Answered step by step

Verified Expert Solution

Question

1 Approved Answer

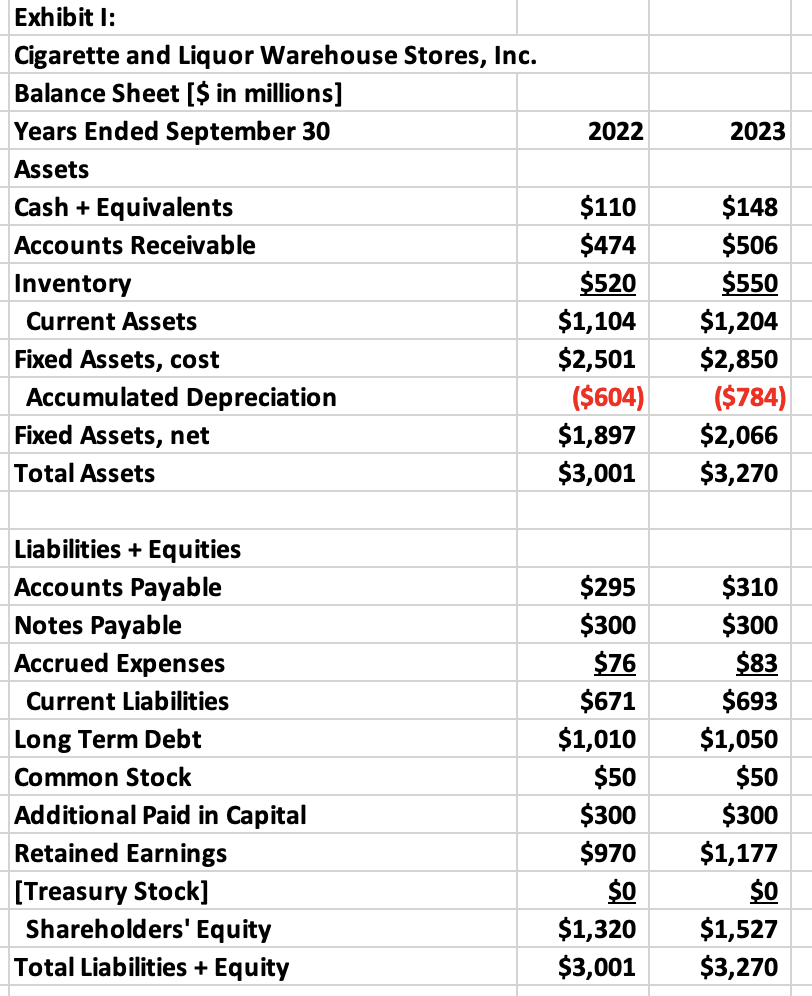

Exhibit I: Cigarette and Liquor Warehouse Stores, Inc. begin{tabular}{|c|c|c|} hline multicolumn{3}{|l|}{ Balance Sheet [$ in millions] } hline Years Ended September 30 & 2022

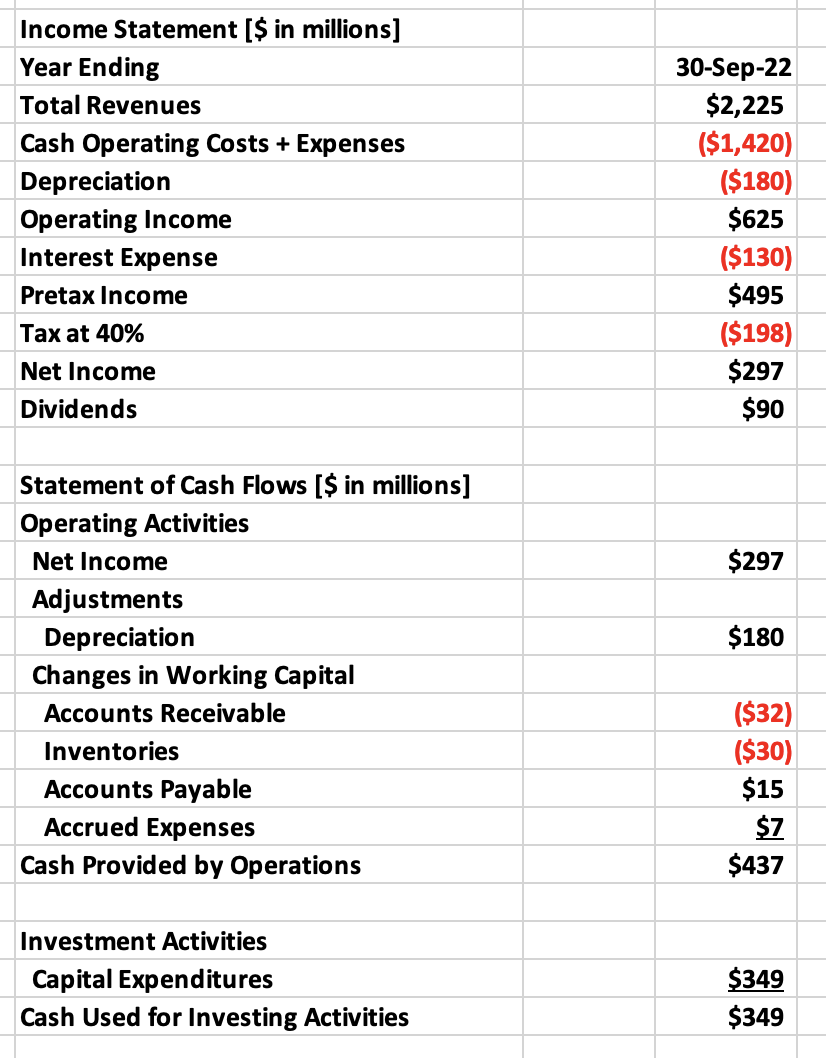

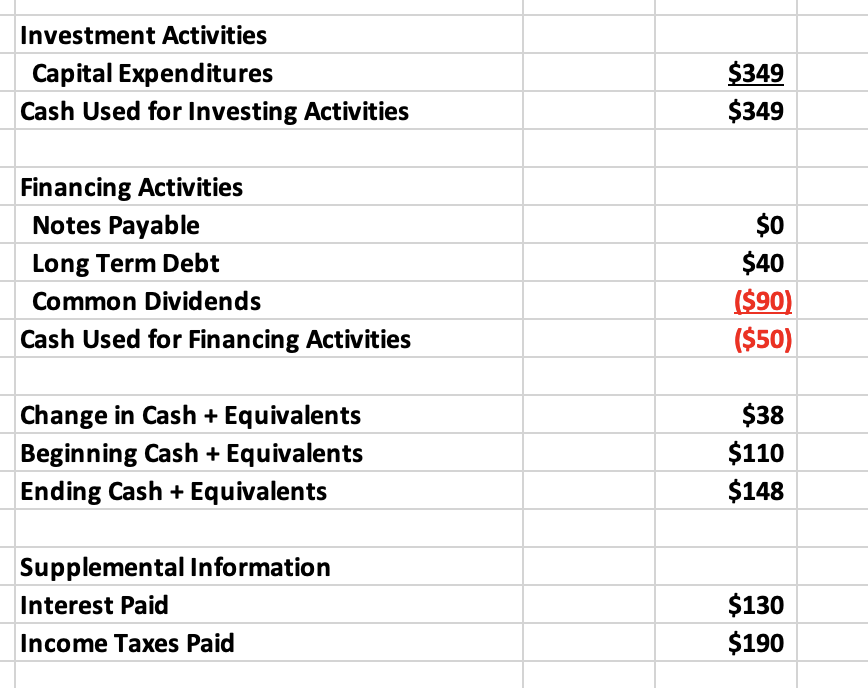

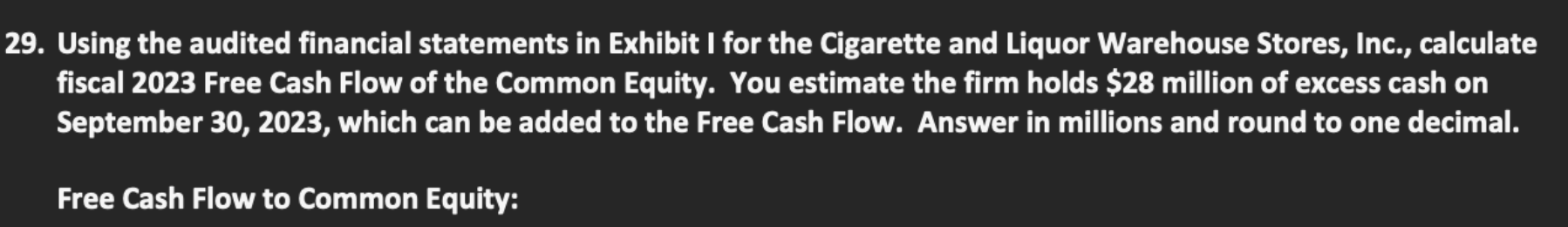

Exhibit I: Cigarette and Liquor Warehouse Stores, Inc. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Balance Sheet [\$ in millions] } \\ \hline Years Ended September 30 & 2022 & 2023 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash + Equivalents & $110 & $148 \\ \hline Accounts Receivable & $474 & $506 \\ \hline Inventory & $520 & $550 \\ \hline Current Assets & $1,104 & $1,204 \\ \hline Fixed Assets, cost & $2,501 & $2,850 \\ \hline Accumulated Depreciation & (\$604) & (\$784) \\ \hline Fixed Assets, net & $1,897 & $2,066 \\ \hline Total Assets & $3,001 & $3,270 \\ \hline \multicolumn{3}{|l|}{ Liabilities + Equities } \\ \hline Accounts Payable & $295 & $310 \\ \hline Notes Payable & $300 & $300 \\ \hline Accrued Expenses & & $83 \\ \hline Current Liabilities & $671 & $693 \\ \hline Long Term Debt & $1,010 & $1,050 \\ \hline Common Stock & $50 & $50 \\ \hline Additional Paid in Capital & $300 & $300 \\ \hline Retained Earnings & $970 & $1,177 \\ \hline [Treasury Stock] & \$so & \$ \\ \hline Shareholders' Equity & $1,320 & $1,527 \\ \hline Total Liabilities + Equity & $3,001 & $3,270 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{ Income Statement [\$ in millions] } \\ \hline Year Ending & 30-Sep-22 \\ \hline Total Revenues & $2,225 \\ \hline Cash Operating Costs + Expenses & ($1,420) \\ \hline Depreciation & ($180) \\ \hline Operating Income & $625 \\ \hline Interest Expense & ($130) \\ \hline Pretax Income & $495 \\ \hline Tax at 40% & (\$198) \\ \hline Net Income & $297 \\ \hline Dividends & $90 \\ \hline \multicolumn{2}{|c|}{ Statement of Cash Flows [\$ in millions] } \\ \hline \multicolumn{2}{|l|}{ Operating Activities } \\ \hline Net Income & $297 \\ \hline \multicolumn{2}{|l|}{ Adjustments } \\ \hline Depreciation & $180 \\ \hline \multicolumn{2}{|l|}{ Changes in Working Capital } \\ \hline Accounts Receivable & ($32) \\ \hline Inventories & ($30) \\ \hline Accounts Payable & $15 \\ \hline Accrued Expenses & \$\$1 \\ \hline Cash Provided by Operations & $437 \\ \hline \multicolumn{2}{|l|}{ Investment Activities } \\ \hline Capital Expenditures & $349 \\ \hline Cash Used for Investing Activities & $349 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Investment Activities & \\ \hline Capital Expenditures & \\ \hline Cash Used for Investing Activities & $349 \\ \hline Financing Activities & $349 \\ \hline Notes Payable & \\ \hline Long Term Debt & $0 \\ \hline Common Dividends & $40 \\ \hline Cash Used for Financing Activities & $90) \\ \hline & $50) \\ \hline Change in Cash + Equivalents & \\ \hline Beginning Cash + Equivalents & $38 \\ \hline Ending Cash + Equivalents & $110 \\ \hline Supplemental Information & $148 \\ \hline Interest Paid & \\ \hline Income Taxes Paid & $130 \\ \hline \end{tabular} 19. Using the audited financial statements in Exhibit I for the Cigarette and Liquor Warehouse Stores, Inc., calculate fiscal 2023 Free Cash Flow of the Common Equity. You estimate the firm holds $28 million of excess cash on September 30, 2023, which can be added to the Free Cash Flow. Answer in millions and round to one decimal. Free Cash Flow to Common Equity

Exhibit I: Cigarette and Liquor Warehouse Stores, Inc. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Balance Sheet [\$ in millions] } \\ \hline Years Ended September 30 & 2022 & 2023 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash + Equivalents & $110 & $148 \\ \hline Accounts Receivable & $474 & $506 \\ \hline Inventory & $520 & $550 \\ \hline Current Assets & $1,104 & $1,204 \\ \hline Fixed Assets, cost & $2,501 & $2,850 \\ \hline Accumulated Depreciation & (\$604) & (\$784) \\ \hline Fixed Assets, net & $1,897 & $2,066 \\ \hline Total Assets & $3,001 & $3,270 \\ \hline \multicolumn{3}{|l|}{ Liabilities + Equities } \\ \hline Accounts Payable & $295 & $310 \\ \hline Notes Payable & $300 & $300 \\ \hline Accrued Expenses & & $83 \\ \hline Current Liabilities & $671 & $693 \\ \hline Long Term Debt & $1,010 & $1,050 \\ \hline Common Stock & $50 & $50 \\ \hline Additional Paid in Capital & $300 & $300 \\ \hline Retained Earnings & $970 & $1,177 \\ \hline [Treasury Stock] & \$so & \$ \\ \hline Shareholders' Equity & $1,320 & $1,527 \\ \hline Total Liabilities + Equity & $3,001 & $3,270 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|l|}{ Income Statement [\$ in millions] } \\ \hline Year Ending & 30-Sep-22 \\ \hline Total Revenues & $2,225 \\ \hline Cash Operating Costs + Expenses & ($1,420) \\ \hline Depreciation & ($180) \\ \hline Operating Income & $625 \\ \hline Interest Expense & ($130) \\ \hline Pretax Income & $495 \\ \hline Tax at 40% & (\$198) \\ \hline Net Income & $297 \\ \hline Dividends & $90 \\ \hline \multicolumn{2}{|c|}{ Statement of Cash Flows [\$ in millions] } \\ \hline \multicolumn{2}{|l|}{ Operating Activities } \\ \hline Net Income & $297 \\ \hline \multicolumn{2}{|l|}{ Adjustments } \\ \hline Depreciation & $180 \\ \hline \multicolumn{2}{|l|}{ Changes in Working Capital } \\ \hline Accounts Receivable & ($32) \\ \hline Inventories & ($30) \\ \hline Accounts Payable & $15 \\ \hline Accrued Expenses & \$\$1 \\ \hline Cash Provided by Operations & $437 \\ \hline \multicolumn{2}{|l|}{ Investment Activities } \\ \hline Capital Expenditures & $349 \\ \hline Cash Used for Investing Activities & $349 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Investment Activities & \\ \hline Capital Expenditures & \\ \hline Cash Used for Investing Activities & $349 \\ \hline Financing Activities & $349 \\ \hline Notes Payable & \\ \hline Long Term Debt & $0 \\ \hline Common Dividends & $40 \\ \hline Cash Used for Financing Activities & $90) \\ \hline & $50) \\ \hline Change in Cash + Equivalents & \\ \hline Beginning Cash + Equivalents & $38 \\ \hline Ending Cash + Equivalents & $110 \\ \hline Supplemental Information & $148 \\ \hline Interest Paid & \\ \hline Income Taxes Paid & $130 \\ \hline \end{tabular} 19. Using the audited financial statements in Exhibit I for the Cigarette and Liquor Warehouse Stores, Inc., calculate fiscal 2023 Free Cash Flow of the Common Equity. You estimate the firm holds $28 million of excess cash on September 30, 2023, which can be added to the Free Cash Flow. Answer in millions and round to one decimal. Free Cash Flow to Common Equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started