Answered step by step

Verified Expert Solution

Question

1 Approved Answer

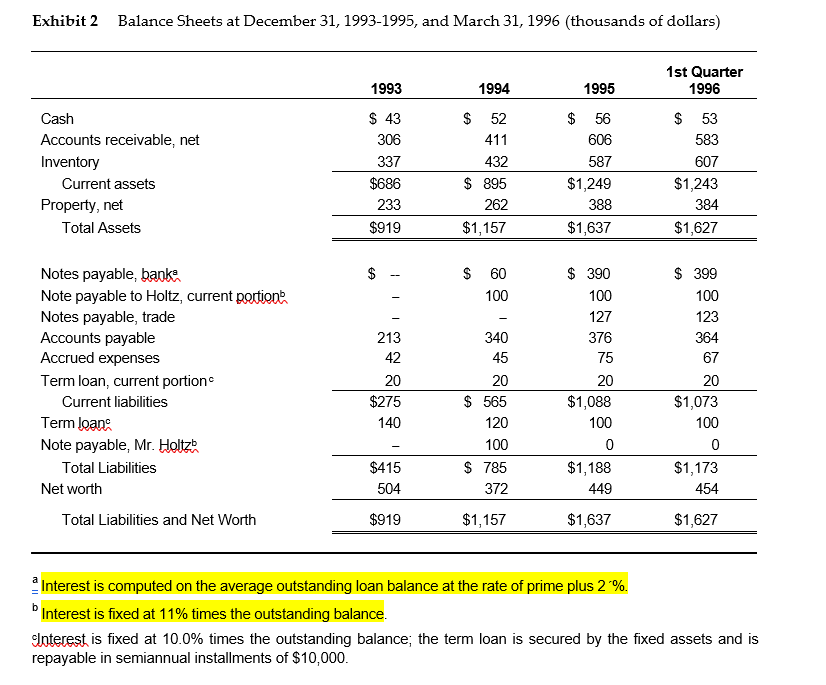

Exhibit 2 Balance Sheets at December 31, 1993-1995, and March 31, 1996 (thousands of dollars) 1st Quarter 1993 1994 1995 1996 Cash $ 43

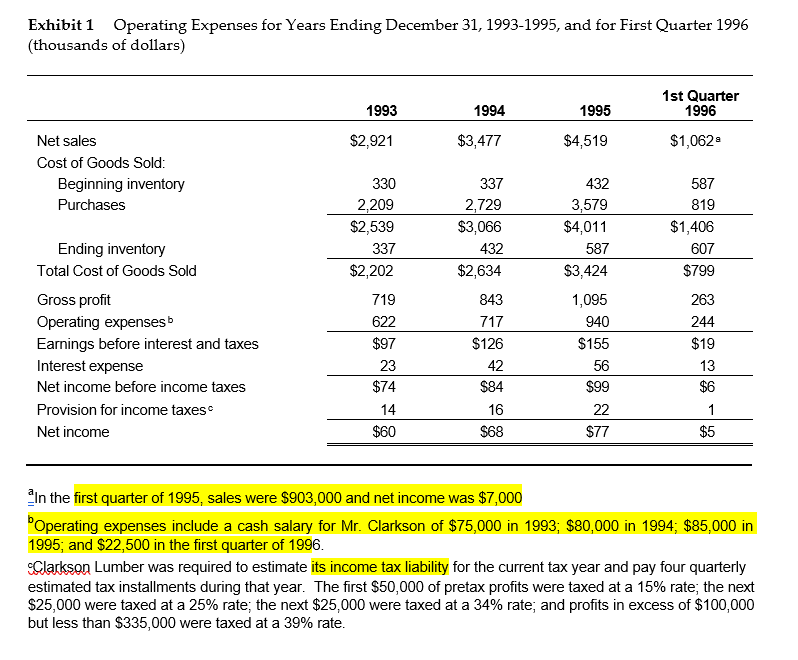

Exhibit 2 Balance Sheets at December 31, 1993-1995, and March 31, 1996 (thousands of dollars) 1st Quarter 1993 1994 1995 1996 Cash $ 43 $ 52 $ 56 $ 53 Accounts receivable, net 306 411 606 583 Inventory 337 432 587 607 Current assets $686 $ 895 $1,249 $1,243 Property, net 233 262 Total Assets $919 $1,157 388 $1,637 384 $1,627 Notes payable, banka $ $ 60 $ 390 $ 399 Note payable to Holtz, current portion 100 100 100 Notes payable, trade 127 123 Accounts payable 213 340 376 364 Accrued expenses 42 45 75 67 Term loan, current portion 20 20 20 20 Current liabilities $275 $ 565 $1,088 $1,073 Term Joan 140 120 100 100 Note payable, Mr. Holtzb 100 0 0 Total Liabilities $415 $ 785 $1,188 $1,173 Net worth 504 372 449 454 Total Liabilities and Net Worth $919 $1,157 $1,637 $1,627 Interest is computed on the average outstanding loan balance at the rate of prime plus 20%. b Interest is fixed at 11% times the outstanding balance. Interest is fixed at 10.0% times the outstanding balance; the term loan is secured by the fixed assets and is repayable in semiannual installments of $10,000. Exhibit 1 Operating Expenses for Years Ending December 31, 1993-1995, and for First Quarter 1996 (thousands of dollars) 1st Quarter 1993 1994 1995 1996 Net sales $2,921 $3,477 $4,519 $1,062 Cost of Goods Sold: Beginning inventory 330 337 432 587 Purchases 2,209 2,729 3,579 819 $2,539 $3,066 $4,011 $1,406 Ending inventory 337 432 587 607 Total Cost of Goods Sold $2,202 $2,634 $3,424 $799 Gross profit 719 843 1,095 263 Operating expenses b 622 717 940 244 Earnings before interest and taxes $97 $126 $155 $19 Interest expense 23 42 56 13 Net income before income taxes $74 $84 $99 $6 Provision for income taxes 14 16 22 1 Net income $60 $68 $77 $5 In the first quarter of 1995, sales were $903,000 and net income was $7,000 "Operating expenses include a cash salary for Mr. Clarkson of $75,000 in 1993; $80,000 in 1994; $85,000 in 1995; and $22,500 in the first quarter of 1996. *Clarkson Lumber was required to estimate its income tax liability for the current tax year and pay four quarterly estimated tax installments during that year. The first $50,000 of pretax profits were taxed at a 15% rate; the next $25,000 were taxed at a 25% rate; the next $25,000 were taxed at a 34% rate; and profits in excess of $100,000 but less than $335,000 were taxed at a 39% rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started