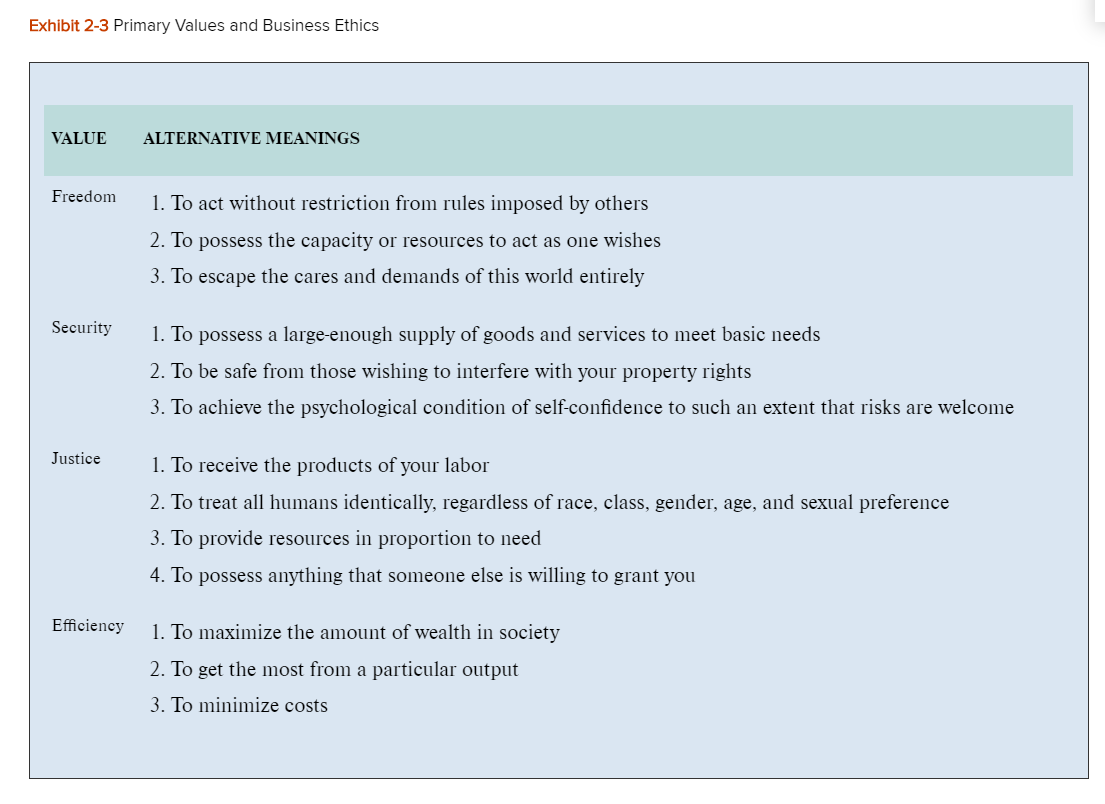

Question: Exhibit 2-3 Primary Values and Business Ethics VALUE ALTERNATIVE MEANINGS Freedom 1. To act without restriction from rules imposed by others 2. To possess the

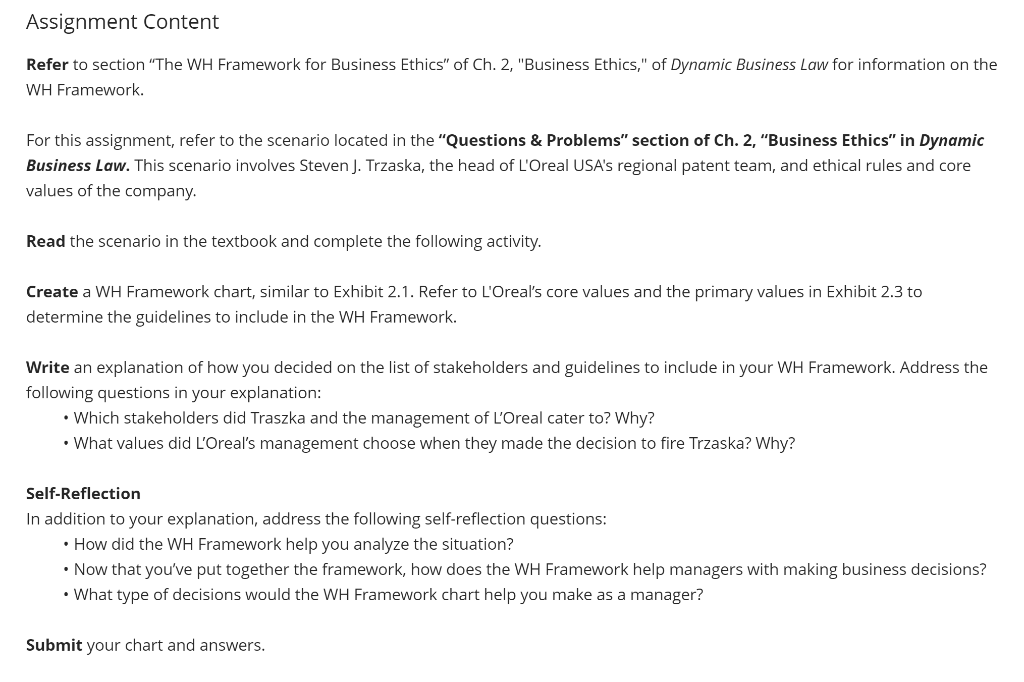

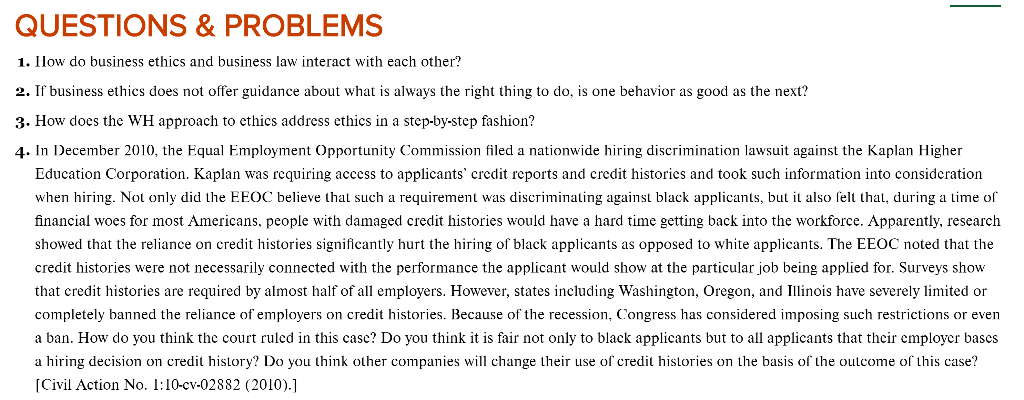

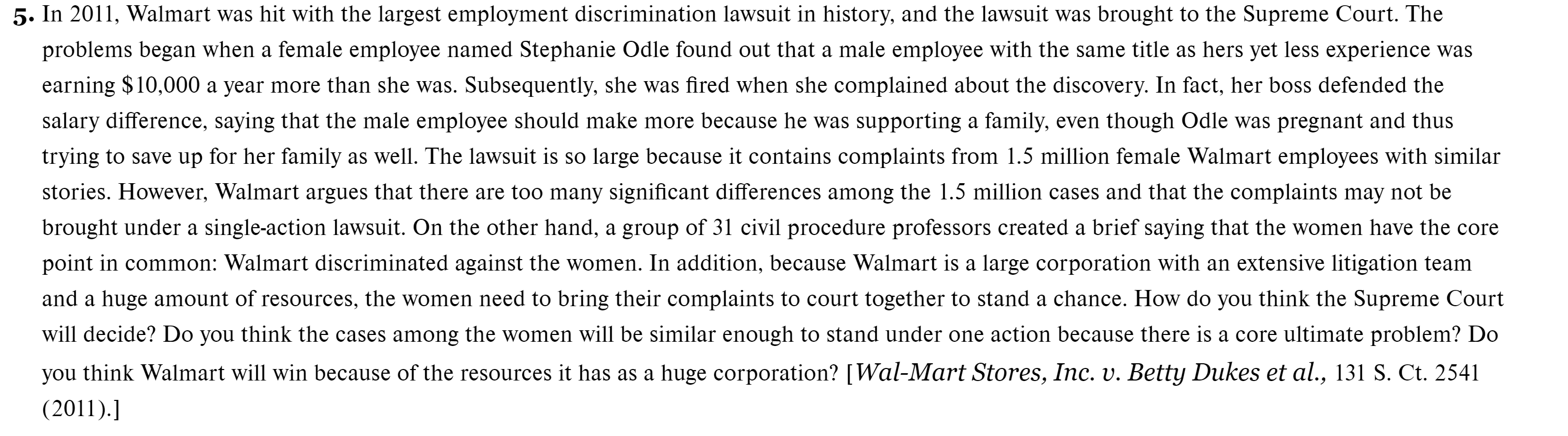

Exhibit 2-3 Primary Values and Business Ethics VALUE ALTERNATIVE MEANINGS Freedom 1. To act without restriction from rules imposed by others 2. To possess the capacity or resources to act as one wishes 3. To escape the cares and demands of this world entirely Security 1. To possess a large-enough supply of goods and services to meet basic needs 2. To be safe from those wishing to interfere with your property rights 3. To achieve the psychological condition of self-confidence to such an extent that risks are welcome Justice 1. To receive the products of your labor 2. To treat all humans identically, regardless of race, class, gender, age, and sexual preference 3. To provide resources in proportion to need 4. To possess anything that someone else is willing to grant you Efficiency 1. To maximize the amount of wealth in society 2. To get the most from a particular output 3. To minimize costs Assignment Content Ch. 2, "Business Ethics," of Dynamic Business Law for information on the Refer to section "The WH Framework for Business Ethics" WH Framework. For this assignment, refer to the scenario located in the "Questions & Problems" section of Ch. 2, "Business Ethics" in Dynamic Business Law. This scenario involves Steven J. Trzaska, the head of L'Oreal USA's regional patent team, and ethical rules and core values of the company. Read the scenario in the textbook and complete the following activity. Create a WH Framework chart, similar to Exhibit 2.1. Refer to L'Oreal's core values and the primary values in Exhibit 2.3 to determine the guidelines to include in the WH Framework. Write an explanation of how you decided on the list of stakeholders and guidelines to include in your WH Framework. Address the following questions in your explanation: Which stakeholders did Traszka and the management of L'Oreal cater to? Why? What values did L'Oreal's management choose when they made the decision to fire Trzaska? Why? Self-Reflection In addition to your explanation, address the following self-reflection questions: How did the WH Framework help you analyze the situation? Now that you've put together the framework, how does the WH Framework help managers with making business decisions? What type of decisions would the WH Framework chart help you make as a manager? Submit your chart and answers. QUESTIONS & PROBLEMS 1. How do business ethics and business law interact with each other? 2. If business ethics does not offer guidance about what is always the right thing to do, is one behavior as good as the next? 3. How does the WH approach to ethics address ethics in a step-by-step fashion? 4. In December 2010, the Equal Employment Opportunity Commission filed a nationwide hiring discrimination lawsuit against the Kaplan Higher Education Corporation. Kaplan was requiring access to applicants' credit reports and credit histories and took such information into consideration when hiring. Not only did the EEOC believe that such a requirement was discriminating against black applicants, but it also felt thal, during a time of financial woes for most Americans, people with damaged credit histories would have a hard time getting back into the workforce. Apparently, research showed that the reliance on credit histories significantly hurt the hiring of black applicants as opposed to white applicants. The EEOC noted that the credit histories were not necessarily connected with the performance the applicant would show at the particular job being applied for. Surveys show that credit histories are required by almost half of all employers. However, states including Washington, Oregon, and Illinois have severely limited or completely banned the reliance of employers on credit histories. Because of the recession, Congress has considered imposing such restrictions or even a ban. How do you think the court ruled in this case? Do you think it is fair not only to black applicants but to all applicants that their employer bases a hiring decision on credit history? Do you think other companies will change their use of credit histories on the basis of the outcome of this case? [Civil Action No. 1:10-cv-02882 (2010).] 5. In 2011, Walmart was hit with the largest employment discrimination lawsuit in history, and the lawsuit was brought to the Supreme Court. The problems began when a female employee named Stephanie Odle found out that a male employee with the same title as hers yet less experience was earning $10,000 a year more than she was. Subsequently, she was fired when she complained about the discovery. In fact, her boss defended the salary difference, saying that the male employee should make more because he was supporting a family, even though Odle was pregnant and thus trying to save up for her family as well. The lawsuit is so large because it contains complaints from 1.5 million female Walmart employees with similar stories. However, Walmart argues that there are too many significant differences among the 1.5 million cases and that the complaints may not be brought under a single-action lawsuit. On the other hand, a group of 31 civil procedure professors created a brief saying that the women have the core point in common: Walmart discriminated against the women. In addition, because Walmart is a large corporation with an extensive litigation team and a huge amount of resources, the women need to bring their complaints to court together to stand a chance. How do you think the Supreme Court will decide? Do you think the cases among the women will be similar enough to stand under one action because there is a core ultimate problem? Do you think Walmart will win because of the resources it has as a huge corporation? [Wal-Mart Stores, Inc. v. Betty Dukes et al., 131 S. Ct. 2541 (2011).] 6. Steven J. Trzaska was the head of L'Oreal USA's regional patent team, managing the procedure by which the company patented products. As an attorney barred in Pennsylvania, Trzaska had to adhere to professional rules of conduct established by the Supreme Court of Pennsylvania in addition to rules promulgated by the US Patent and Trademark Office (USPTO). In 2014, L'Oreal S.A, the French parent of company of L'Oreal USA, enacted a global quota of patent applications each regional office had to file each year. Employees were informed that failure to meet the quota would negatively impact their careers and even their continued employment at L'Oreal. Meanwhile, L'Oreal USA simultaneously enacted a rule to increase the quality of patent applications filed with the USPTO. The second rule led to a decrease in number of patents that could be filed with the USPTO, Trzaska's team would not be able to fulfill the patent quota. Faced with the problem, Trzaska informed management that his team would not file patents that they did not believe in good faith were patentable. Several weeks after Trzaska's meeting with the management, he was offered two severance packages that he did not accept. Finally, Trzaska Page 33 was let go. Trzaska subsequently sued L'Oreal, alleging that he was fired for his refusal to violate ethical rules that regulate the legal profession. Which stakeholders did Trzaska and the management of L'Oreal cater to? Referring back to Exhibit 2-5, what values did L'Oreal's management choose when they made the decision to fire Trzaska? [Trzaska v. L'OREAL USA, INC., 865 F. 3d 155 (2017)] 7. In 2015, the public discovered Volkswagen using a defeat device to cheat emissions tests for nearly 600,000 diesel-injected vehicles. Without the defeat device, Volkswagen's relevant diesel engine vehicles would not have earned EPA Certificates of Conformity. Implicated in the scandal was Bosch, a parts supplier that allegedly developed and manufactured the defeat devices used to illegally pass the emissions test. Bosch also hid knowledge of the defeat device from federal regulators when concerns were raised about the emissions controls systems in some diesel vehicles. Although Volkswagen has admitted wrongdoing, Bosch denies any claim of wrongdoing. This denial plays a part in Justice Breyer's approval of a class action settlement between Bosch and the class action plaintiffs that took place in a fairness hearing on May 11, 2017. One of the 9th Circuit Court's rationale to prefer settlements, as cited by Justice Breyer, is to reduce the cost to the legal system. Breyer also states that because Bosch denied the allegations of wrongdoing, the plaintiff's case against Bosch is weaker than the plaintiff's case against Volkswagen and therefore the aforementioned factor favored settlement. To what extent should lowering costs outweigh the predilection for justice? Considering the cost of a protracted legal battle, which stakeholders did Bosch consider when it decided to settle despite denying any wrongdoing? TIN RE: VOLKSWAGEN CLEAN DIESEL MARKETING, SALES PRACTICES, AND PRODUCTS LIABILITY LITIGATION. United States District Court, N.D. California. (2017)] 8. LeadClick managed an affiliate-marketing network to provide its customers online advertising. Instead of running its own online advertising, LeadClick would connect its clients with third-party affiliates that would design and implement the advertisements. The client party would pay LeadClick for every clicked advertisement link that resulted in a purchase, and LeadClick would remit a percentage of the payment to the third-party affiliate that created the advertisement itself, pocketing the difference as revenue. One such client was LeanSpa, which hired LeadClick to promote weight loss and colon cleansing products in 2010. In 2011, the FTC filed a complaint against LeanSpa, among other defendants for unfair trade practices. Unknown to LeanSpa, LeadClick's affiliates used fake news sites to promote its advertisements. Fake news sites consisted of websites that looked like genuine news sites, with logos that resembled news sites, and photographs of reporters that did not exist. The news sites contained articles that claimed that real reporters had conducted an independent analysis of Lean Spa's products and believed they worked. While LeanSpa was not aware of the third-party affiliates business practices, LeadClick had direct knowledge and the FTC amended the complaint in 2012 to include LeadClick. Lastly, in 2013, the FTC again amended the complaint to include Core Logic, a company that wholly owned LeadClick and of which LeadClick was a direct subsidiary. In 2015, the district court granted the FTC's motion for summary judgment and required LeadClick to disgorge $11.9 million in payment received from LeanSpa. Of that $11.9 million, $4.1 million had already been transferred to CoreLogic. The disgorgement of payment ordered by the district court included the $4.1 million. Core Logic and LeadClick appealed. Do you think LeadClick should be held liable for unfair trading practices? Do you think CoreLogic should be forced to disgorge the $4.1 million even if they had no knowledge of LeadClick's day-to-day practices? Ilow did the appeals court decide? [FTC v. LeadClick Media, LLC, 838 F. 3d 158 (2016)] 8. LeadClick managed an affiliate-marketing network to provide its customers online advertising. Instead of running its own online advertising, LeadClick would connect its clients with third-party affiliates that would design and implement the advertisements. The client party would pay LeadClick for every clicked advertisement link that resulted in a purchase, and LeadClick would remit a percentage of the payment to the third-party affiliate that created the advertisement itself, pocketing the difference as revenue. One such client was LeanSpa, which hired LeadClick to promote weight loss and colon cleansing products in 2010. In 2011, the FTC filed a complaint against LeanSpa, among other defendants for unfair trade practices. Unknown to LeanSpa, LeadClick's affiliates used fake news sites to promote its advertisements. Fake news sites consisted of websites that looked like genuine news sites, with logos that resembled news sites, and photographs of reporters that did not exist. The news sites contained articles that claimed that real reporters had conducted an independent analysis of Lean Spa's products and believed they worked. While LeanSpa was not aware of the third-party affiliates business practices, LeadClick had direct knowledge and the FTC amended the complaint in 2012 to include LeadClick. Lastly, in 2013, the FTC again amended the complaint to include Core Logic, a company that wholly owned LeadClick and of which LeadClick was a direct subsidiary. In 2015, the district court granted the FTC's motion for summary judgment and required LeadClick to disgorge $11.9 million in payment received from LeanSpa. Of that $11.9 million, $4.1 million had already been transferred to CoreLogic. The disgorgement of payment ordered by the district court included the $4.1 million. Core Logic and LeadClick appealed. Do you think LeadClick should be held liable for unfair trading practices? Do you think CoreLogic should be forced to disgorge the $4.1 million even if they had no knowledge of LeadClick's day-to-day practices? Ilow did the appeals court decide? [FTC v. LeadClick Media, LLC, 838 F. 3d 158 (2016)] 9. Mr. Caperton was the owner of a coal company that operated Harman mine. He sued Massey, which is a very large and powerful energy company. The suit was brought against Massey for a number of reasons. First, Massey bought another coal company called Wellmore Coal. Prior to the takeover, Wellmore Coal had bought Caperton's high-grade coal and blended that coal with its own, later selling the product to a steel company called LTV. After the takeover, Massey cut Caperton's high-quality coal out of the mix and tried to sell the cheaper product to LTV. However, LTV Page 34 refused the new, low-grade coal. Thus, Massey took steps not only to make Caperton's land and business look undesirable but to ruin his business completely so that LTV had no opportunity to work with Caperton or Harman mine unless Massey owned it. Massey pushed LTV to alter contracts in ways that would financially hurt Caperton's business, and then Massey bought land around the mine to make the area unappealing to potential buyers of the mine. Massey finally offered to buy Caperton's business and mine at a huge discount. Massey told Caperton not to sue, as Massey had the resources to spend $1 million a month to fight the bankrupt company. When Caperton did sue, the lower court found Massey liable for $50 million in damages. In 2008, Massey appealed to the supreme court of appeals of West Virginia; however, the judge had special ties with the CEO of Massey. Specifically, the CEO had donated $3 million to secure Justice Benjamin's seat when he had campaigned for the supreme court of appeals. Caperton immediately motioned for Justice Benjamin to excuse himself from the case, but the court dismissed the motion, with Benjamin voting for the majority. The court then moved to dismiss the $50 million and reverse the case. Caperton finally appealed to bring the case to the Supreme Court. What do you think the Supreme Court decided? Do you think it believed that the involvement of Justice Benjamin in the case was unethical? Do you think the CEO of Massey was contributing to the campaigns of high justices to create political tics and thus garner political support? [Caperton v.A.T. Massey Coal Co., Inc., 225 W. Va. 128; 690 S.E.2d 322 (2008).] 10. In 2000, Donald Stern incorporated a startup company named Grail in order to market a new and revolutionary chip design that Stern had invented. While witnesses expressed the view that Stern's innovation would be the "Holy Grail of memory technology," the company was unable to find investors and by March 2001, Grail had run out of money. On April 19, 2001, the following month, Stern met with Ryuichi Matsuo and Kazutoshi Hirayama, two representatives from Mitsubishi. Matsuo signed a nondisclosure agreement (NDA) which required Mitsubishi "to keep in strict confidence and trust and not use, disclose or make available to others, including any of its alliliales or third parties any 'Proprietary Information and Company Documents and Materials' without the prior written consent of [Grail]." In the meeting, Stern showed Hirayama 16 items of proprietary information, including the core concept behind his miracle memory chip, of which Hirayama took extensive notes. Nothing came from the meeting between Grail and Mitsubishi. In 2003, Mitsubishi and Hitachi formed Renasas Technology in a joint venture. Hirayama was one of the employees transferred from Mitsubishi, Stern suspected that Renasas was using his innovations and that Mitsubishi had broken the NDA because of an article he read promoting Renasas' new technology. In the ensuing 2012 trial, expert witnesses found that of the 16 items of confidential information disclosed to Mitsubishi, 11 had been implemented" in Renasas' new technology. On May 16, 2012, the jury found that Mitsubishi had violated the NDA and determined damages to be $123.898,889.00. Mitsubishi has filed an appeal for a new trial to address the damages which is ongoing now. How would Mitsubishi's violation of the NDA affect the decisions of other innovative tech companies to approach potential investors? Consider the WH process of ethical decision-making. While the court ruled against Mitsubishi for breaking the NDA, are there aspects of the WH process that support Mitsubishi's actions? Which aspects of the WII process did Mitsubishi neglect in their decision to break the NDA? [Grail Semiconductor, Inc. v. Mitsubishi Electric & Electronics USA, Inc., 225 Cal. App. 4th 786 (2014).] Exhibit 2-3 Primary Values and Business Ethics VALUE ALTERNATIVE MEANINGS Freedom 1. To act without restriction from rules imposed by others 2. To possess the capacity or resources to act as one wishes 3. To escape the cares and demands of this world entirely Security 1. To possess a large-enough supply of goods and services to meet basic needs 2. To be safe from those wishing to interfere with your property rights 3. To achieve the psychological condition of self-confidence to such an extent that risks are welcome Justice 1. To receive the products of your labor 2. To treat all humans identically, regardless of race, class, gender, age, and sexual preference 3. To provide resources in proportion to need 4. To possess anything that someone else is willing to grant you Efficiency 1. To maximize the amount of wealth in society 2. To get the most from a particular output 3. To minimize costs Assignment Content Ch. 2, "Business Ethics," of Dynamic Business Law for information on the Refer to section "The WH Framework for Business Ethics" WH Framework. For this assignment, refer to the scenario located in the "Questions & Problems" section of Ch. 2, "Business Ethics" in Dynamic Business Law. This scenario involves Steven J. Trzaska, the head of L'Oreal USA's regional patent team, and ethical rules and core values of the company. Read the scenario in the textbook and complete the following activity. Create a WH Framework chart, similar to Exhibit 2.1. Refer to L'Oreal's core values and the primary values in Exhibit 2.3 to determine the guidelines to include in the WH Framework. Write an explanation of how you decided on the list of stakeholders and guidelines to include in your WH Framework. Address the following questions in your explanation: Which stakeholders did Traszka and the management of L'Oreal cater to? Why? What values did L'Oreal's management choose when they made the decision to fire Trzaska? Why? Self-Reflection In addition to your explanation, address the following self-reflection questions: How did the WH Framework help you analyze the situation? Now that you've put together the framework, how does the WH Framework help managers with making business decisions? What type of decisions would the WH Framework chart help you make as a manager? Submit your chart and answers. QUESTIONS & PROBLEMS 1. How do business ethics and business law interact with each other? 2. If business ethics does not offer guidance about what is always the right thing to do, is one behavior as good as the next? 3. How does the WH approach to ethics address ethics in a step-by-step fashion? 4. In December 2010, the Equal Employment Opportunity Commission filed a nationwide hiring discrimination lawsuit against the Kaplan Higher Education Corporation. Kaplan was requiring access to applicants' credit reports and credit histories and took such information into consideration when hiring. Not only did the EEOC believe that such a requirement was discriminating against black applicants, but it also felt thal, during a time of financial woes for most Americans, people with damaged credit histories would have a hard time getting back into the workforce. Apparently, research showed that the reliance on credit histories significantly hurt the hiring of black applicants as opposed to white applicants. The EEOC noted that the credit histories were not necessarily connected with the performance the applicant would show at the particular job being applied for. Surveys show that credit histories are required by almost half of all employers. However, states including Washington, Oregon, and Illinois have severely limited or completely banned the reliance of employers on credit histories. Because of the recession, Congress has considered imposing such restrictions or even a ban. How do you think the court ruled in this case? Do you think it is fair not only to black applicants but to all applicants that their employer bases a hiring decision on credit history? Do you think other companies will change their use of credit histories on the basis of the outcome of this case? [Civil Action No. 1:10-cv-02882 (2010).] 5. In 2011, Walmart was hit with the largest employment discrimination lawsuit in history, and the lawsuit was brought to the Supreme Court. The problems began when a female employee named Stephanie Odle found out that a male employee with the same title as hers yet less experience was earning $10,000 a year more than she was. Subsequently, she was fired when she complained about the discovery. In fact, her boss defended the salary difference, saying that the male employee should make more because he was supporting a family, even though Odle was pregnant and thus trying to save up for her family as well. The lawsuit is so large because it contains complaints from 1.5 million female Walmart employees with similar stories. However, Walmart argues that there are too many significant differences among the 1.5 million cases and that the complaints may not be brought under a single-action lawsuit. On the other hand, a group of 31 civil procedure professors created a brief saying that the women have the core point in common: Walmart discriminated against the women. In addition, because Walmart is a large corporation with an extensive litigation team and a huge amount of resources, the women need to bring their complaints to court together to stand a chance. How do you think the Supreme Court will decide? Do you think the cases among the women will be similar enough to stand under one action because there is a core ultimate problem? Do you think Walmart will win because of the resources it has as a huge corporation? [Wal-Mart Stores, Inc. v. Betty Dukes et al., 131 S. Ct. 2541 (2011).] 6. Steven J. Trzaska was the head of L'Oreal USA's regional patent team, managing the procedure by which the company patented products. As an attorney barred in Pennsylvania, Trzaska had to adhere to professional rules of conduct established by the Supreme Court of Pennsylvania in addition to rules promulgated by the US Patent and Trademark Office (USPTO). In 2014, L'Oreal S.A, the French parent of company of L'Oreal USA, enacted a global quota of patent applications each regional office had to file each year. Employees were informed that failure to meet the quota would negatively impact their careers and even their continued employment at L'Oreal. Meanwhile, L'Oreal USA simultaneously enacted a rule to increase the quality of patent applications filed with the USPTO. The second rule led to a decrease in number of patents that could be filed with the USPTO, Trzaska's team would not be able to fulfill the patent quota. Faced with the problem, Trzaska informed management that his team would not file patents that they did not believe in good faith were patentable. Several weeks after Trzaska's meeting with the management, he was offered two severance packages that he did not accept. Finally, Trzaska Page 33 was let go. Trzaska subsequently sued L'Oreal, alleging that he was fired for his refusal to violate ethical rules that regulate the legal profession. Which stakeholders did Trzaska and the management of L'Oreal cater to? Referring back to Exhibit 2-5, what values did L'Oreal's management choose when they made the decision to fire Trzaska? [Trzaska v. L'OREAL USA, INC., 865 F. 3d 155 (2017)] 7. In 2015, the public discovered Volkswagen using a defeat device to cheat emissions tests for nearly 600,000 diesel-injected vehicles. Without the defeat device, Volkswagen's relevant diesel engine vehicles would not have earned EPA Certificates of Conformity. Implicated in the scandal was Bosch, a parts supplier that allegedly developed and manufactured the defeat devices used to illegally pass the emissions test. Bosch also hid knowledge of the defeat device from federal regulators when concerns were raised about the emissions controls systems in some diesel vehicles. Although Volkswagen has admitted wrongdoing, Bosch denies any claim of wrongdoing. This denial plays a part in Justice Breyer's approval of a class action settlement between Bosch and the class action plaintiffs that took place in a fairness hearing on May 11, 2017. One of the 9th Circuit Court's rationale to prefer settlements, as cited by Justice Breyer, is to reduce the cost to the legal system. Breyer also states that because Bosch denied the allegations of wrongdoing, the plaintiff's case against Bosch is weaker than the plaintiff's case against Volkswagen and therefore the aforementioned factor favored settlement. To what extent should lowering costs outweigh the predilection for justice? Considering the cost of a protracted legal battle, which stakeholders did Bosch consider when it decided to settle despite denying any wrongdoing? TIN RE: VOLKSWAGEN CLEAN DIESEL MARKETING, SALES PRACTICES, AND PRODUCTS LIABILITY LITIGATION. United States District Court, N.D. California. (2017)] 8. LeadClick managed an affiliate-marketing network to provide its customers online advertising. Instead of running its own online advertising, LeadClick would connect its clients with third-party affiliates that would design and implement the advertisements. The client party would pay LeadClick for every clicked advertisement link that resulted in a purchase, and LeadClick would remit a percentage of the payment to the third-party affiliate that created the advertisement itself, pocketing the difference as revenue. One such client was LeanSpa, which hired LeadClick to promote weight loss and colon cleansing products in 2010. In 2011, the FTC filed a complaint against LeanSpa, among other defendants for unfair trade practices. Unknown to LeanSpa, LeadClick's affiliates used fake news sites to promote its advertisements. Fake news sites consisted of websites that looked like genuine news sites, with logos that resembled news sites, and photographs of reporters that did not exist. The news sites contained articles that claimed that real reporters had conducted an independent analysis of Lean Spa's products and believed they worked. While LeanSpa was not aware of the third-party affiliates business practices, LeadClick had direct knowledge and the FTC amended the complaint in 2012 to include LeadClick. Lastly, in 2013, the FTC again amended the complaint to include Core Logic, a company that wholly owned LeadClick and of which LeadClick was a direct subsidiary. In 2015, the district court granted the FTC's motion for summary judgment and required LeadClick to disgorge $11.9 million in payment received from LeanSpa. Of that $11.9 million, $4.1 million had already been transferred to CoreLogic. The disgorgement of payment ordered by the district court included the $4.1 million. Core Logic and LeadClick appealed. Do you think LeadClick should be held liable for unfair trading practices? Do you think CoreLogic should be forced to disgorge the $4.1 million even if they had no knowledge of LeadClick's day-to-day practices? Ilow did the appeals court decide? [FTC v. LeadClick Media, LLC, 838 F. 3d 158 (2016)] 8. LeadClick managed an affiliate-marketing network to provide its customers online advertising. Instead of running its own online advertising, LeadClick would connect its clients with third-party affiliates that would design and implement the advertisements. The client party would pay LeadClick for every clicked advertisement link that resulted in a purchase, and LeadClick would remit a percentage of the payment to the third-party affiliate that created the advertisement itself, pocketing the difference as revenue. One such client was LeanSpa, which hired LeadClick to promote weight loss and colon cleansing products in 2010. In 2011, the FTC filed a complaint against LeanSpa, among other defendants for unfair trade practices. Unknown to LeanSpa, LeadClick's affiliates used fake news sites to promote its advertisements. Fake news sites consisted of websites that looked like genuine news sites, with logos that resembled news sites, and photographs of reporters that did not exist. The news sites contained articles that claimed that real reporters had conducted an independent analysis of Lean Spa's products and believed they worked. While LeanSpa was not aware of the third-party affiliates business practices, LeadClick had direct knowledge and the FTC amended the complaint in 2012 to include LeadClick. Lastly, in 2013, the FTC again amended the complaint to include Core Logic, a company that wholly owned LeadClick and of which LeadClick was a direct subsidiary. In 2015, the district court granted the FTC's motion for summary judgment and required LeadClick to disgorge $11.9 million in payment received from LeanSpa. Of that $11.9 million, $4.1 million had already been transferred to CoreLogic. The disgorgement of payment ordered by the district court included the $4.1 million. Core Logic and LeadClick appealed. Do you think LeadClick should be held liable for unfair trading practices? Do you think CoreLogic should be forced to disgorge the $4.1 million even if they had no knowledge of LeadClick's day-to-day practices? Ilow did the appeals court decide? [FTC v. LeadClick Media, LLC, 838 F. 3d 158 (2016)] 9. Mr. Caperton was the owner of a coal company that operated Harman mine. He sued Massey, which is a very large and powerful energy company. The suit was brought against Massey for a number of reasons. First, Massey bought another coal company called Wellmore Coal. Prior to the takeover, Wellmore Coal had bought Caperton's high-grade coal and blended that coal with its own, later selling the product to a steel company called LTV. After the takeover, Massey cut Caperton's high-quality coal out of the mix and tried to sell the cheaper product to LTV. However, LTV Page 34 refused the new, low-grade coal. Thus, Massey took steps not only to make Caperton's land and business look undesirable but to ruin his business completely so that LTV had no opportunity to work with Caperton or Harman mine unless Massey owned it. Massey pushed LTV to alter contracts in ways that would financially hurt Caperton's business, and then Massey bought land around the mine to make the area unappealing to potential buyers of the mine. Massey finally offered to buy Caperton's business and mine at a huge discount. Massey told Caperton not to sue, as Massey had the resources to spend $1 million a month to fight the bankrupt company. When Caperton did sue, the lower court found Massey liable for $50 million in damages. In 2008, Massey appealed to the supreme court of appeals of West Virginia; however, the judge had special ties with the CEO of Massey. Specifically, the CEO had donated $3 million to secure Justice Benjamin's seat when he had campaigned for the supreme court of appeals. Caperton immediately motioned for Justice Benjamin to excuse himself from the case, but the court dismissed the motion, with Benjamin voting for the majority. The court then moved to dismiss the $50 million and reverse the case. Caperton finally appealed to bring the case to the Supreme Court. What do you think the Supreme Court decided? Do you think it believed that the involvement of Justice Benjamin in the case was unethical? Do you think the CEO of Massey was contributing to the campaigns of high justices to create political tics and thus garner political support? [Caperton v.A.T. Massey Coal Co., Inc., 225 W. Va. 128; 690 S.E.2d 322 (2008).] 10. In 2000, Donald Stern incorporated a startup company named Grail in order to market a new and revolutionary chip design that Stern had invented. While witnesses expressed the view that Stern's innovation would be the "Holy Grail of memory technology," the company was unable to find investors and by March 2001, Grail had run out of money. On April 19, 2001, the following month, Stern met with Ryuichi Matsuo and Kazutoshi Hirayama, two representatives from Mitsubishi. Matsuo signed a nondisclosure agreement (NDA) which required Mitsubishi "to keep in strict confidence and trust and not use, disclose or make available to others, including any of its alliliales or third parties any 'Proprietary Information and Company Documents and Materials' without the prior written consent of [Grail]." In the meeting, Stern showed Hirayama 16 items of proprietary information, including the core concept behind his miracle memory chip, of which Hirayama took extensive notes. Nothing came from the meeting between Grail and Mitsubishi. In 2003, Mitsubishi and Hitachi formed Renasas Technology in a joint venture. Hirayama was one of the employees transferred from Mitsubishi, Stern suspected that Renasas was using his innovations and that Mitsubishi had broken the NDA because of an article he read promoting Renasas' new technology. In the ensuing 2012 trial, expert witnesses found that of the 16 items of confidential information disclosed to Mitsubishi, 11 had been implemented" in Renasas' new technology. On May 16, 2012, the jury found that Mitsubishi had violated the NDA and determined damages to be $123.898,889.00. Mitsubishi has filed an appeal for a new trial to address the damages which is ongoing now. How would Mitsubishi's violation of the NDA affect the decisions of other innovative tech companies to approach potential investors? Consider the WH process of ethical decision-making. While the court ruled against Mitsubishi for breaking the NDA, are there aspects of the WH process that support Mitsubishi's actions? Which aspects of the WII process did Mitsubishi neglect in their decision to break the NDA? [Grail Semiconductor, Inc. v. Mitsubishi Electric & Electronics USA, Inc., 225 Cal. App. 4th 786 (2014).]

Step by Step Solution

There are 3 Steps involved in it

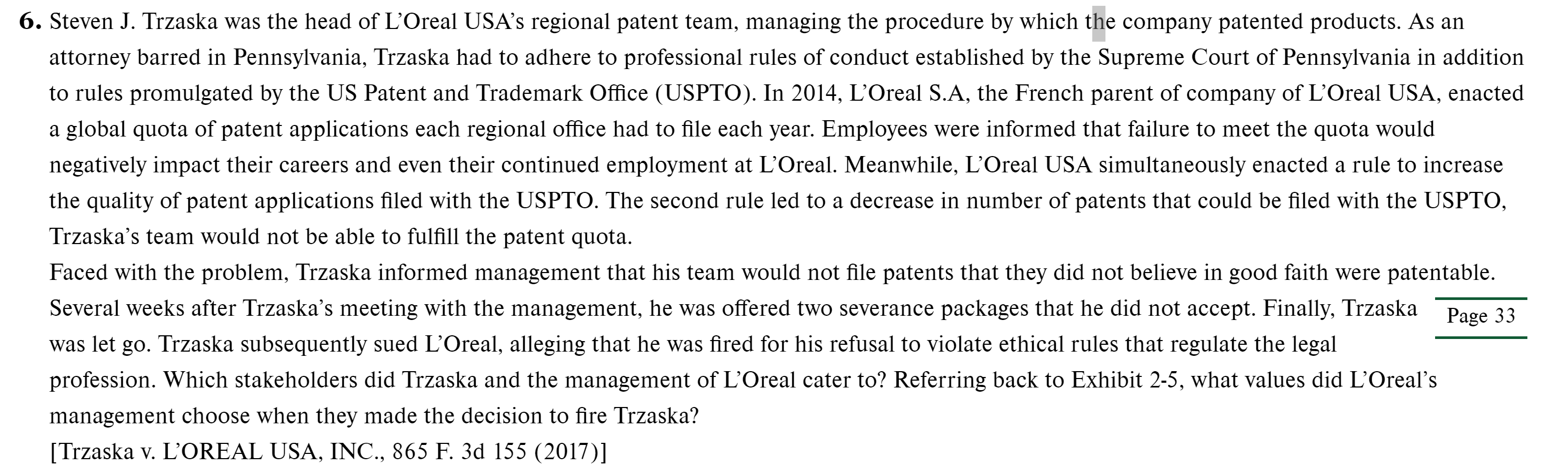

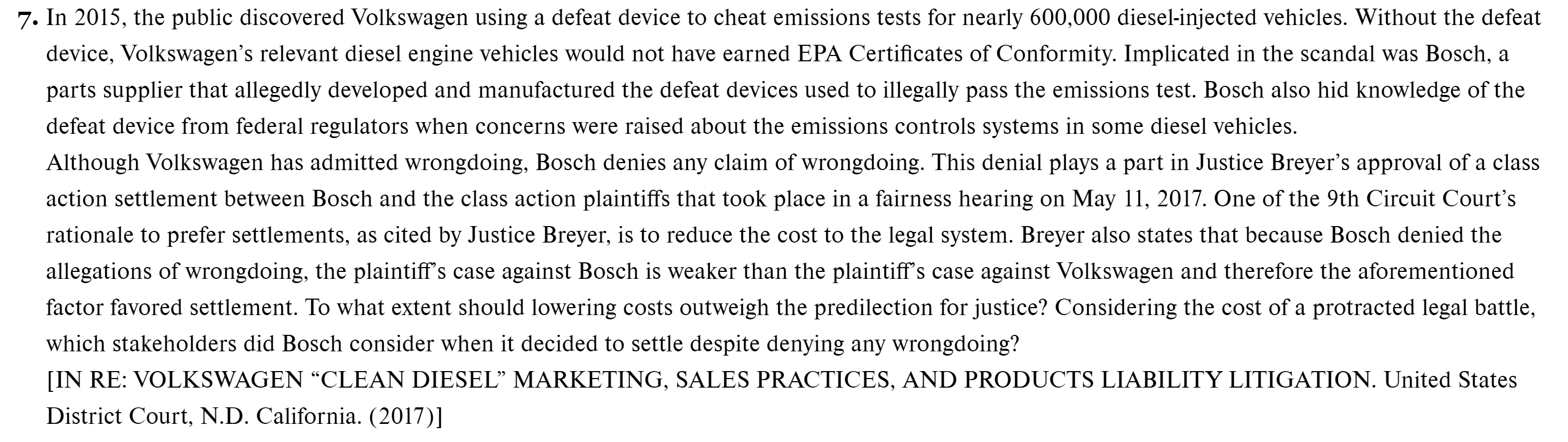

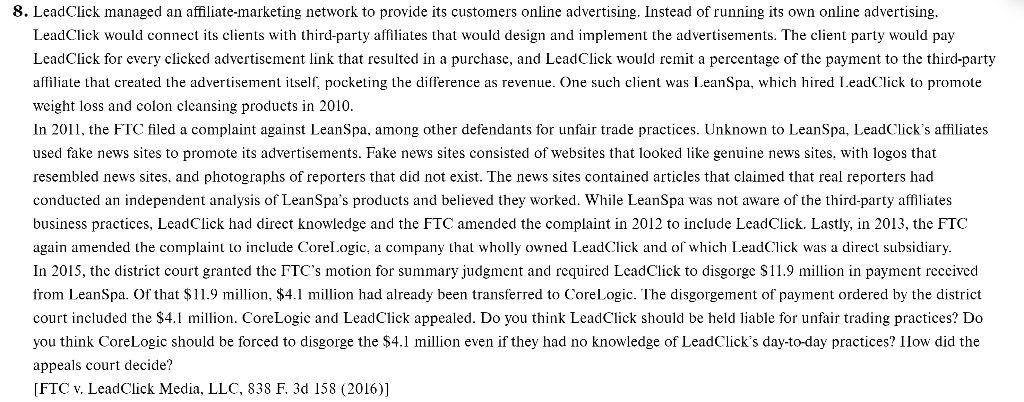

Get step-by-step solutions from verified subject matter experts