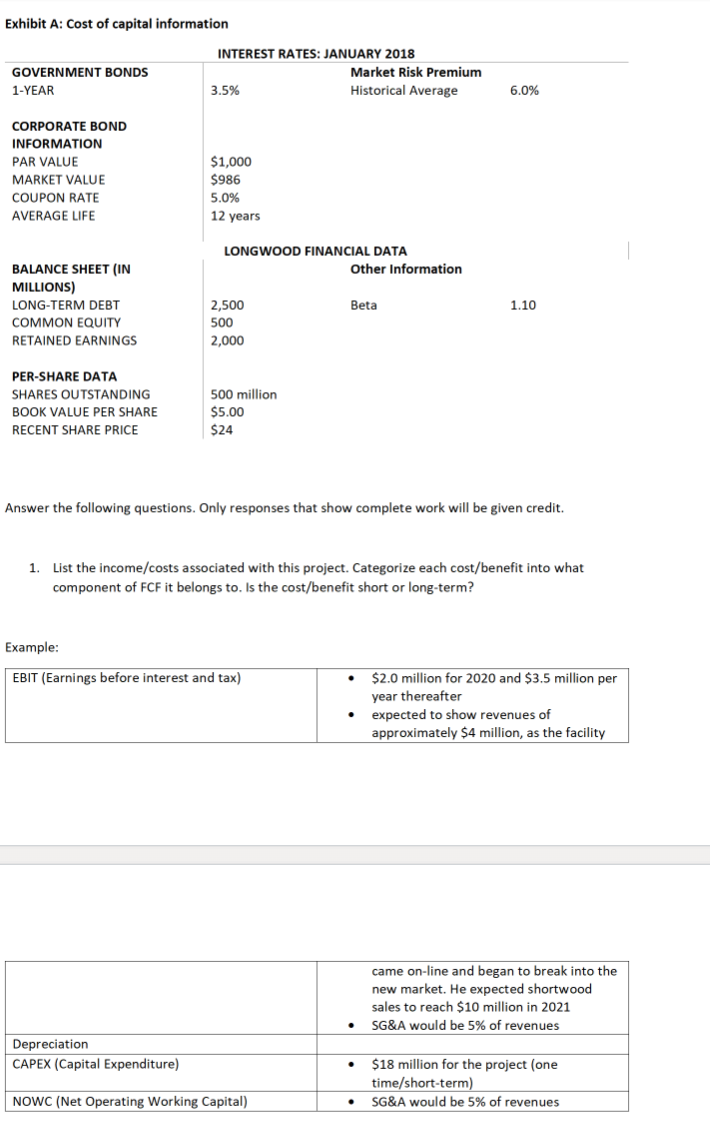

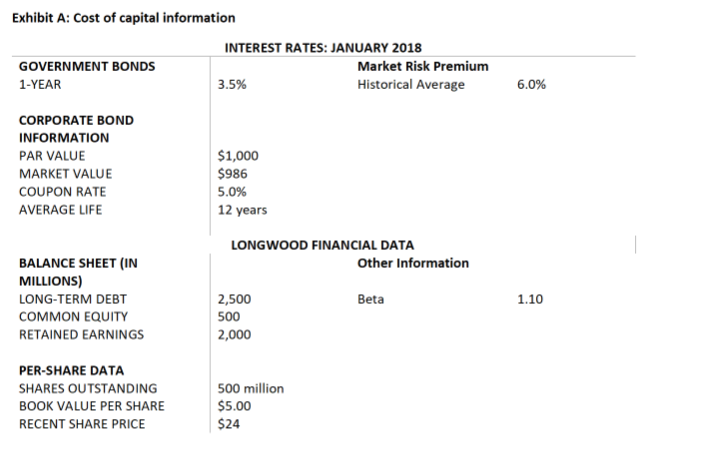

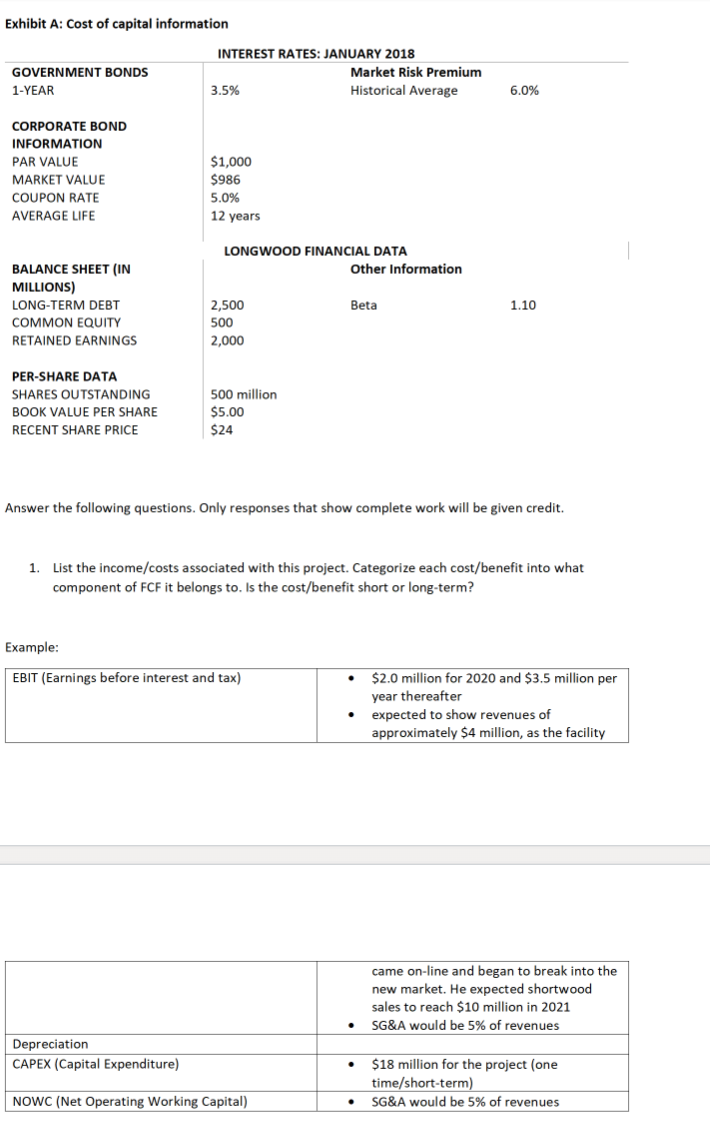

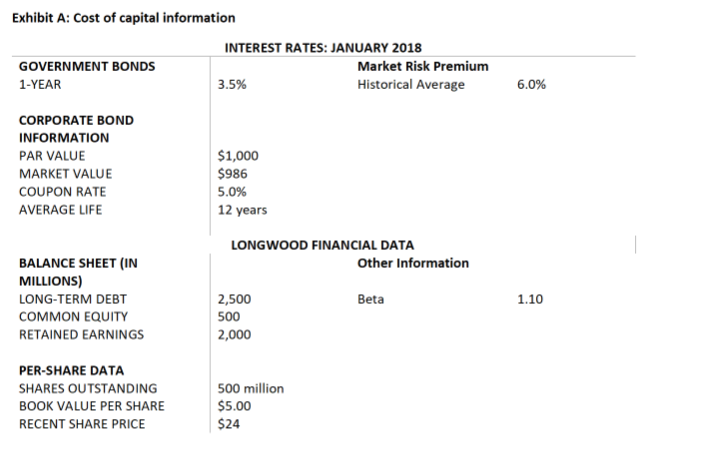

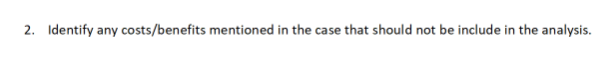

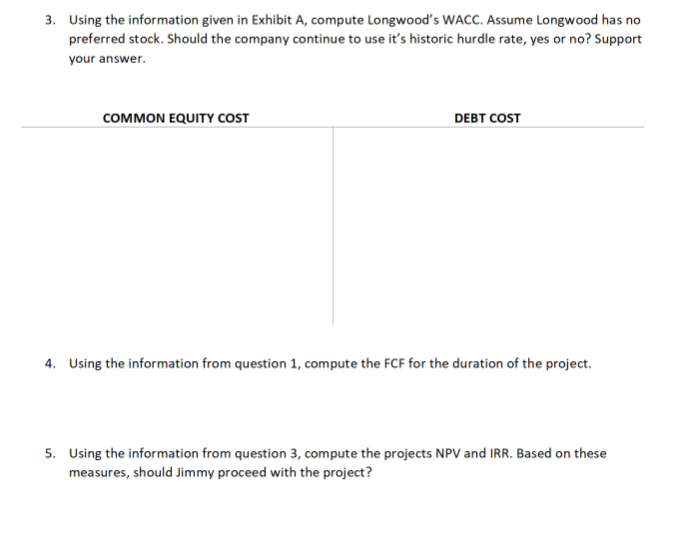

Exhibit A: Cost of capital information INTEREST RATES: JANUARY 2018 GOVERNMENT BONDS Market Risk Premium 1-YEAR - 3.5% Historical Average 6.0% CORPORATE BOND INFORMATION PAR VALUE MARKET VALUE COUPON RATE AVERAGE LIFE $1,000 $986 5.0% 12 years LONGWOOD FINANCIAL DATA Other Information BALANCE SHEET (IN MILLIONS) LONG-TERM DEBT COMMON EQUITY RETAINED EARNINGS Beta 1.10 2,500 500 2,000 PER-SHARE DATA SHARES OUTSTANDING BOOK VALUE PER SHARE RECENT SHARE PRICE 500 million $5.00 $24 Answer the following questions. Only responses that show complete work will be given credit. 1 List the income/costs associated with this project. Categorize each cost/benefit into what component of FCF it belongs to. Is the cost/benefit short or long-term? Example: EBIT (Earnings before interest and tax) $2.0 million for 2020 and $3.5 million per year thereafter expected to show revenues of approximately $4 million, as the facility came on-line and began to break into the new market. He expected shortwood sales to reach $10 million in 2021 SG&A would be 5% of revenues Depreciation CAPEX (Capital Expenditure) $18 million for the project (one time/short-term) SG&A would be 5% of revenues NOWC (Net Operating Working Capital) . Exhibit A: Cost of capital information INTEREST RATES: JANUARY 2018 GOVERNMENT BONDS Market Risk Premium 1-YEAR 3.5% Historical Average 6.0% CORPORATE BOND INFORMATION PAR VALUE MARKET VALUE COUPON RATE AVERAGE LIFE $1,000 $986 5.0% 12 years LONGWOOD FINANCIAL DATA Other Information BALANCE SHEET (IN MILLIONS) LONG-TERM DEBT COMMON EQUITY RETAINED EARNINGS Beta 1.10 2,500 500 2,000 PER-SHARE DATA SHARES OUTSTANDING BOOK VALUE PER SHARE RECENT SHARE PRICE 500 million $5.00 $24 2. Identify any costs/benefits mentioned in the case that should not be include in the analysis. 3. Using the information given in Exhibit A, compute Longwood's WACC. Assume Longwood has no preferred stock. Should the company continue to use it's historic hurdle rate, yes or no? Support your answer. COMMON EQUITY COST DEBT COST 4. Using the information from question 1, compute the FCF for the duration of the project. 5. Using the information from question 3, compute the projects NPV and IRR. Based on these measures, should Jimmy proceed with the project? Exhibit A: Cost of capital information INTEREST RATES: JANUARY 2018 GOVERNMENT BONDS Market Risk Premium 1-YEAR - 3.5% Historical Average 6.0% CORPORATE BOND INFORMATION PAR VALUE MARKET VALUE COUPON RATE AVERAGE LIFE $1,000 $986 5.0% 12 years LONGWOOD FINANCIAL DATA Other Information BALANCE SHEET (IN MILLIONS) LONG-TERM DEBT COMMON EQUITY RETAINED EARNINGS Beta 1.10 2,500 500 2,000 PER-SHARE DATA SHARES OUTSTANDING BOOK VALUE PER SHARE RECENT SHARE PRICE 500 million $5.00 $24 Answer the following questions. Only responses that show complete work will be given credit. 1 List the income/costs associated with this project. Categorize each cost/benefit into what component of FCF it belongs to. Is the cost/benefit short or long-term? Example: EBIT (Earnings before interest and tax) $2.0 million for 2020 and $3.5 million per year thereafter expected to show revenues of approximately $4 million, as the facility came on-line and began to break into the new market. He expected shortwood sales to reach $10 million in 2021 SG&A would be 5% of revenues Depreciation CAPEX (Capital Expenditure) $18 million for the project (one time/short-term) SG&A would be 5% of revenues NOWC (Net Operating Working Capital) . Exhibit A: Cost of capital information INTEREST RATES: JANUARY 2018 GOVERNMENT BONDS Market Risk Premium 1-YEAR 3.5% Historical Average 6.0% CORPORATE BOND INFORMATION PAR VALUE MARKET VALUE COUPON RATE AVERAGE LIFE $1,000 $986 5.0% 12 years LONGWOOD FINANCIAL DATA Other Information BALANCE SHEET (IN MILLIONS) LONG-TERM DEBT COMMON EQUITY RETAINED EARNINGS Beta 1.10 2,500 500 2,000 PER-SHARE DATA SHARES OUTSTANDING BOOK VALUE PER SHARE RECENT SHARE PRICE 500 million $5.00 $24 2. Identify any costs/benefits mentioned in the case that should not be include in the analysis. 3. Using the information given in Exhibit A, compute Longwood's WACC. Assume Longwood has no preferred stock. Should the company continue to use it's historic hurdle rate, yes or no? Support your answer. COMMON EQUITY COST DEBT COST 4. Using the information from question 1, compute the FCF for the duration of the project. 5. Using the information from question 3, compute the projects NPV and IRR. Based on these measures, should Jimmy proceed with the project