Answered step by step

Verified Expert Solution

Question

1 Approved Answer

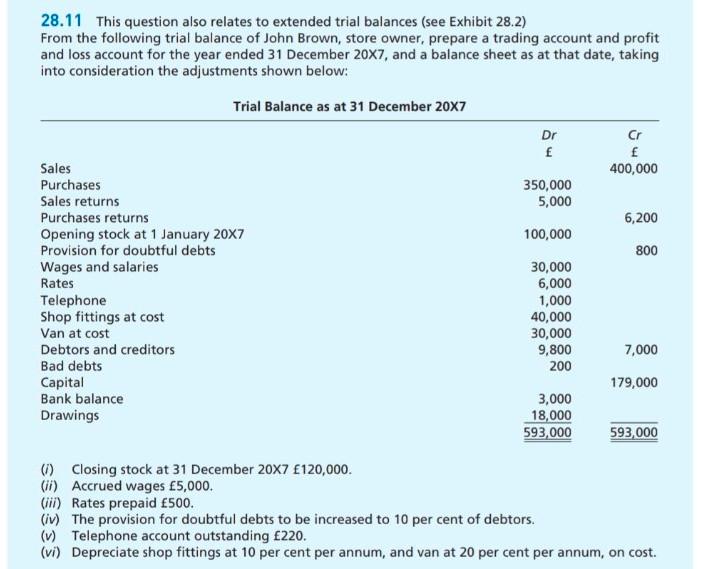

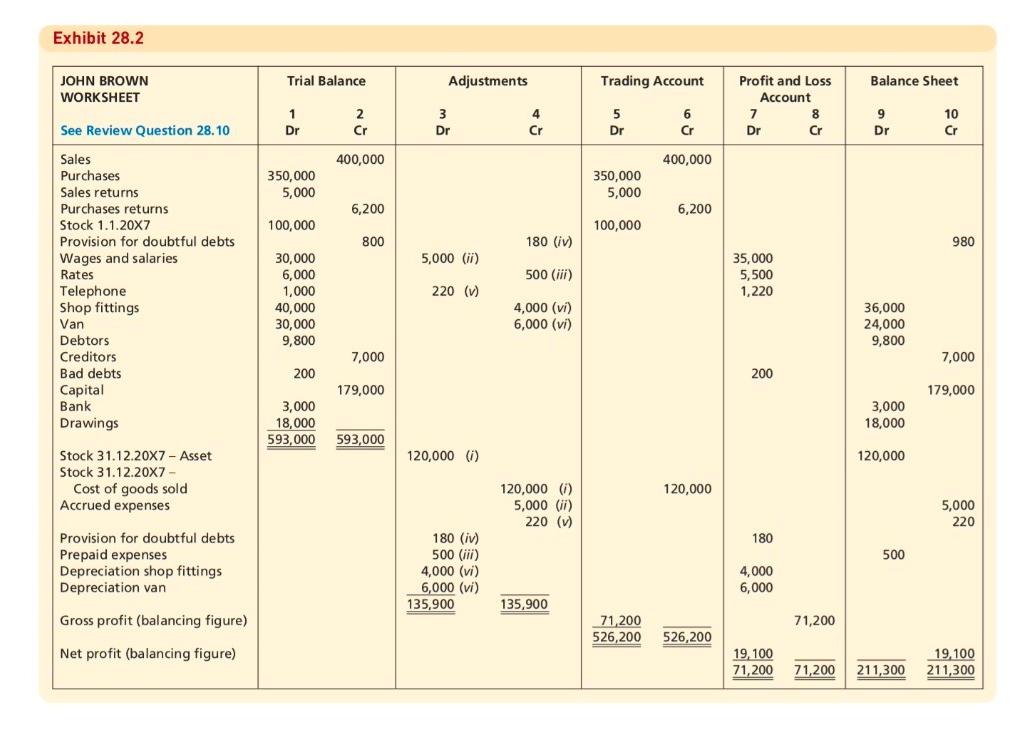

exhibit 28.2 are below which we need in question 28.11 This question also relates to extended trial balances (see Exhibit 28.2) From the following trial

exhibit 28.2 are below which we need in question

28.11 This question also relates to extended trial balances (see Exhibit 28.2) From the following trial balance of John Brown, store owner, prepare a trading account and profit and loss account for the year ended 31 December 20x7, and a balance sheet as at that date, taking into consideration the adjustments shown below: Trial Balance as at 31 December 20X7 Dr f Cr f 400,000 350,000 5,000 6,200 100,000 800 Sales Purchases Sales returns Purchases returns Opening stock at 1 January 20x7 Provision for doubtful debts Wages and salaries Rates Telephone Shop fittings at cost Van at cost Debtors and creditors Bad debts Capital Bank balance Drawings 30,000 6,000 1,000 40,000 30,000 9,800 200 7,000 179,000 3,000 18,000 593,000 593,000 (1) Closing stock at 31 December 20X7 120,000. (1) Accrued wages 5,000. (iii) Rates prepaid 500. (iv) The provision for doubtful debts to be increased to 10 per cent of debtors. (1) Telephone account outstanding 220. (vi) Depreciate shop fittings at 10 per cent per annum, and van at 20 per cent per annum, on cost. Exhibit 28.2 Trial Balance JOHN BROWN WORKSHEET Adjustments Trading Account Balance Sheet Profit and Loss Account 7 8 Dr Cr 1 Dr 3 Dr 4 6 Cr 9 Dr 10 Cr See Review Question 28.10 Cr Cr Dr 400,000 400,000 350,000 5,000 350,000 5,000 6,200 6,200 100,000 100,000 800 180 (iv) 980 5,000 (ii) 500 (iii) Sales Purchases Sales returns Purchases returns Stock 1.1.20X7 Provision for doubtful debts Wages and salaries Rates Telephone Shop fittings Van Debtors Creditors Bad debts Capital Bank Drawings 35,000 5,500 1,220 220 (V) 30,000 6,000 1,000 40,000 30,000 9,800 4,000 (vi) 6,000 (vi) 36,000 24,000 9,800 7,000 7,000 200 200 179,000 179,000 3,000 18,000 593,000 3,000 18,000 593,000 120,000 (1) 120,000 Stock 31.12.20X7 - Asset Stock 31.12.20x7 Cost of goods sold Accrued expenses 120,000 120,000 (7) 5,000 (ii) 220 (v) 5,000 220 180 500 Provision for doubtful debts Prepaid expenses Depreciation shop fittings Depreciation van 180 (iv) 500 (iii) 4,000 (vi) 6,000 (vi) 135,900 4,000 6,000 135,900 Gross profit (balancing figure) 71,200 71,200 526,200 526,200 Net profit (balancing figure) 19, 100 71,200 71,200 19.100 211,300 211,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started