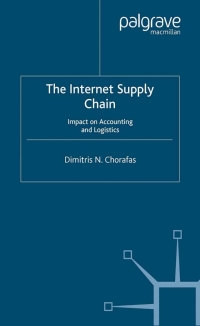

EXHIBIT 14B-1 Present Value of $1; (1 + r)" Periods 1 2 2 3 4 5 6 7 8 9 10 11 12 13 14 15 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.694 0.683 0.683 0.672 0.661 0.650 0.640 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.467 0.451 0.437 0.423 0.410 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 0.760 0.711 0.665 0.623 0.583 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0.249 0.235 0.222 0.210 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.266 0.249 0.233 0.218 0.218 0.204 0.191 0.179 0.168 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.137 0.126 0.116 0.107 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.055 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.065 0.057 0.051 0.045 0.040 0.035 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.039 0.034 0.030 0.026 0.023 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 0.475 0.396 0.396 0.331 0.277 0.232 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.031 0.026 0.022 0.019 0.016 0.014 0.012 0.439 0.359 0.294 0.2420.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.422 0.342 0.278 0.226 0.184 0.150 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.007 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.091 0.074 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.0120.010 0.010 0.009 0.007 0.006 0.390 0.310 0.247 0.197 0.158 0.126 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.016 0.013 0.010 0.009 0.007 0.006 0.005 0.004 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0.033 0.026 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.347 0.268 0.207 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.002 0.333 0.255 0.196 0.150 0.116 0.090 0.069 0.054 0.042 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 0.308 0.231 0.174 0.131 0.099 0.075 0.075 0.057 0.044 0.033 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 16 17 18 19 20 0.123 21 22 23 24 25 26 27 28 29 30 40 1 EXHIBIT 14B-2 Present Value of an Annulty of $1 In Arrears; Periods 1 2 3 4 5 6 8 9 0 1 7 3 14 15 4% 58 6% 7% 8% 9% 10% 18 128 % 4% 5% 16% 7% % 19% 20% 21% 22% 23% 248 25% 0.962 0.952 0.943 0935 0926 097 0909 0901 0.893 0.885 0.87 0.870 0.862 0.855 0847 0840 0.83 0826 0820 0.813 0.806 0800 1.886 159 133 1.808 1.783 1759 136 17 1.690 1.668 1.647 1.626 1605 1585 1.566 1547 1528 1509 1.492 1.474 1.457 1.440 2.75 2.723 2.63 2.624 25] 2531 2.487 2.444 2.402 2361 2.322 2.283 2246 2.246 2.210 274 2140 2106 2.074 2.042 2.0t 1.9 1.952 3.630 3.546 3.465 3.387 3.32 3.240 3.70 3.102 3.037 2974 2014 285 2.798 2.743 2.60 2.639 2.589 2540 2540 2.494 2.494 2.448 2.404 2.362 4.452 4329 44.212 4.100 3993 3.90 3.71 3.696 3.605 3.517 3.433 3.352 3.274 3199 3.27 3.058 299 2926 2864 2.803 2.745 2.689 5.242 5.076 4917 4.767 4.623 4.486 4.355 4.231 4 398 3.89 3.784 3.685 3.589 3589 3.498 3.410 3326 3.245 3167 3.092 3.020 2951 6.002 5.786 5.582 5.389 5.206 5.033 4.68 472 4564 4.423 4288 4160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 6.733 65.463 6.210 5.97] 5.747 5535 5.335 5.146 4.968 4799 4.639 4.487 4.344 4.207 4.078 3.954 3.37 3.726 3.519 3.518 3.421 3.329 7435 7.108 6.802 6.55 6.247 5.995 5.759 55375328 532 4.946 4.72 4.607 4.451 4303 4.163 4.031 3.905 3786 3.573 3.566 3463 18.11 7722 7.360 1024 6.7/10 6.418 6.145 5.888 5.650 5426 5.216 5.019 4.833 4.659 4.494 439 4192 4054 3.923 3.799 3.682 357 8.760 8306 7887 7.499 7139 6.805 6.495 6.207 58 5.687 5.453 5.234 5.029 4.36 4.656 4.486 4327 47 4.035 3902 376 3.656 9.385 8.863 8.384 7.943 7536 7161 6.814 6.492 6194 5.918 5.660 5421 5197 4.98 4793 4.6m 4.439 4.278 4.27 3995 3851 3.725 9.986 9394 8.853 8.358 7904 7.487 7103 6.750 6.424 622 5.842 5583 5342 5.8 4.910 475 4.533 4.362 4.203 4.053 4.0533.912 3.780 10.563 9899 9295 8.745 8.244 7.786 7.36] 6.982 6.628 6.302 6.002 5.724 5.468 5.468 5.229 5.008 4.802 4.5m 4.432 4.265 4.108 3.962 3.824 18 10.380 9.712 9108 8.559 8.06] 7606 I199 6.8 6.462 6142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4315 453 4.000 3.859 1662 10.838 10106 9.47 8.85] 8.313 7824 1379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4730 4.536 4357 49 4.033 3.87 2.166 11.274 10.477 9763 9.22 8.544 8.022 7549 7120 6.729 6.373 6.047 5.749 5.475 5.222 4990 475 4576 431 4219 4.059 3.910 12.69 1.690 10.828 10.059 9.372 8.756 8.201 7702 7.250 6.840 6.46] 6128 5.818 5.534 5273 5033 4.812 4.608 4.49 4.243 4.080 3.928 134 12.085 1158 10336 9.604 8.950 8.365 7.839 7.366 6.988 6.550 6198 5.87 5.584 5.36 5.070 4.43 4.635 4.442 4.263 4.097 3.942 13.50 2.462 1470 10.594 9.818 929 854 7963 7469 7.025 6.623 6.259 5.929 5.628 5.628 5.353 5101 4.870 4.657 4.460 4279 4.10 3.954 14.029 2.821 1764 10.86 0.07 10.07 9.292 8.649 8.075 7562 7102 6.687 6.312 5.973 5.665 5.384 5127 4.91 4.675 4.476 4.292 41 3.963 14.451 13.163 2.042 1.061 10.20 9.442 88.T2 876 7.645 770 6.743 6.359 6.00 5.696 5.410 5.149 4.909 4.690 4.488 4.48 4.302 4.0 3.970 14.857 13.489 2303 2.303 1272 10.371 9.580 8.83 8266 7718 7.230 6.792 6.39 6.04 5.723 5.4325167 4.925 4703 4.499 4.31 47 3.976 5.247 3.799 2.550 11.469 10.529 9.707 8.985 8.348 7784 7.283 6.835 6.434 6.073 5.746 5.451 582 4.937 473 4507 4.318 4.43 3.98] 5.622 14.094 2.783 11.654 10.675 9.823 9.07 8.4227.843 7.330 6.83 6.464 6.097 5.766 5.766 5.46] 595 4.948 4721 4514 4.323 4.147 3.985 5.93 14.375 13.003 11.826 10.810 9929 9161 8.488 7.896 1.372 6.906 6.491 618 5.783 5.480 5.206 4.956 4.728 4520 4.328 4.151 3988 6.330 4.643 13.21 11987 10.935 10.027 9.237 8548 7943 7409 6.935 6.54 6136 5.798 5.492 5.25 4964 4734 4.524 4.332 4.32 4154 3.990 16.663 14.898 3.406 2.137 11.051 10.116 9.307 8.602 7.984 7441 6.961 6.534 6152 5.810 5.5025.223 4970 4739 4528 4.35 4.157 3.992 | 16.984 15.141 13.51 12278 158 10198 9.370 8.650 8.022 7470 6.983 6.551 6.166 5.820 550 5.229 4.975 4743 4531 4.337 4 4.159 3.94 7292 15.372 5.372 13.765 2.409 11.258 10.274 19427 8.694 8.055 1496 7.003 6.566 6 5.829 5.51 5.235 4.979 4746 4.534 4.339 4.160 3.95 19.793 17.159 15.046 3.332 1.925 0.75] 979 8.951 8.24 7.634 I105 6.642 6233 5.871 5548 5.258 4.997 4.60 4.544 4347 4166 3.999 6 7 9 20 21 2 3 24 5 26 27 8 9 30 40 Gaston Company is considering a capital budgeting project that would require a $2,300,000 investment in equipment with a useful life of five years and no salvage value. The company's tax rate is 30% and its after-tax cost of capital is 13%. It uses the straight-line depreciation method for financial reporting and tax purposes. The project would provide net operating income each year for five years as follows: $3,100,000 1,690,000 1,410,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs Depreciation Total fixed expenses Net operating income $530,000 460,000 990,000 $ 420,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. H. Required: Compute the project's net present value. Net present value Lander Company has an opportunity to pursue a capital budgeting project with a five-year time horizon. After careful study, Lander estimated the following costs and revenues for the project: $ 290,000 $ 66,000 $ 21,000 Cost of equipment needed Working capital needed Repair the equipment in two years Annual revenues and costs: Sales revenues Variable expenses Fixed out-of-pocket operating costs $410,000 $ 210,000 $ 92,000 The piece of equipment mentioned above has a useful life of five years and zero salvage value. Lander uses straight-line depreciation for financial reporting and tax purposes. The company's tax rate is 30% and its after-tax cost of capital is 13%. When the project concludes in five years the working capital will be released for investment elsewhere within the company. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate the annual income tax expense for each of years 1 through 5 that will arise as a result of this investment opportunity. 2. Calculate the net present value of this investment opportunity. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar.) 1 Income tax expense Year 1 Year 2 Year 3 Year 4 Year 5 2. Net present value