Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exhibit 45.8 provides some guidance on two scenarios: bullish and bearish cash flow forecasts. Based on the two scenarios, model cash flows for American Greetings

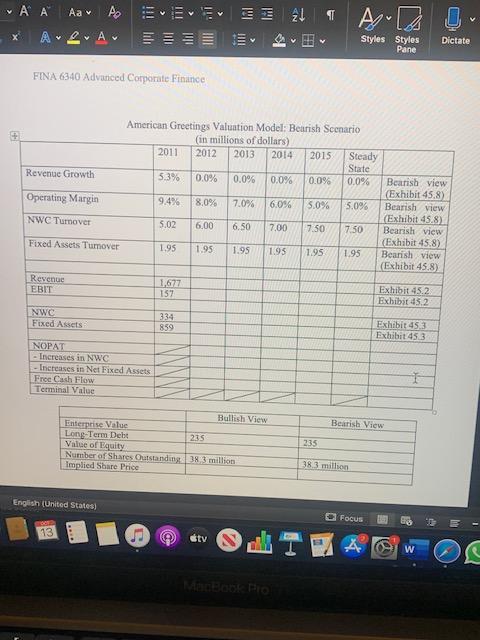

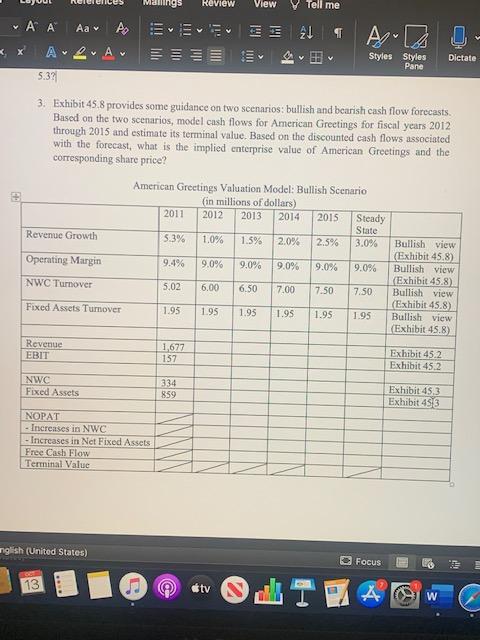

- Exhibit 45.8 provides some guidance on two scenarios: bullish and bearish cash flow forecasts. Based on the two scenarios, model cash flows for American Greetings for fiscal years 2012 through 2015 and estimate its terminal value. Based on the discounted cash flows associated with the forecast, what is the implied enterprise value of American Greetings and the corresponding share price?

WACC/Discount Rate Used : 8.43%

Marginal Tax Rate: 39%

A A Aav A A.2.A. FINA 6340 Advanced Corporate Finance Revenue Growth Operating Margin NWC Turnover Fixed Assets Tumover Revenue EBIT NWC Fixed Assets SE NOPAT - Increases in NWC -Increases in Net Fixed Assets Free Cash Flow Terminal Value English (United States) 2011 5.3% American Greetings Valuation Model: Bearish Scenario (in millions of dollars) 2012 2013 2014 2015 0.0% 0.0% 0.0% 0.0% 9.4% 8.0% 7.0% 6.0% 5.0% 5.02 6.00 6.50 7.00 7.50 1.95 1,677 157 334 859 Enterprise Value Long-Term Debt Value of Equity Number of Shares Outstanding Implied Share Price 1.95 stv 1.95 1.95 235 383 million Bullish View 2 MacBook Pro 1.95 235 Styles Styles Dictate Pane Steady State 0.0% 5.0% 7.50 1.95 38.3 million Focus Bearish view (Exhibit 45.8) Bearish view (Exhibit 45.8) Bearish view (Exhibit 45.8) Bearish view (Exhibit 45.8) Bearish View Exhibit 45.2 Exhibit 45.2 Exhibit 45.3 Exhibit 45.3 T AW

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To model the cash flows for American Greetings for fiscal years 2012 through 2015 and estimate its terminal value we need to use the discounted cash flow method The first step is to project the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started