Answered step by step

Verified Expert Solution

Question

1 Approved Answer

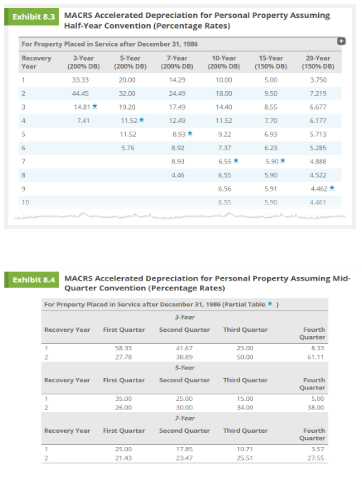

Exhibit 8.3 MACRS Accelerated Depreciation for Personal Property Assuming Half-Year Convention (Percentage Rates) For Property Placed in Service after December 31, 1986 Recovery Year

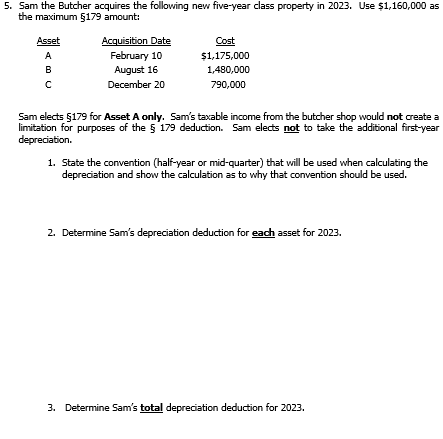

Exhibit 8.3 MACRS Accelerated Depreciation for Personal Property Assuming Half-Year Convention (Percentage Rates) For Property Placed in Service after December 31, 1986 Recovery Year 3-Year (200% DB) 5-Year (200% DB) 7-Year (200% DB) 10-Year 15-Year (200% DB) (150% DB) 20-Year (150% DB) 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 7.41 11.52* 12.49 11.52 7.70 6.177 11.52 8.93 9.22 6.93 5.713 5.76 8.92 7.37 6.23 5.285 8.93 6.55 M 5.90 4.888 4.46 6.55 5.90 4.522 6.56 5.91 4.462 10 6.55 5.90 4.461 Exhibit 8.4 MACRS Accelerated Depreciation for Personal Property Assuming Mid- Quarter Convention (Percentage Rates) For Property Placed in Service after December 31, 1986 (Partial Table * ) 3-Year Recovery Year First Quarter Second Quarter Third Quarter Fourth Quarter 2 58.33 27.78 41.67 25.00 8.33 38.89 50.00 61.11 5-Year Recovery Year First Quarter Second Quarter Third Quarter Fourth Quarter 1 2 35.00 26.00 25.00 30.00 15.00 34.00 5.00 38.00 7-Year Recovery Year First Quarter Second Quarter Third Quarter Fourth Quarter 1 25.00 1735 10.71 3.57 21.43 2347 25.51 27.55 5. Sam the Butcher acquires the following new five-year class property in 2023. Use $1,160,000 as the maximum 179 amount: Asset Acquisition Date Cost A February 10 $1,175,000 B August 16 1,480,000 December 20 790,000 Sam elects 179 for Asset A only. Sam's taxable income from the butcher shop would not create a limitation for purposes of the 179 deduction. Sam elects not to take the additional first-year depreciation. 1. State the convention (half-year or mid-quarter) that will be used when calculating the depreciation and show the calculation as to why that convention should be used. 2. Determine Sam's depreciation deduction for each asset for 2023. 3. Determine Sam's total depreciation deduction for 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started