Answered step by step

Verified Expert Solution

Question

1 Approved Answer

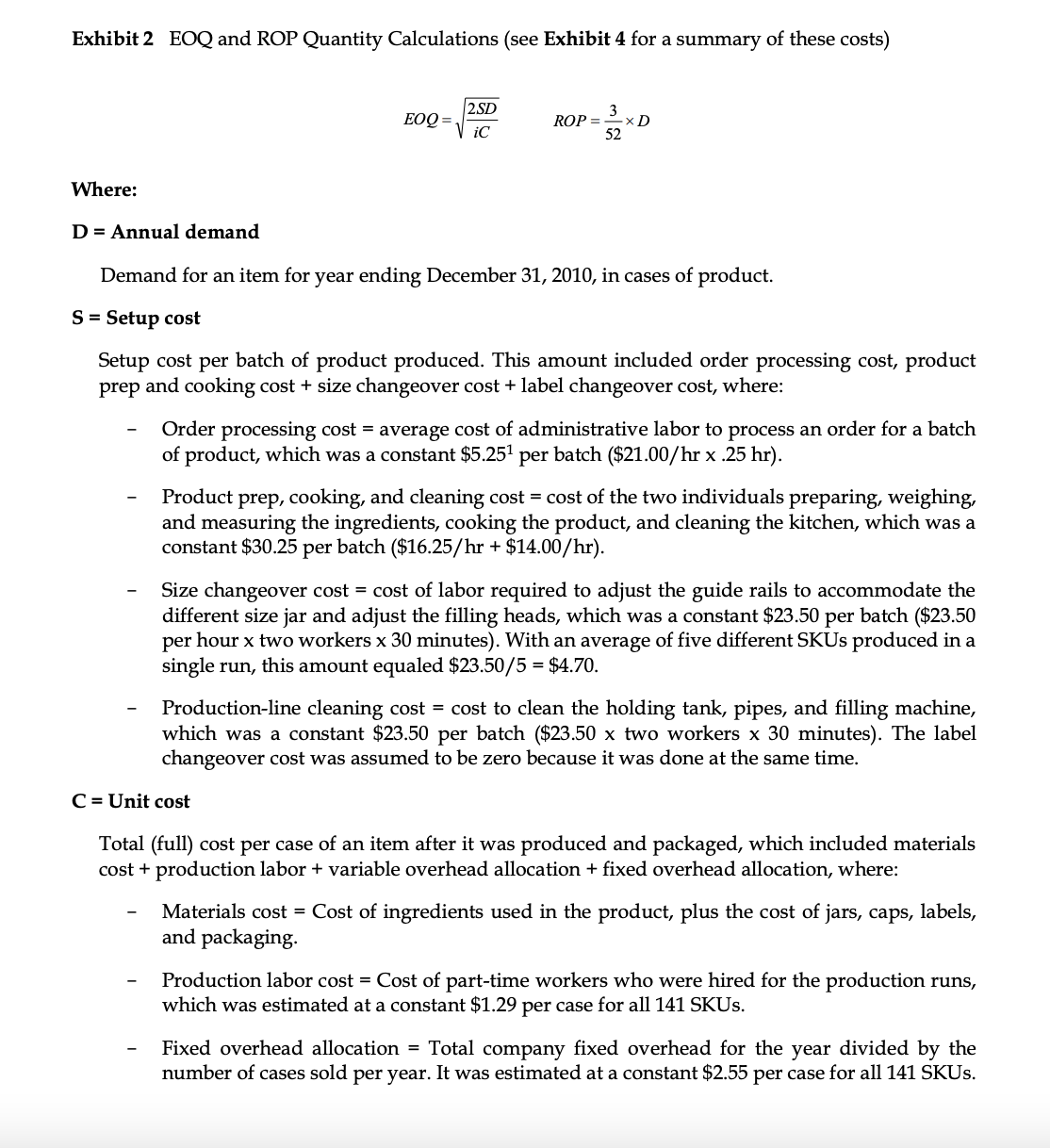

Exhibit 2 EOQ and ROP Quantity Calculations (see Exhibit 4 for a summary of these costs) Where: EOQ= 2SD iC 3 ROP= D 52

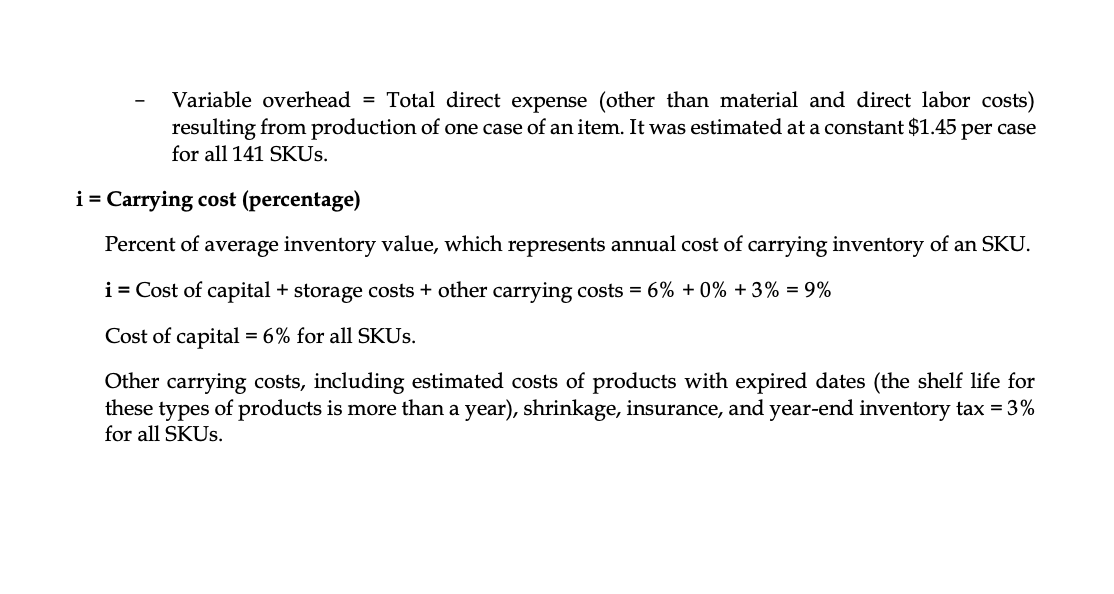

Exhibit 2 EOQ and ROP Quantity Calculations (see Exhibit 4 for a summary of these costs) Where: EOQ= 2SD iC 3 ROP= D 52 D = Annual demand Demand for an item for year ending December 31, 2010, in cases of product. S = Setup cost Setup cost per batch of product produced. This amount included order processing cost, product prep and cooking cost + size changeover cost + label changeover cost, where: Order processing cost = average cost of administrative labor to process an order for a batch of product, which was a constant $5.25 per batch ($21.00/hr x .25 hr). Product prep, cooking, and cleaning cost = cost of the two individuals preparing, weighing, and measuring the ingredients, cooking the product, and cleaning the kitchen, which was a constant $30.25 per batch ($16.25/hr + $14.00/hr). Size changeover cost = cost of labor required to adjust the guide rails to accommodate the different size jar and adjust the filling heads, which was a constant $23.50 per batch ($23.50 per hour x two workers x 30 minutes). With an average of five different SKUs produced in a single run, this amount equaled $23.50/5 = $4.70. Production-line cleaning cost = cost to clean the holding tank, pipes, and filling machine, which was a constant $23.50 per batch ($23.50 x two workers x 30 minutes). The label changeover cost was assumed to be zero because it was done at the same time. C = Unit cost Total (full) cost per case of an item after it was produced and packaged, which included materials cost + production labor + variable overhead allocation + fixed overhead allocation, where: Materials cost Cost of ingredients used in the product, plus the cost of jars, caps, labels, and packaging. Production labor cost = Cost of part-time workers who were hired for the production runs, which was estimated at a constant $1.29 per case for all 141 SKUs. Fixed overhead allocation = Total company fixed overhead for the year divided by the number of cases sold per year. It was estimated at a constant $2.55 per case for all 141 SKUs. - Variable overhead = Total direct expense (other than material and direct labor costs) resulting from production of one case of an item. It was estimated at a constant $1.45 per case for all 141 SKUs. i = Carrying cost (percentage) Percent of average inventory value, which represents annual cost of carrying inventory of an SKU. i = Cost of capital + storage costs + other carrying costs = 6% +0% +3% = 9% Cost of capital = 6% for all SKUs. Other carrying costs, including estimated costs of products with expired dates (the shelf life for these types of products is more than a year), shrinkage, insurance, and year-end inventory tax = 3% for all SKUs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started