Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exide Industries is considering the proposal to replace one of its machines. In this connection, the following information is available. The existing machine was

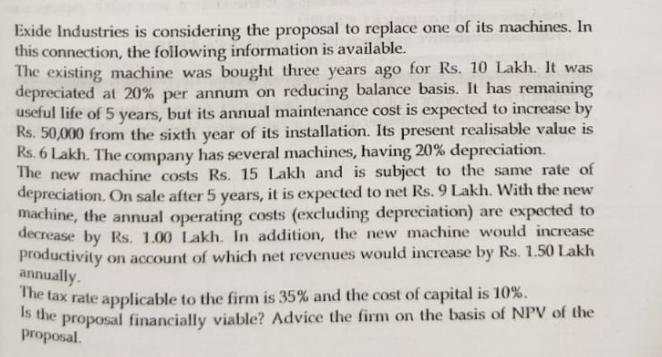

Exide Industries is considering the proposal to replace one of its machines. In this connection, the following information is available. The existing machine was bought three years ago for Rs. 10 Lakh. It was depreciated at 20% per annum on reducing balance basis. It has remaining useful life of 5 years, but its annual maintenance cost is expected to increase by Rs. 50,000 from the sixth year of its installation. Its present realisable value is Rs. 6 Lakh. The company has several machines, having 20% depreciation. The new machine costs Rs. 15 Lakh and is subject to the same rate of depreciation. On sale after 5 years, it is expected to net Rs. 9 Lakh. With the new machine, the annual operating costs (excluding depreciation) are expected to decrease by Rs. 1.00 Lakh. In addition, the new machine would increase productivity on account of which net revenues would increase by Rs. 1.50 Lakh annually. The tax rate applicable to the firm is 35% and the cost of capital is 10%. Is the proposal financially viable? Advice the firm on the basis of NPV of the proposal.

Step by Step Solution

★★★★★

3.47 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

To determine the financial viability of the proposal we need to calculate the Net Present Value NPV of the project NPV helps us assess the profitabili...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started