Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXHIBIT 2 Zynga Consolidated Income Statements ($ thousands, except per-share data) begin{tabular}{|c|c|c|c|} hline & Year E & ded Decem & er 31, hline &

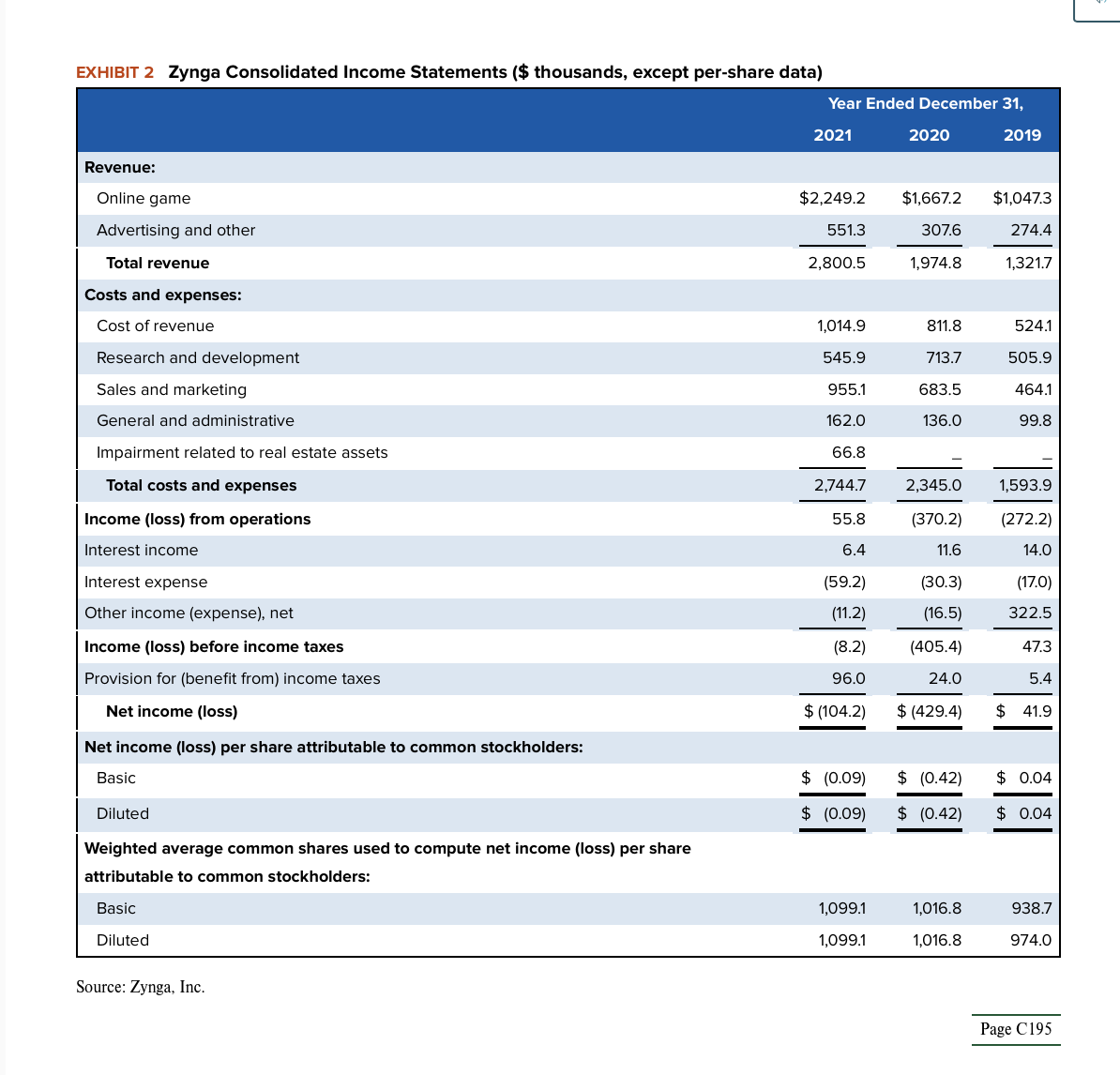

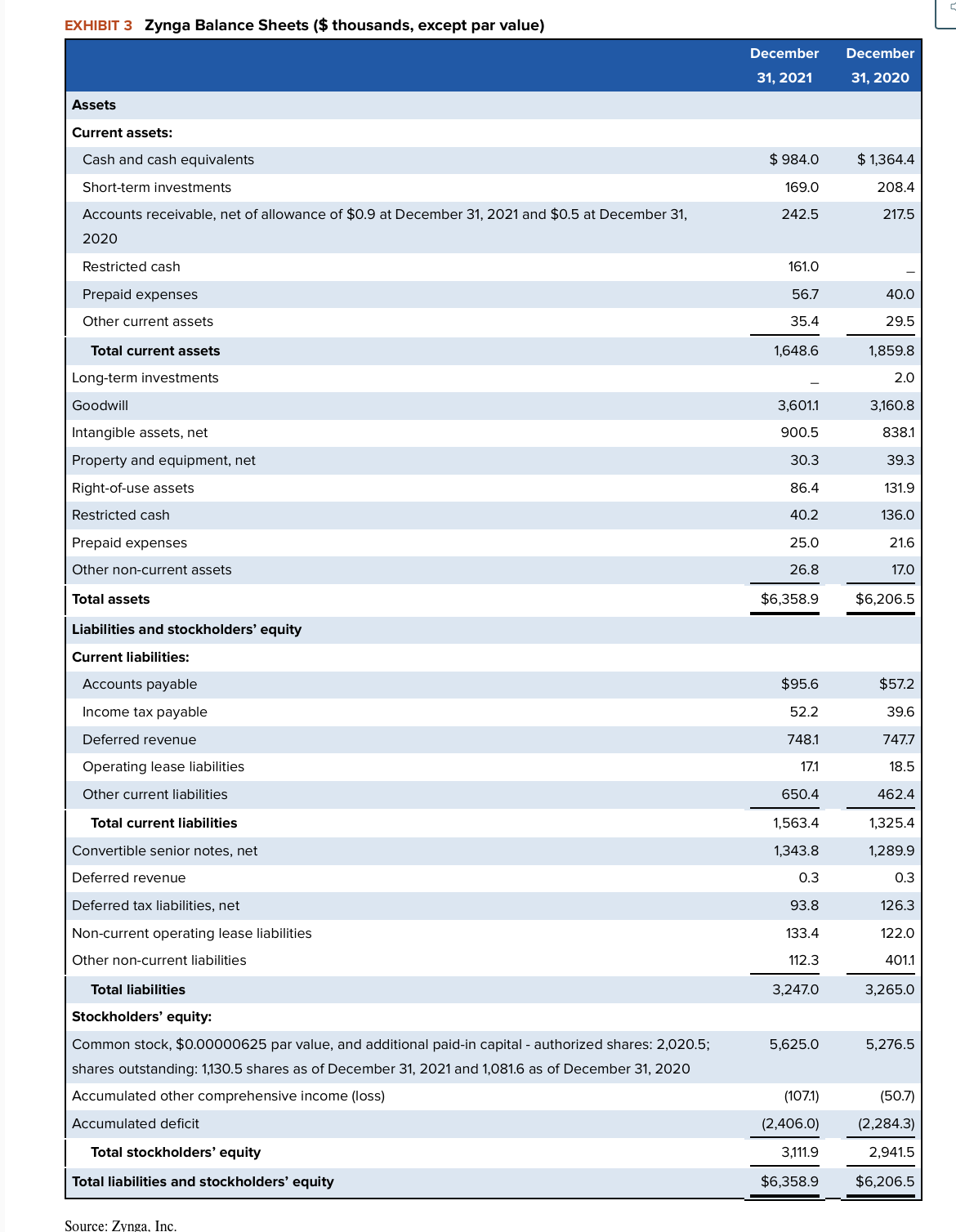

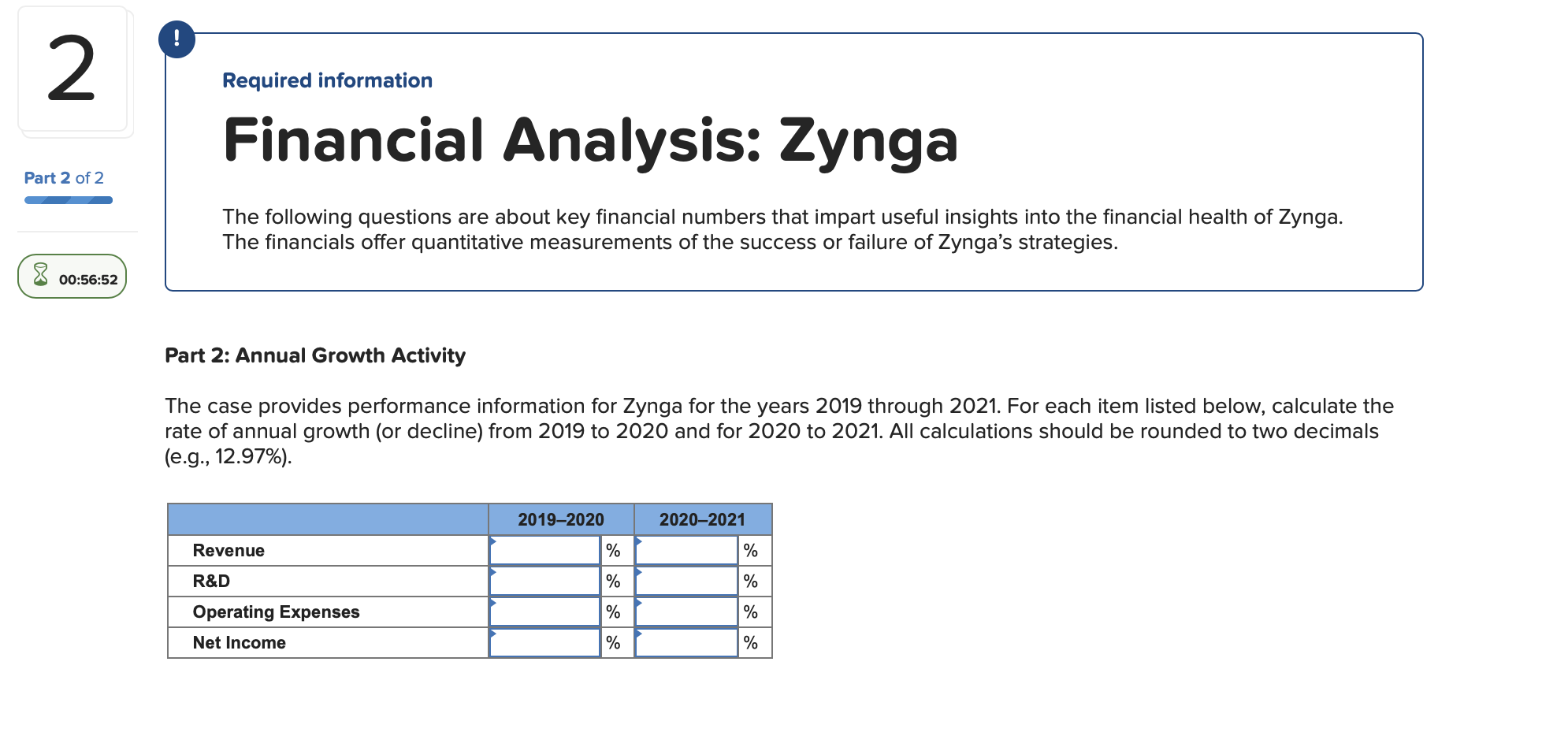

EXHIBIT 2 Zynga Consolidated Income Statements (\$ thousands, except per-share data) \begin{tabular}{|c|c|c|c|} \hline & Year E & ded Decem & er 31, \\ \hline & 2021 & 2020 & 2019 \\ \hline Revenue: & & & \\ \hline Online game & $2,249.2 & $1,667.2 & $1,047.3 \\ \hline Advertising and other & 551.3 & 307.6 & 274.4 \\ \hline Total revenue & 2,800.5 & 1,974.8 & 1,321.7 \\ \hline Costs and expenses: & & & \\ \hline Cost of revenue & 1,014.9 & 811.8 & 524.1 \\ \hline Research and development & 545.9 & 713.7 & 505.9 \\ \hline Sales and marketing & 955.1 & 683.5 & 464.1 \\ \hline General and administrative & 162.0 & 136.0 & 99.8 \\ \hline Impairment related to real estate assets & 66.8 & - & - \\ \hline Total costs and expenses & 2,744.7 & 2,345.0 & 1,593.9 \\ \hline Income (loss) from operations & 55.8 & (370.2) & (272.2) \\ \hline Interest income & 6.4 & 11.6 & 14.0 \\ \hline Interest expense & (59.2) & (30.3) & (17.0) \\ \hline Other income (expense), net & (11.2) & (16.5) & 322.5 \\ \hline Income (loss) before income taxes & (8.2) & (405.4) & 47.3 \\ \hline Provision for (benefit from) income taxes & 96.0 & 24.0 & 5.4 \\ \hline Net income (loss) & $(104.2) & $(429.4) & $41.9 \\ \hline Net income (loss) per share attributable t & & & \\ \hline Basic & $(0.09) & $(0.42) & $0.04 \\ \hline Diluted & $(0.09) & $(0.42) & $0.04 \\ \hline Weightedaveragecommonsharesusedattributabletocommonstockholders: & & & \\ \hline Basic & 1,099.1 & 1,016.8 & 938.7 \\ \hline Diluted & 1,099.1 & 1,016.8 & 974.0 \\ \hline \end{tabular} Source: Zynga, Inc. EXHIBIT 3 Zynga Balance Sheets (\$ thousands, except par value) \begin{tabular}{|c|c|c|} \hline & December31,2021 & December31,2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $984.0 & $1,364.4 \\ \hline Short-term investments & 169.0 & 208.4 \\ \hline Accountsreceivable,netofallowanceof$0.9atDecember31,2021and$0.5atDecember31,2020 & 242.5 & 217.5 \\ \hline Restricted cash & 161.0 & - \\ \hline Prepaid expenses & 56.7 & 40.0 \\ \hline Other current assets & 35.4 & 29.5 \\ \hline Total current assets & 1,648.6 & 1,859.8 \\ \hline Long-term investments & - & 2.0 \\ \hline Goodwill & 3,601.1 & 3,160.8 \\ \hline Intangible assets, net & 900.5 & 838.1 \\ \hline Property and equipment, net & 30.3 & 39.3 \\ \hline Right-of-use assets & 86.4 & 131.9 \\ \hline Restricted cash & 40.2 & 136.0 \\ \hline Prepaid expenses & 25.0 & 21.6 \\ \hline Other non-current assets & 26.8 & 17.0 \\ \hline Total assets & $6,358.9 & $6,206.5 \\ \hline \multicolumn{3}{|l|}{ Liabilities and stockholders' equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $95.6 & $57.2 \\ \hline Income tax payable & 52.2 & 39.6 \\ \hline Deferred revenue & 748.1 & 747.7 \\ \hline Operating lease liabilities & 17.1 & 18.5 \\ \hline Other current liabilities & 650.4 & 462.4 \\ \hline Total current liabilities & 1,563.4 & 1,325.4 \\ \hline Convertible senior notes, net & 1,343.8 & 1,289.9 \\ \hline Deferred revenue & 0.3 & 0.3 \\ \hline Deferred tax liabilities, net & 93.8 & 126.3 \\ \hline Non-current operating lease liabilities & 133.4 & 122.0 \\ \hline Other non-current liabilities & 112.3 & 401.1 \\ \hline Total liabilities & 3,247.0 & 3,265.0 \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline Commonstock,$0.00000625parvalue,andadditionalpaid-incapital-authorizedshares:2,020.5;sharesoutstanding:1,130.5sharesasofDecember31,2021and1,081.6asofDecember31,2020 & 5,625.0 & 5,276.5 \\ \hline Accumulated other comprehensive income (loss) & (107.1) & (50.7) \\ \hline Accumulated deficit & (2,406.0) & (2,284.3) \\ \hline Total stockholders' equity & 3,111.9 & 2,941.5 \\ \hline Total liabilities and stockholders' equity & $6,358.9 & $6,206.5 \\ \hline \end{tabular} Source: Zynga. Inc. Required information Financial Analysis: Zynga The following questions are about key financial numbers that impart useful insights into the financial health of Zynga. The financials offer quantitative measurements of the success or failure of Zynga's strategies. Part 2: Annual Growth Activity The case provides performance information for Zynga for the years 2019 through 2021. For each item listed below, calculate the rate of annual growth (or decline) from 2019 to 2020 and for 2020 to 2021. All calculations should be rounded to two decimals (e.g., 12.97\%)

EXHIBIT 2 Zynga Consolidated Income Statements (\$ thousands, except per-share data) \begin{tabular}{|c|c|c|c|} \hline & Year E & ded Decem & er 31, \\ \hline & 2021 & 2020 & 2019 \\ \hline Revenue: & & & \\ \hline Online game & $2,249.2 & $1,667.2 & $1,047.3 \\ \hline Advertising and other & 551.3 & 307.6 & 274.4 \\ \hline Total revenue & 2,800.5 & 1,974.8 & 1,321.7 \\ \hline Costs and expenses: & & & \\ \hline Cost of revenue & 1,014.9 & 811.8 & 524.1 \\ \hline Research and development & 545.9 & 713.7 & 505.9 \\ \hline Sales and marketing & 955.1 & 683.5 & 464.1 \\ \hline General and administrative & 162.0 & 136.0 & 99.8 \\ \hline Impairment related to real estate assets & 66.8 & - & - \\ \hline Total costs and expenses & 2,744.7 & 2,345.0 & 1,593.9 \\ \hline Income (loss) from operations & 55.8 & (370.2) & (272.2) \\ \hline Interest income & 6.4 & 11.6 & 14.0 \\ \hline Interest expense & (59.2) & (30.3) & (17.0) \\ \hline Other income (expense), net & (11.2) & (16.5) & 322.5 \\ \hline Income (loss) before income taxes & (8.2) & (405.4) & 47.3 \\ \hline Provision for (benefit from) income taxes & 96.0 & 24.0 & 5.4 \\ \hline Net income (loss) & $(104.2) & $(429.4) & $41.9 \\ \hline Net income (loss) per share attributable t & & & \\ \hline Basic & $(0.09) & $(0.42) & $0.04 \\ \hline Diluted & $(0.09) & $(0.42) & $0.04 \\ \hline Weightedaveragecommonsharesusedattributabletocommonstockholders: & & & \\ \hline Basic & 1,099.1 & 1,016.8 & 938.7 \\ \hline Diluted & 1,099.1 & 1,016.8 & 974.0 \\ \hline \end{tabular} Source: Zynga, Inc. EXHIBIT 3 Zynga Balance Sheets (\$ thousands, except par value) \begin{tabular}{|c|c|c|} \hline & December31,2021 & December31,2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $984.0 & $1,364.4 \\ \hline Short-term investments & 169.0 & 208.4 \\ \hline Accountsreceivable,netofallowanceof$0.9atDecember31,2021and$0.5atDecember31,2020 & 242.5 & 217.5 \\ \hline Restricted cash & 161.0 & - \\ \hline Prepaid expenses & 56.7 & 40.0 \\ \hline Other current assets & 35.4 & 29.5 \\ \hline Total current assets & 1,648.6 & 1,859.8 \\ \hline Long-term investments & - & 2.0 \\ \hline Goodwill & 3,601.1 & 3,160.8 \\ \hline Intangible assets, net & 900.5 & 838.1 \\ \hline Property and equipment, net & 30.3 & 39.3 \\ \hline Right-of-use assets & 86.4 & 131.9 \\ \hline Restricted cash & 40.2 & 136.0 \\ \hline Prepaid expenses & 25.0 & 21.6 \\ \hline Other non-current assets & 26.8 & 17.0 \\ \hline Total assets & $6,358.9 & $6,206.5 \\ \hline \multicolumn{3}{|l|}{ Liabilities and stockholders' equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $95.6 & $57.2 \\ \hline Income tax payable & 52.2 & 39.6 \\ \hline Deferred revenue & 748.1 & 747.7 \\ \hline Operating lease liabilities & 17.1 & 18.5 \\ \hline Other current liabilities & 650.4 & 462.4 \\ \hline Total current liabilities & 1,563.4 & 1,325.4 \\ \hline Convertible senior notes, net & 1,343.8 & 1,289.9 \\ \hline Deferred revenue & 0.3 & 0.3 \\ \hline Deferred tax liabilities, net & 93.8 & 126.3 \\ \hline Non-current operating lease liabilities & 133.4 & 122.0 \\ \hline Other non-current liabilities & 112.3 & 401.1 \\ \hline Total liabilities & 3,247.0 & 3,265.0 \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline Commonstock,$0.00000625parvalue,andadditionalpaid-incapital-authorizedshares:2,020.5;sharesoutstanding:1,130.5sharesasofDecember31,2021and1,081.6asofDecember31,2020 & 5,625.0 & 5,276.5 \\ \hline Accumulated other comprehensive income (loss) & (107.1) & (50.7) \\ \hline Accumulated deficit & (2,406.0) & (2,284.3) \\ \hline Total stockholders' equity & 3,111.9 & 2,941.5 \\ \hline Total liabilities and stockholders' equity & $6,358.9 & $6,206.5 \\ \hline \end{tabular} Source: Zynga. Inc. Required information Financial Analysis: Zynga The following questions are about key financial numbers that impart useful insights into the financial health of Zynga. The financials offer quantitative measurements of the success or failure of Zynga's strategies. Part 2: Annual Growth Activity The case provides performance information for Zynga for the years 2019 through 2021. For each item listed below, calculate the rate of annual growth (or decline) from 2019 to 2020 and for 2020 to 2021. All calculations should be rounded to two decimals (e.g., 12.97\%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started