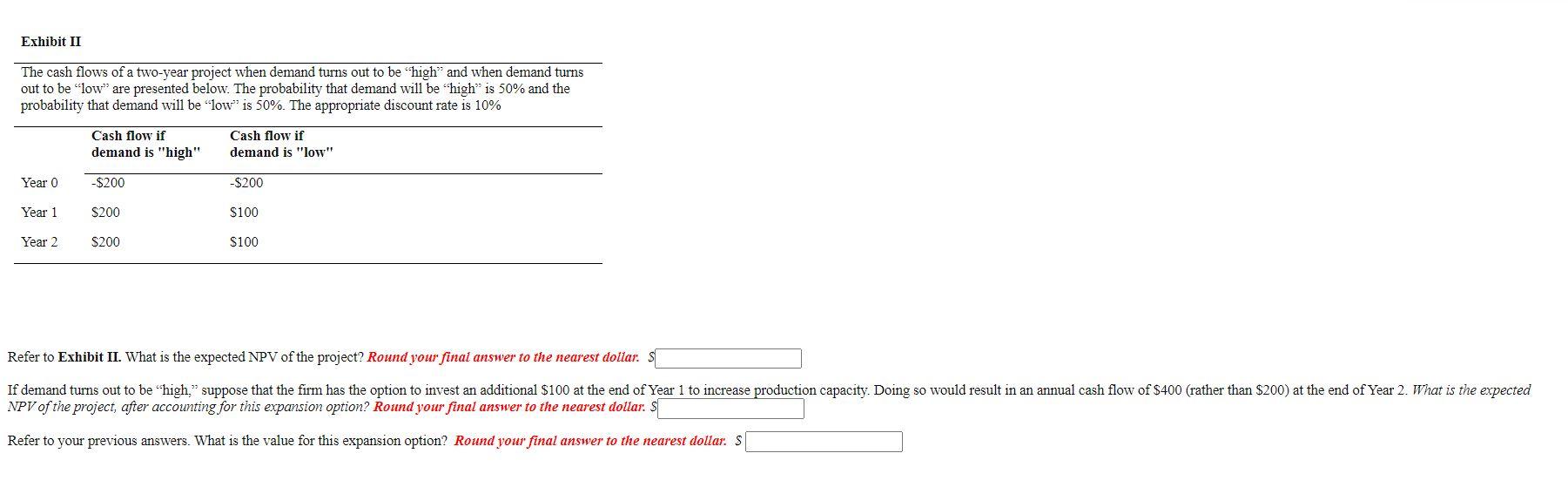

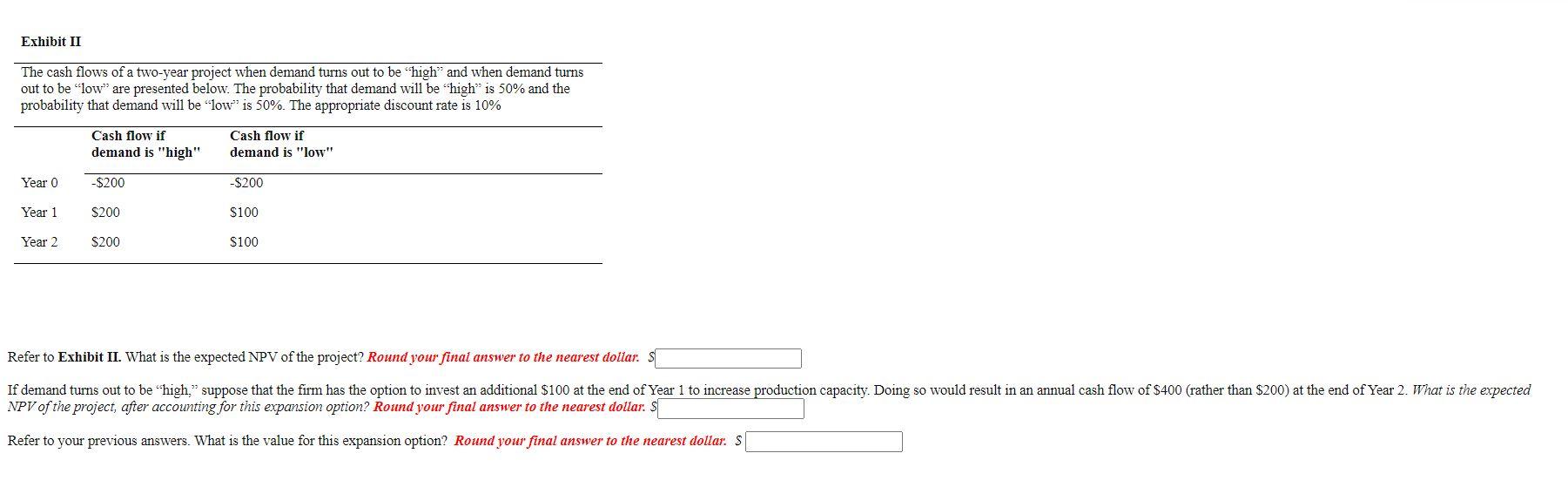

Exhibit II The cash flows of a two-year project when demand turns out to be "high" and when demand turns out to be "low" are presented below. The probability that demand will be "high" is 50% and the probability that demand will be "low" is 50%. The appropriate discount rate is 10% Cash flow if demand is "high" Cash flow if demand is "low" Year 0 -$200 -$200 Year 1 S200 $100 Year 2 $200 $100 Refer to Exhibit II. What is the expected NPV of the project? Round your final answer to the nearest dollar. SC If demand turns out to be "high" suppose that the firm has the option to invest an additional $100 at the end of Year 1 to increase production capacity. Doing so would result in an annual cash flow of $400 (rather than $200) at the end of Year 2. What is the expected NPV of the project, after accounting for this expansion option? Round your final answer to the nearest dollar. $ Refer to your previous answers. What is the value for this expansion option? Round your final answer to the nearest dollar. S Exhibit II The cash flows of a two-year project when demand turns out to be "high" and when demand turns out to be "low" are presented below. The probability that demand will be "high" is 50% and the probability that demand will be "low" is 50%. The appropriate discount rate is 10% Cash flow if demand is "high" Cash flow if demand is "low" Year 0 -$200 -$200 Year 1 S200 $100 Year 2 $200 $100 Refer to Exhibit II. What is the expected NPV of the project? Round your final answer to the nearest dollar. SC If demand turns out to be "high" suppose that the firm has the option to invest an additional $100 at the end of Year 1 to increase production capacity. Doing so would result in an annual cash flow of $400 (rather than $200) at the end of Year 2. What is the expected NPV of the project, after accounting for this expansion option? Round your final answer to the nearest dollar. $ Refer to your previous answers. What is the value for this expansion option? Round your final answer to the nearest dollar. S