Answered step by step

Verified Expert Solution

Question

1 Approved Answer

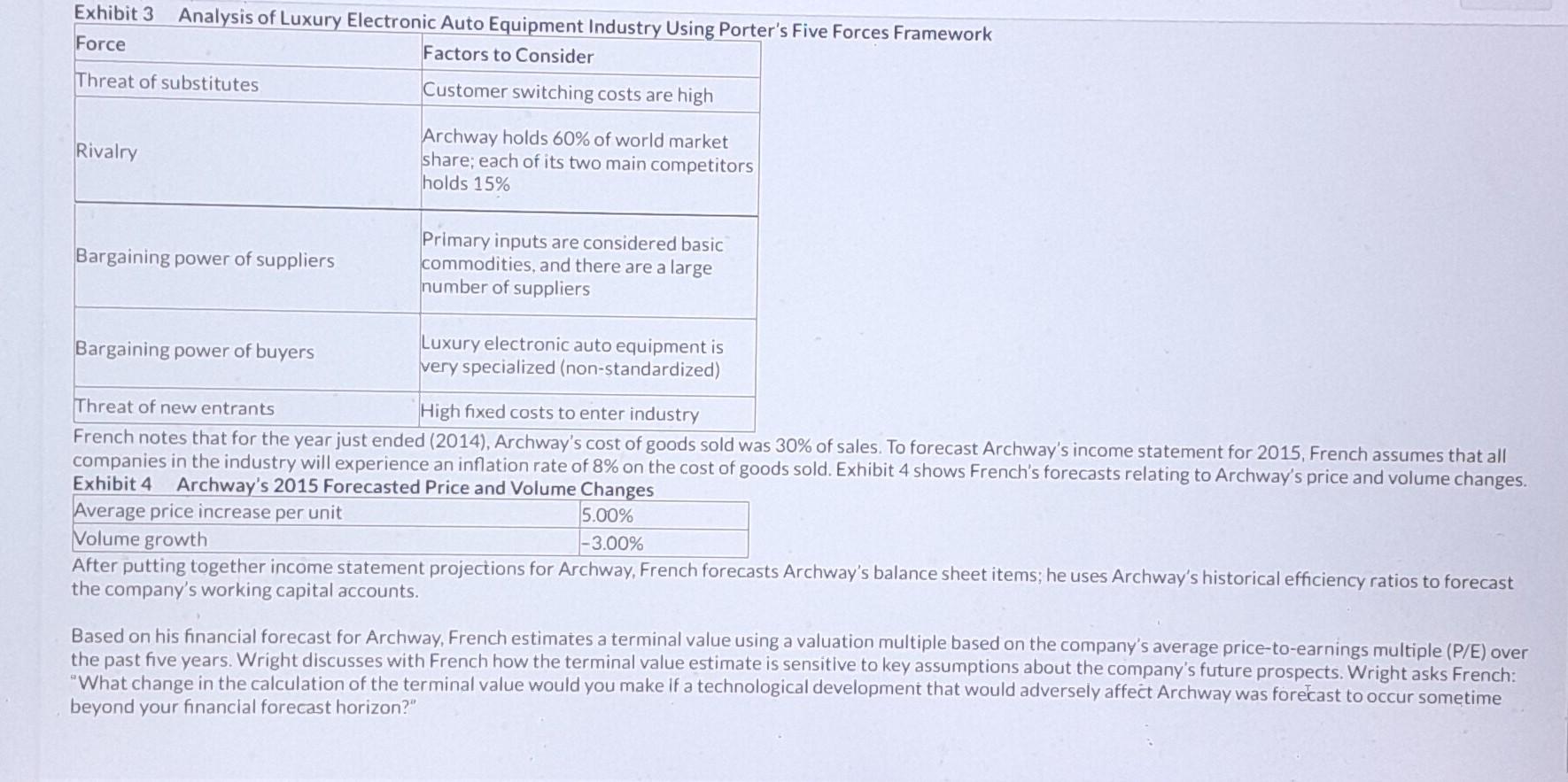

Exhibit 3 Analysis of Luxury Electronic Auto Equipment Industrv Usino Pnrter's Five Forces Framework French notes that for the year just ended (2014), Archway's cost

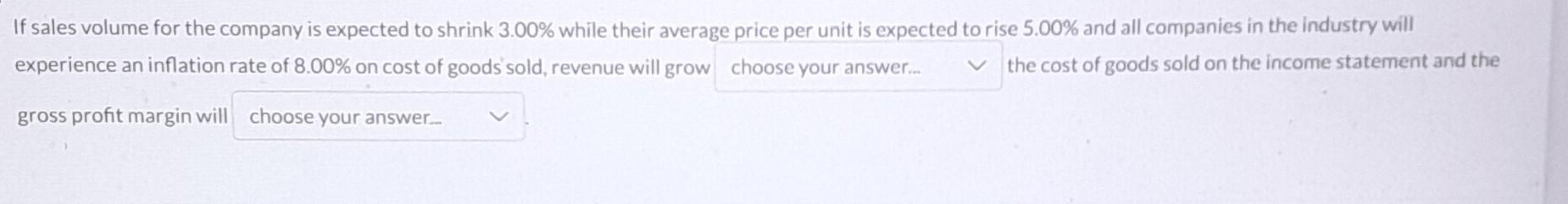

Exhibit 3 Analysis of Luxury Electronic Auto Equipment Industrv Usino Pnrter's Five Forces Framework French notes that for the year just ended (2014), Archway's cost of goods sold was 30% of sales. To forecast Archway's income statement for 2015 , French assumes that all companies in the industry will experience an inflation rate of 8% on the cost of goods sold. Exhibit 4 shows French's forecasts relating to Archway's price and volume changes. Exhibit 4 Archwav's 2015 Foreracted Drira and V/aluma rhanan After putting together income statement projections for Archway, French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway, French estimates a terminal value using a valuation multiple based on the company's average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon?" If sales volume for the company is expected to shrink 3.00% while their average price per unit is expected to rise 5.00% and all companies in the industry will experience an inflation rate of 8.00% on cost of goods sold, revenue will grow the cost of goods sold on the income statement and the gross profit margin will Exhibit 3 Analysis of Luxury Electronic Auto Equipment Industrv Usino Pnrter's Five Forces Framework French notes that for the year just ended (2014), Archway's cost of goods sold was 30% of sales. To forecast Archway's income statement for 2015 , French assumes that all companies in the industry will experience an inflation rate of 8% on the cost of goods sold. Exhibit 4 shows French's forecasts relating to Archway's price and volume changes. Exhibit 4 Archwav's 2015 Foreracted Drira and V/aluma rhanan After putting together income statement projections for Archway, French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway, French estimates a terminal value using a valuation multiple based on the company's average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon?" If sales volume for the company is expected to shrink 3.00% while their average price per unit is expected to rise 5.00% and all companies in the industry will experience an inflation rate of 8.00% on cost of goods sold, revenue will grow the cost of goods sold on the income statement and the gross profit margin will

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started