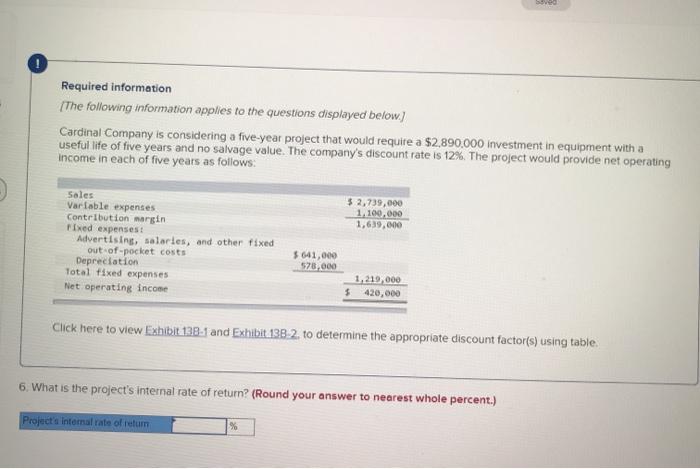

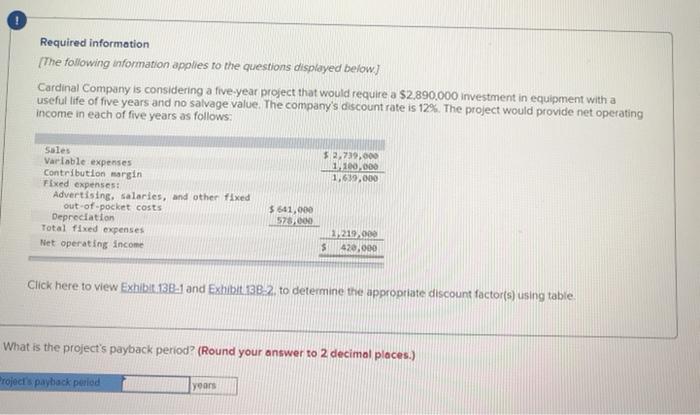

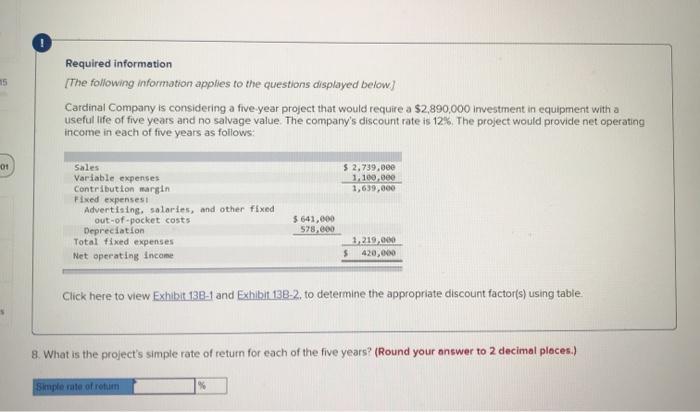

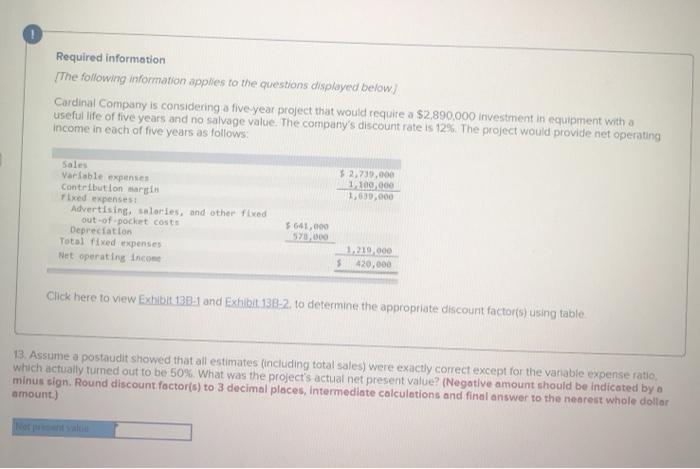

EXHIBIT 130-2 Present Value of an Annuity of $1 in Artears 11+ Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 221 24 25 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0877 0.870 0.862 0.855 0 847 0.840 0.833 0826 0820 081) 0006 O 300 2 1.886 1.859 1833 1,808 1.783 1.759 1.736 1.713 1690 1668 1647 1626 1,605 1 585 1566 1547 1520 1509 1.492 1.474 1457 1.440 3 2775 2.723 2673 2624 2577 2.531 2487 2444 2.402 2361 2,322 2283 2246 2210 2.174 2.140 2106 2074 2042 2011 1981 1952 4 3,630 3.546 3.465 3.387 3.312 3.240 3 170 3.102 3.037 2974 2.914 2.855 2.798 2.743 2.690 2.639 2 589 2540 2494 2.448 2404 2.362 5 4.452 4.329 4.212 4.100 39933.890 3.791 3.696 3.605 3.517 3.433 3.352 3274 3.199 3.127 3.058 2.991 2.926 2864 2803 2.745 2689 6 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4 231 4 111 3.998 3.889 3.784 3.685 3.589 3.498 3410 3326 3.245 3.167 3052 3.020 2951 7 6.002 5786 5.582 5.389 5.206 5.033 4868 4712 4564 4.423 4.288 4.160 4039 3.922 3.812 3706 3.605 3.508 3.416 3327 3.242 3161 8 6.733 6.463 6.210 5.971 5.7475.535 5.335 5.146 4 968 4799 4.639 4487 4.344 4.207 4,078 3954 3837 3.726 3.619 3518 3421 2329 9 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5537 5328 5.132 4.946 4.772 4.607 4.451 4 303 4.163 4031 3.905 3.786 3.673 3566 3.463 10 8.111 7722 7360 7.024 6.710 6.418 6.145 5.889 5650 5.426 5.216 5.019 4.833 4.659 4.494 4339 4. 192 4.054 3023 3.799 3682 1.571 11 8.760 8.306 7.887 7.499 7.139 6.805 6,495 6.207 5.938 5.687 5.453 5234 6.029 4.8364656 4486 4327 4177 4.035 3.902 3.776 3.656 12 9,385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5421 5.197 4.988 4.793 4.611 4.439 4278 4.127 3.985 3.851 3725 13 9.936 9.394 8.853 8.358 7904 7.487 7.103 6.750 6.424 6.122 5842 5583 5.342 5.118 4.910 4715 4533 4.362 4203 4053 3912 3 780 14 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6,628 6.302 6.002 5724 5.468 5.229 5,008 4802 4611 4.432 4.265 4.108 3.962 3824 15 11.118 10 380 9.712 9108 8559 8061 7606 7.191 6.811 6.462 6.142 5.847 5575 5 324 5.092 4 876 4 675 4 489 4 315 4.153 4001 855 16 11652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6974 6604 6.265 5 954 5668 5.405 5.162 4.938 4730 4.536 4.357 4 189 4,033 3887 17 12.166 11 274 10.477 9763 9.122 8.544 8,022 7.549 7.120 6.729 6373 6.047 5.749 5.475 5222 4 990 4.775 4.576 4391 4219 4050 3.910 18 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4419 4243 4080 3.928 19 13.134 12085 11.158 10.336 9.604 8.950 8 365 7.839 7366 6938 6.550 6.198 5877 5.584 5316 5070 4.843 4635 4.442 4.263 4.097 3.942 20 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7469 7025 6.623 6.259 5.929 5.628 5.353 5101 4870 4,657 4,460 4 279 4.110 3954 21 14.029 12.821 11.764 10.836 10.017 9292 8.649 8.075 7.562 7.102 6.687 6312 5.973 5,665 5.384 5.127 4 891 4.675 4.476 4 292 4.121 3963 22 14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 7.645 7:170 6743 6.359 6011 5.696 5410 5.149 4 909 4.690 4 488 4.302 4.130 3970 23 14.857 13.489 12.303 11.272 10.371 9.580 8893 8.266 7718 7230 6792 6.399 6.044 5723 5432 5 167 4.925 4.703 4.499 4311 4137 3.976 24 15 247 13.799 12550 11.469 10.529 9.707 8.985 8.348 7784 7283 6.835 6.434 6.073 5.746 5.451 5182 4937 4.713 4.507 4318 4.143 3.981 25 15.622 14.094 12783 11.654 10.675 9.823 9.077 8.422 7.843 7330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4 323 4.147 3.985 26 15983 14.375 13.003 11.826 10.810 9.929 9.161 8,488 7.896 7.372 6.906 6.491 6.118 5.783 5.480 5206 4 956 4.728 4520 4 328 4151 3.988 27 16330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7943 7 409 6.935 6.514 6.136 5.798 5.492 5215 4964 4734 4524 4332 4.154 3.990 28 16.663 14.898 13.406 12.137 11051 10.116 9.307 8.602 7984 7.441 6961 6,534 6.152 5.810 5.502 5.223 4,970 4.739 4528 4 335 4157 3.992 29 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8 022 7470 6.983 6.551 6.166 5.820 5.510 5229 4 975 4.743 4531 4.337 4.159 3.994 30 17.292 15 372 12.765 12 409 11.258 10 274 9.427 8.694 8.055 7.496 7003 6.566 6.177 5.829 5.517 5.235 4 979 4.746 4534 4.339 4160 3.995 40 19.793 17 159 15.046 13.332 11.925 10.757 9.779 8951 8.244 7634 7.105 6.642 6.233 5.871 5548 5258 4 997 4750 4544 4.347 4.166 2 999 EXHIBIT 128-1 Present Value of $1 Periods 4 64 79 8 9 10% 11% 12% 131 145 15 1612 19% 20% 21% 22 23 24 25 1 0.962 0.952 0.043 0.935 0926 0,917 0909 0.901 0.893 0.385 0.877 0870 0.362 0.855 0.847 0.840 0.833 0.826 0820 0313 0.806 0.300 2 0.925 0.907 0.890 0.873 0857 0842 0826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0,694 0.683 0672 0.661 0.650 0.640 3 0.889 0864 0 840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0,675 0.658 0.641 0.524 0 609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 4 0.855 0823 0.792 0.763 0.735 0.708 0.683 0659 0.636 0.613 0.592 0.572 0.552 0534 0.516 0.499 0.412 0.467 0.451 0437 0.423 0.410 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.385 0 370 0.355 0.341 0.328 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 7 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0333 0.314 0.296 0.279 0.263 0.249 0.235 0.222 0.210 8 0.731 0.677 0627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0 35+ 0.327 0 305 0205 0.266 0.249 0233 0.218 0.204 0.191 0.179 0.168 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0 308 0.284 0.263 0243 0.225 0.200 0.194 0.180 0.167 0.155 0.144 0.134 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0247 0.227 0 208 0.191 0.176 0.162 0.149 0.137 0.125 0.116 0.107 11 0.650 0585 0.527 0.475 0.429 0.388 0.350 0317 0.287 0.261 0.237 0.215 0.195 0.17 0.162 0.141 0135 0.123 0.112 0.102 0.094 0086 12 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.002 0.003 0.076 0.069 13 0,601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.014 0.075 0.068 0.051 0055 14 0.57% 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 15 0.556 0.481 0.417 0362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0051 0.045 0.040 0.035 16 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.003 0.081 0.071 0.062 0.054 0.047 0.042 0,036 0.032 0.020 17 0.513 0436 0.371 0.17 0.270 0.231 0,198 0.170 0.146 0.125 0.108 0.093 0.000 0.069 0.060 0,052 0.045 0,039 0.034 0.030 0026 0.023 18 0.494 0416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.060 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0018 19 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0023 0.020 0.017 0014 20 0456 0.377 0312 0.258 0.215 0.178 0149 0.124 0.104 0087 0.073 0.061 0.051 0.043 0.037 0.031 0.025 0.022 0010 0.016 0.014 0.012 21 0.439 0.359 0.294 0 242 0.199 0.164 0.135 0.112 0,093 0077 0.064 0.053 0044 0.037 0.031 0.025 0.022 0.018 0015 0013 0.011 0.000 22 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.007 23 0.406 0326 0.262 0.211 0.170 0.138 0.112 0.091 0.074 0.060 0.049 0.040 0033 0.027 0.022 0018 0.015 0.012 0010 0009 0.007 0.006 24 0.390 0.30 0.247 0.197 0.158 0.126 0.102 0082 0.066 0053 0.043 0.035 0.028 0.023 0.019 0015 0.013 0010 0.00 0.007 0.005 0.005 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0016 0.013 0.010 0.009 0.007 0.006 0.005 0.004 26 0.361 0.21 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0042 0,033 0.025 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.001 0.003 27 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0047 0.037 0,029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0004 0.003 0,002 28 0.333 0.255 0.196 0.150 0.116 0.090 0.069 0.054 0.042 0033 0.025 0.020 0.016 0,012 0.010 0008 0.006 0005 0.004 0.003 0.002 0.002 20 0.321 0.243 0.185 0.141 0.107 0,082 0.063 0.048 0.037 0.029 0,022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 30 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0026 0.020 0015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 40 0.200 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 Sve Required information [The following information applies to the questions displayed below) Cardinal Company is considering a five-year project that would require a $2,890.000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating Income in each of five years as follows: $ 2,739,000 1.100.000 1,639,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 641,000 578,000 1.219,000 $ 420,000 Click here to view Exhibit 138-1 and Exhibit 138-2. to determine the appropriate discount factor(s) using table 6. What is the project's internal rate of return? (Round your answer to nearest whole percent.) Project's internal rate of return % Required information [The following information applies to the questions displayed below) Cardinal Company is considering a five-year project that would require a $2,890.000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows 52,739,000 1 100,000 1,639,000 Sales Variable expenses Contribution margin Fixed expenses Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 641,000 578.000 1,219,000 $ 420,000 Click here to view Exhibit 138-1 and Exhibit 1382. to determine the appropriate discount factor(s) using table. What is the project's payback period (Round your answer to 2 decimal places.) roject's payback period years 15 Required information [The following information applies to the questions displayed below) Cardinal Company is considering a five-year project that would require a $2,890,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: 01 $ 2,739.000 3.100.000 1,639,000 Sales Variable expenses Contribution margin Fixed expenses Advertising. salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 641,000 578,000 1,219,00 $ 420,000 Click here to view Exhibit 138-1 and Exhibit 13B-2. to determine the appropriate discount factor(s) using table; 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places.) Simple rate of return Required information [The following information applies to the questions displayed below) Cardinal Company is considering a five-year project that would require a $2,890,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: 3.2, 730,000 1.100.000 1,630,000 Sales Variable expenses Contribution margin Fixed expenses Advertising, alories, and other fived out-of-pocket costs Depreciation Total fixed expenses Net operating Income 5641.000 570,000 1,219,000 420,000 Click here to view Exhibit 138-1 and Exhibit 13B-2. to determine the appropriate discount factors) using table. 13. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 50%. What was the project's actual net present value? (Negative amount should be indicated by a minus sign. Round discount foctor(s) to 3 decimal places, intermediate calculations and final answer to the nearest whole dollar amount.)