Answered step by step

Verified Expert Solution

Question

1 Approved Answer

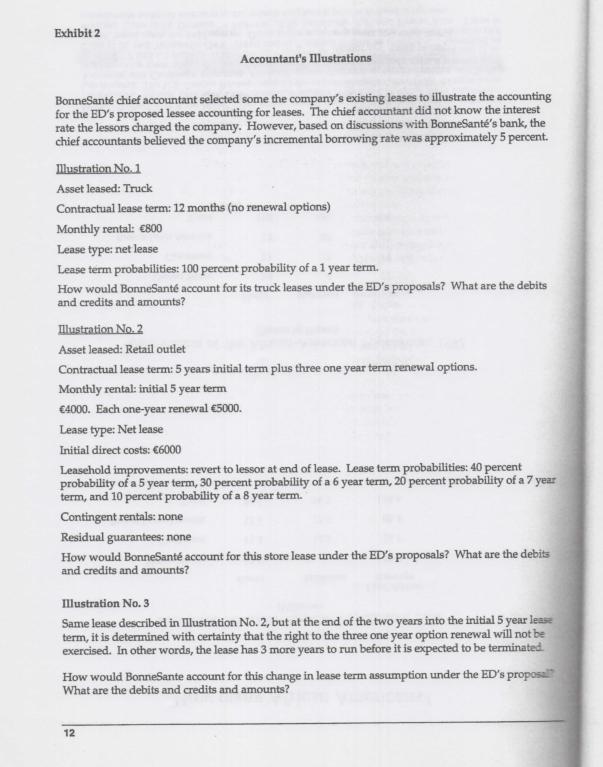

Exhibit 2 Accountant's Illustrations BonneSant chief accountant selected some the company's existing leases to illustrate the accounting for the ED's proposed lessee accounting for

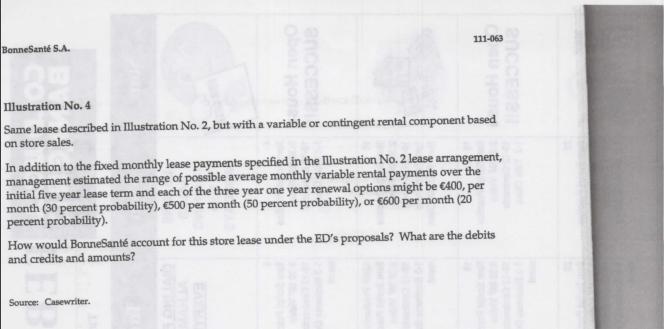

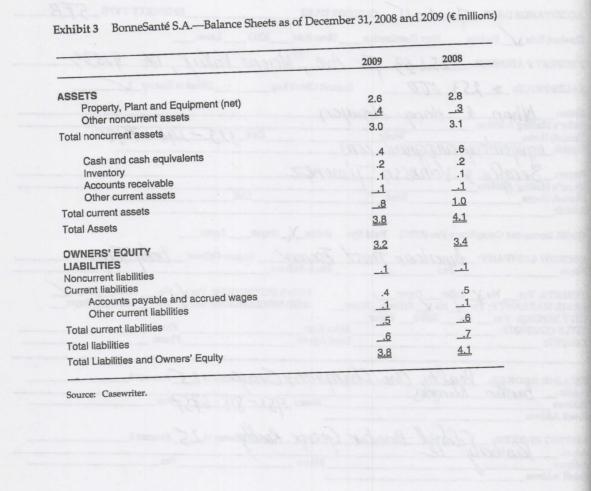

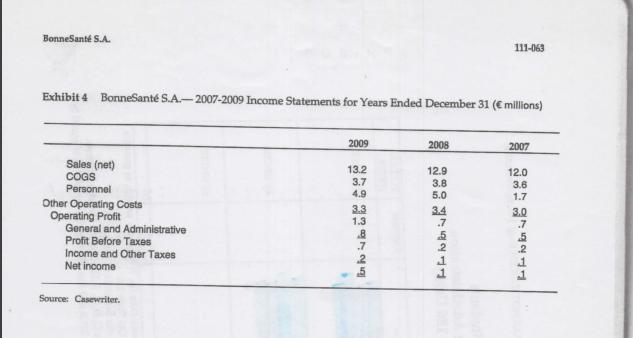

Exhibit 2 Accountant's Illustrations BonneSant chief accountant selected some the company's existing leases to illustrate the accounting for the ED's proposed lessee accounting for leases. The chief accountant did not know the interest rate the lessors charged the company. However, based on discussions with BonneSant's bank, the chief accountants believed the company's incremental borrowing rate was approximately 5 percent. Illustration No.1 Asset leased: Truck Contractual lease term: 12 months (no renewal options) Monthly rental: 800 Lease type:net lease Lease term probabilities: 100 percent probability of a 1 year term. How would BonneSant account for its truck leases under the ED's proposals? What are the debits and credits and amounts? Illustration No. 2 Asset leased: Retail outlet Contractual lease term: 5 years initial term plus three one year term renewal options. Monthly rental: initial 5 year term 4000. Each one-year renewal 5000. Lease type: Net lease Initial direct costs: 6000 Leasehold improvements: revert to lessor at end of lease. Lease term probabilities: 40 percent probability of a 5 year term, 30 percent probability of a 6 year term, 20 percent probability of a 7 year term, and 10 percent probability of a 8 year term. Contingent rentals: none Residual guarantees: none How would BonneSant account for this store lease under the ED's proposals? What are the debits and credits and amounts? Illustration No. 3 Same lease described in Illustration No. 2, but at the end of the two years into the initial 5 year lease term, it is determined with certainty that the right to the three one year option renewal will not be exercised. In other words, the lease has 3 more years to run before it is expected to be terminated. How would BonneSante account for this change in lease term assumption under the ED's proposal What are the debits and credits and amounts? 12 BonneSant S.A. 111-063 Illustration No. 4 Same lease described in Illustration No. 2, but with a variable or contingent rental component based on store sales. In addition to the fixed monthly lease payments specified in the Illustration No. 2 lease arrangement, management estimated the range of possible average monthly variable rental payments over the initial five year lease term and each of the three year one year renewal options might be 400, per month (30 percent probability), 500 per month (50 percent probability), or 600 per month (20 percent probability). How would BonneSant account for this store lease under the ED's proposals? What are the debits and credits and amounts? Source: Casewriter. Exhibit 3 BonneSant S.A.-Balance Sheets as of December 31, 2008 and 2009 ( millions) ASSETS Property, Plant and Equipment (net) Other noncurrent assets Total noncurrent assets Cash and cash equivalents Inventory Accounts receivable Other current assets Total current assets Total Assets OWNERS' EQUITY LIABILITIES Noncurrent liabilities Current liabilities Accounts payable and accrued wages Other current liabilities Total current liabilities Total liabilities Total Liabilities and Owners' Equity Source: Casewriter. 2009 ELLL L RELLINA SL 2008 ELbLoL REELING 2 4.1 4.1 BonneSant S.A. Exhibit 4 BonneSant S.A.-2007-2009 Income Statements for Years Ended December 31 ( millions) Sales (net) COGS Personnel Other Operating Costs Operating Profit General and Administrative Profit Before Taxes Income and Other Taxes Net income Source: Casewriter. 2009 13.2 3.7 4.9 3.3 1.3 .7 in t 2008 12.9 3.8 5.0 111-063 3.4 .7 2007 20170715211 3.6 3.0 .7

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 Under the EDs proposals BonneSant would account for the truck lease as a lease liability and a rightofuse asset The lease liability would be measured at the present value of the lease payments disco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started