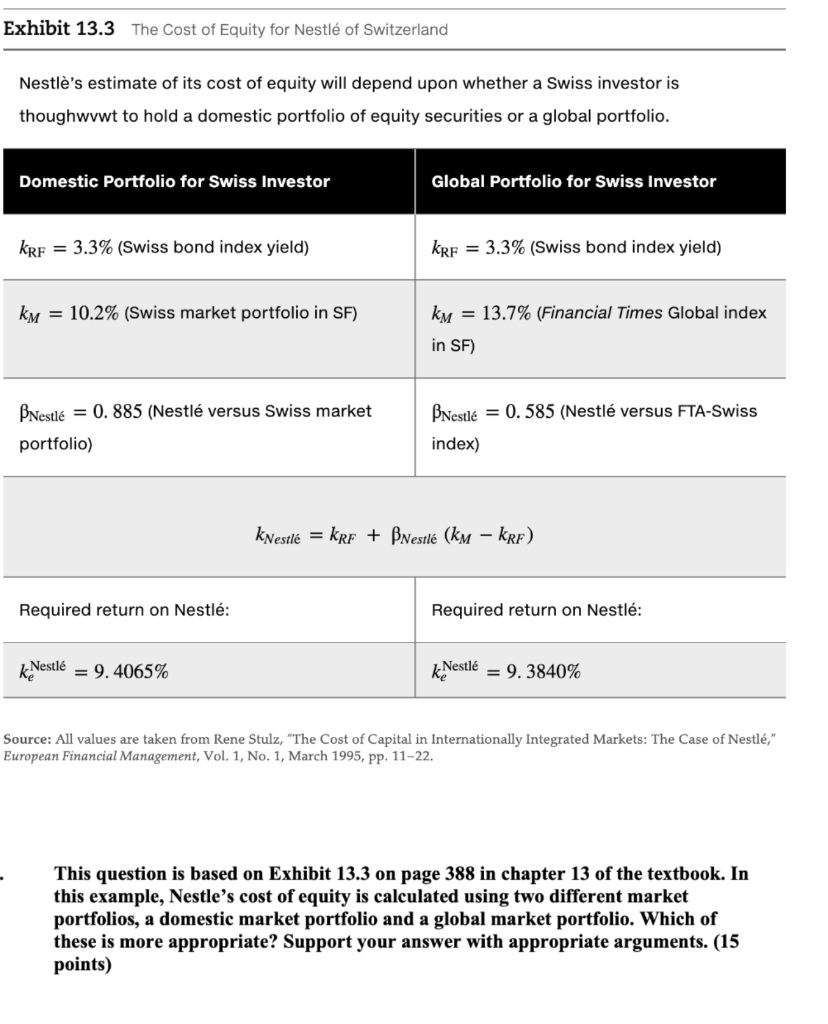

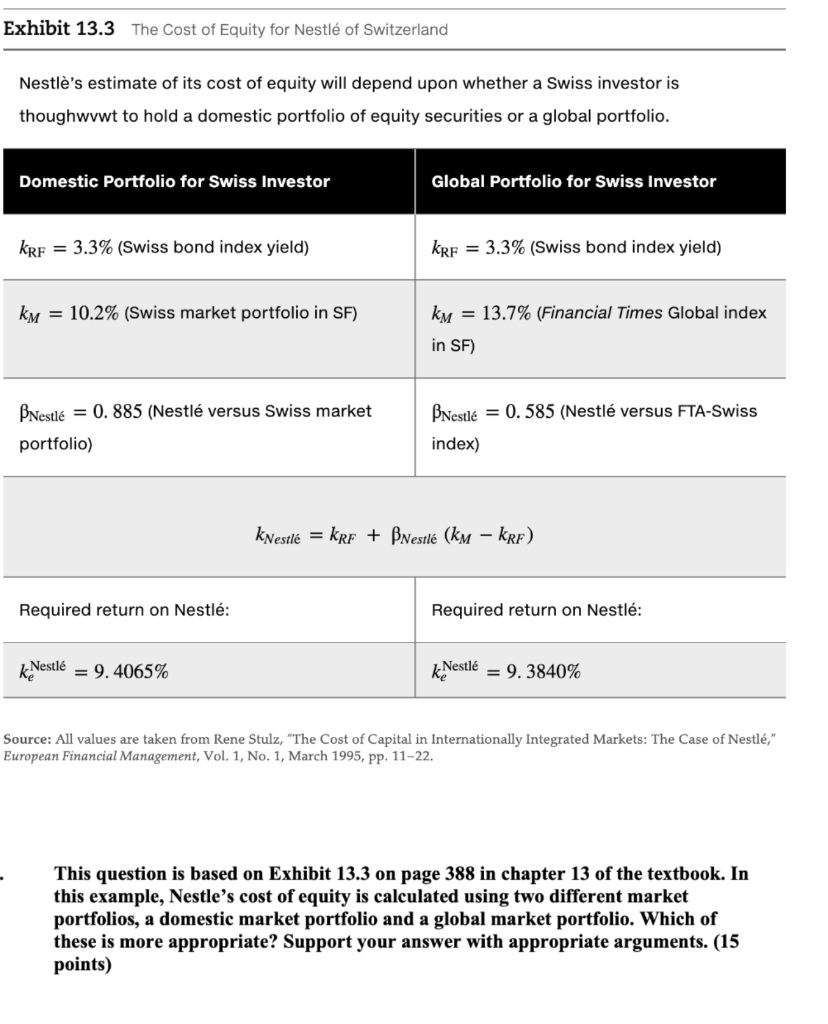

Exhibit 13.3 The Cost of Equity for Nestl of Switzerland Nestl's estimate of its cost of equity will depend upon whether a Swiss investor is thoughwvwt to hold a domestic portfolio of equity securities or a global portfolio Domestic Portfolio for Swiss Investor Global Portfolio for Swiss Investor kRF 3.3% (Swiss bond index yield) kRF 3.3% (Swiss bond index yield) = 10.2% (Swiss market portfolio in SF) ky-13.7% (Financial Times Global index in SF) PNestl - 0. 885 (Nestl versus Swiss market est0.585 (Nestl versus FTA-Swiss portfolio) index) Required return on Nestl Required return on Nestl kNestl-: 9.4065% kNestl-: 9.3840% Source: All values are taken from Rene Stulz, "The Cost of Capital in Internationally Integrated Markets: The Case of Nestl," European Financial Management, Vol. 1, No. 1, March 1995, pp. 11-22. This question is based on Exhibit 13.3 on page 388 in chapter 13 of the textbook. In this example, Nestle's cost of equity is calculated using two different market portfolios, a domestic market portfolio and a global market portfolio. Which of these is more appropriate? Support your answer with appropriate arguments. (15 points) Exhibit 13.3 The Cost of Equity for Nestl of Switzerland Nestl's estimate of its cost of equity will depend upon whether a Swiss investor is thoughwvwt to hold a domestic portfolio of equity securities or a global portfolio Domestic Portfolio for Swiss Investor Global Portfolio for Swiss Investor kRF 3.3% (Swiss bond index yield) kRF 3.3% (Swiss bond index yield) = 10.2% (Swiss market portfolio in SF) ky-13.7% (Financial Times Global index in SF) PNestl - 0. 885 (Nestl versus Swiss market est0.585 (Nestl versus FTA-Swiss portfolio) index) Required return on Nestl Required return on Nestl kNestl-: 9.4065% kNestl-: 9.3840% Source: All values are taken from Rene Stulz, "The Cost of Capital in Internationally Integrated Markets: The Case of Nestl," European Financial Management, Vol. 1, No. 1, March 1995, pp. 11-22. This question is based on Exhibit 13.3 on page 388 in chapter 13 of the textbook. In this example, Nestle's cost of equity is calculated using two different market portfolios, a domestic market portfolio and a global market portfolio. Which of these is more appropriate? Support your answer with appropriate arguments. (15 points)