Answered step by step

Verified Expert Solution

Question

1 Approved Answer

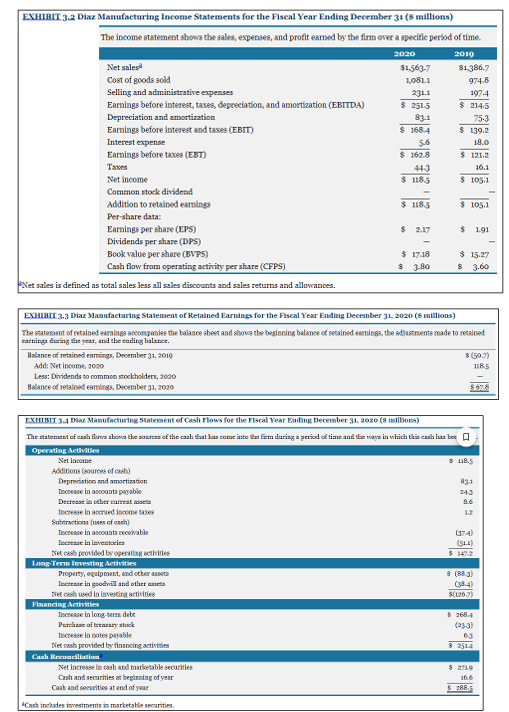

EXHIBIT 3.2 Diaz Manufacturing Income Statements for the Fiscal Year Ending December 31 (8 millions) The income statement shows the sales, expenses, and profit

EXHIBIT 3.2 Diaz Manufacturing Income Statements for the Fiscal Year Ending December 31 (8 millions) The income statement shows the sales, expenses, and profit earned by the firm over a specific period of time. 2020 Net sales Cost of goods sold $1,563-7 1,081.1 Selling and administrative expenses 231.1 2019 $1,386.7 974-8 197-4 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $ 251-5 Depreciation and amortization Earnings before interest and taxes (EBIT) Interest expense 5.6 Earnings before taxes (EBT) 83.1 $ 168.4 $ 162.8 $ 214-5 75-3 $139.2 18.0 $ 121.2 Taxes Net income Common stock dividend Addition to retained earnings Per-share data: Earnings per share (EPS) Dividends per share (DPS) 443 $ 118.5 16.1 $ 105.1 $ 1185 $ 105.1 $ 2.17 $ 1.91 - $ 17.18 $ 3.80 $ 15.27 $ 3.60 Book value per share (BVPS) Cash flow from operating activity per share (CFPS) *Net sales is defined as total sales less all sales discounts and sales returns and allowances. EXHIBIT 3.3 Diaz Manufacturing Statement of Retained Earnings for the Fiscal Year Ending December 31, 2020 (8 millions) The statement of retained earnings accompanies the balance sheet and shows the beginning balance of retained earnings, the adjustments made to retained earnings during the year, and the ending balance. Balance of retained earnings, December 31, 2019 Add: Net income, 2020 Less: Dividends to common stockholders, 2020 Balance of retained earnings, December 31, 2020 8 (50.7) 118.5 $678 EXHIBIT 3.4 Diaz Manufacturing Statement of Cash Flows for the Fiscal Year Ending December 31, 2020 (8 millions) The statement of cash flows shows the sources of the cash that has come into the firm during a period of time and the ways in which this cash has bee Operating Activities Net income Additions (sources of cash) Depreciation and amortization Increase in accounts payable Decrease in other current assets Increase in accrued income taxes Subtractions (uses of cash) Increase in accounts receivable Increase in inventories Net cash provided by operating activities Long-Term Investing Activities Property, equipment, and other assets Increase in goodwill and other assets Net cash used in investing activities Financing Activities Increase in long-term debt 8 118.5 83.1 243 8.6 1.2 (374) (511) $147.2 8 (883) (38-4) $(1207) Purchase of treasury stock Increase in notes payable Net cash provided by financing activities Cash Reconciliation Net increase in cash and marketable securities Cash and securities at beginning of year Cash and securities at end of year "Cash includes investments in marketable securities. $ 268.4 (233) 03 2514 $ 2719 16.6 288.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information here is a summary of the financial data for Diaz Manufacturing for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started