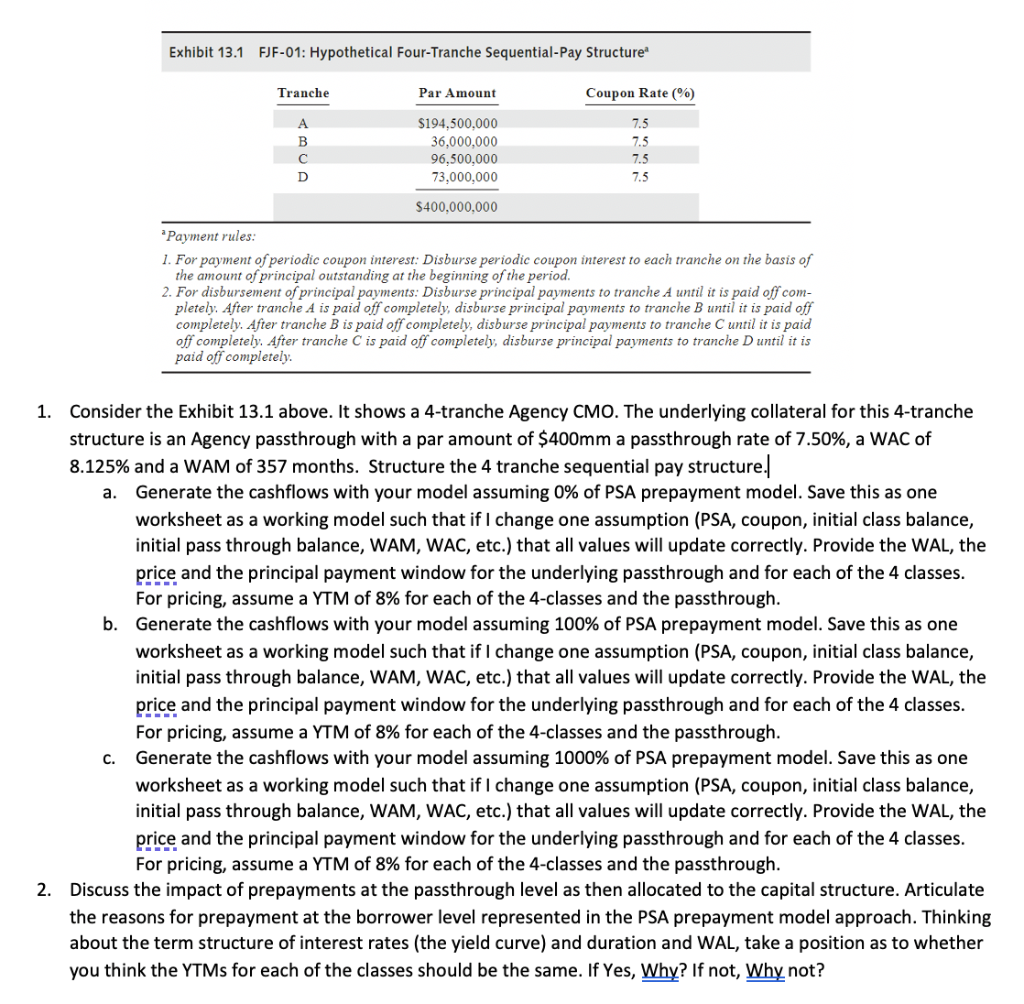

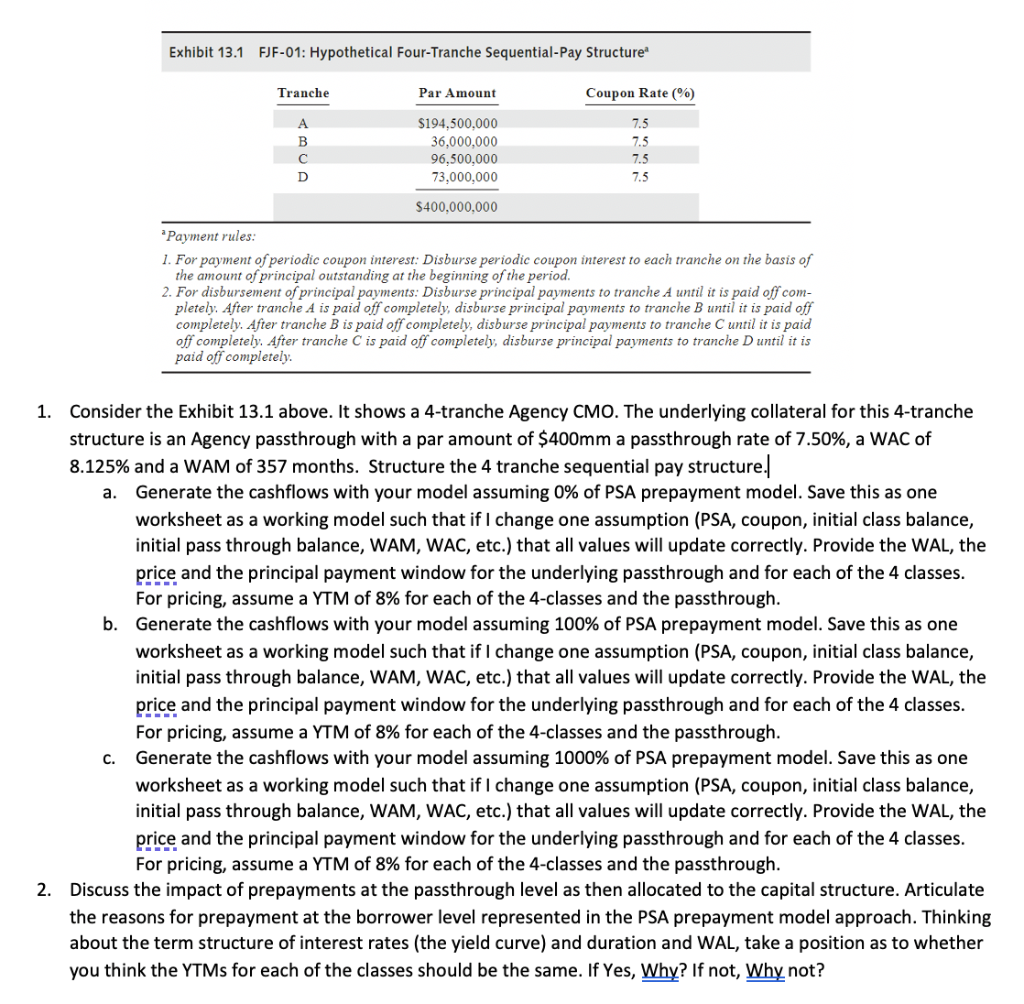

Exhibit 13.1 FJF-01: Hypothetical Four-Tranche Sequential-Pay Structure Tranche Par Amount Coupon Rate (%) A B D $194,500,000 36,000,000 96,500,000 73,000,000 7.5 7.5 7.5 7.5 $400,000,000 Payment rules: 1. For payment of periodic coupon interest: Disburse periodic coupon interest to each tranche on the basis of the amount of principal outstanding at the beginning of the period. 2. For disbursement of principal payments: Disburse principal payments to tranche A until it is paid off com- pletely. After tranche A is paid off completely, disburse principal payments to tranche B until it is paid off completely. After tranche B is paid off completely, disburse principal payments to tranche C until it is paid off completely. After tranche C is paid off completely, disburse principal payments to tranche D until it is paid off completely 1. Consider the Exhibit 13.1 above. It shows a 4-tranche Agency CMO. The underlying collateral for this 4-tranche structure is an Agency passthrough with a par amount of $400mm a passthrough rate of 7.50%, a WAC of 8.125% and a WAM of 357 months. Structure the 4 tranche sequential pay structure. a. Generate the cashflows with your model assuming 0% of PSA prepayment model. Save this as one worksheet as a working model such that if I change one assumption (PSA, coupon, initial class balance, initial pass through balance, WAM, WAC, etc.) that all values will update correctly. Provide the WAL, the price and the principal payment window for the underlying passthrough and for each of the 4 classes. For pricing, assume a YTM of 8% for each of the 4-classes and the passthrough. b. Generate the cashflows with your model assuming 100% of PSA prepayment model. Save this as one worksheet as a working model such that if I change one assumption (PSA, coupon, initial class balance, initial pass through balance, WAM, WAC, etc.) that all values will update correctly. Provide the WAL, the price and the principal payment window for the underlying passthrough and for each of the 4 classes. For pricing, assume a YTM of 8% for each of the 4-classes and the passthrough. Generate the cashflows with your model assuming 1000% of PSA prepayment model. Save this as one worksheet as a working model such that if I change one assumption (PSA, coupon, initial class balance, initial pass through balance, WAM, WAC, etc.) that all values will update correctly. Provide the WAL, the price and the principal payment window for the underlying passthrough and for each of the 4 classes. For pricing, assume a YTM of 8% for each of the 4-classes and the passthrough. 2. Discuss the impact of prepayments at the passthrough level as then allocated to the capital structure. Articulate the reasons for prepayment at the borrower level represented in the PSA prepayment model approach. Thinking about the term structure of interest rates (the yield curve) and duration and WAL, take a position as to whether you think the YTMs for each of the classes should be the same. If Yes, Why? If not, Why not? C. Exhibit 13.1 FJF-01: Hypothetical Four-Tranche Sequential-Pay Structure Tranche Par Amount Coupon Rate (%) A B D $194,500,000 36,000,000 96,500,000 73,000,000 7.5 7.5 7.5 7.5 $400,000,000 Payment rules: 1. For payment of periodic coupon interest: Disburse periodic coupon interest to each tranche on the basis of the amount of principal outstanding at the beginning of the period. 2. For disbursement of principal payments: Disburse principal payments to tranche A until it is paid off com- pletely. After tranche A is paid off completely, disburse principal payments to tranche B until it is paid off completely. After tranche B is paid off completely, disburse principal payments to tranche C until it is paid off completely. After tranche C is paid off completely, disburse principal payments to tranche D until it is paid off completely 1. Consider the Exhibit 13.1 above. It shows a 4-tranche Agency CMO. The underlying collateral for this 4-tranche structure is an Agency passthrough with a par amount of $400mm a passthrough rate of 7.50%, a WAC of 8.125% and a WAM of 357 months. Structure the 4 tranche sequential pay structure. a. Generate the cashflows with your model assuming 0% of PSA prepayment model. Save this as one worksheet as a working model such that if I change one assumption (PSA, coupon, initial class balance, initial pass through balance, WAM, WAC, etc.) that all values will update correctly. Provide the WAL, the price and the principal payment window for the underlying passthrough and for each of the 4 classes. For pricing, assume a YTM of 8% for each of the 4-classes and the passthrough. b. Generate the cashflows with your model assuming 100% of PSA prepayment model. Save this as one worksheet as a working model such that if I change one assumption (PSA, coupon, initial class balance, initial pass through balance, WAM, WAC, etc.) that all values will update correctly. Provide the WAL, the price and the principal payment window for the underlying passthrough and for each of the 4 classes. For pricing, assume a YTM of 8% for each of the 4-classes and the passthrough. Generate the cashflows with your model assuming 1000% of PSA prepayment model. Save this as one worksheet as a working model such that if I change one assumption (PSA, coupon, initial class balance, initial pass through balance, WAM, WAC, etc.) that all values will update correctly. Provide the WAL, the price and the principal payment window for the underlying passthrough and for each of the 4 classes. For pricing, assume a YTM of 8% for each of the 4-classes and the passthrough. 2. Discuss the impact of prepayments at the passthrough level as then allocated to the capital structure. Articulate the reasons for prepayment at the borrower level represented in the PSA prepayment model approach. Thinking about the term structure of interest rates (the yield curve) and duration and WAL, take a position as to whether you think the YTMs for each of the classes should be the same. If Yes, Why? If not, Why not? C