Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exon Oil Company is trying to decide whether to lease or buy a new computer-assisted drilling system for its oil exploration business. The system

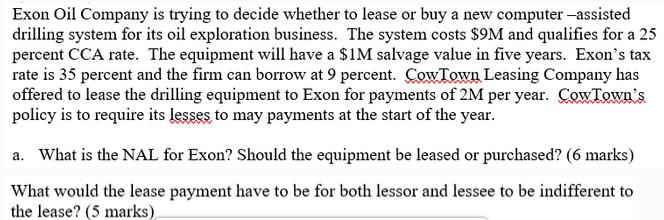

Exon Oil Company is trying to decide whether to lease or buy a new computer-assisted drilling system for its oil exploration business. The system costs $9M and qualifies for a 25 percent CCA rate. The equipment will have a $1M salvage value in five years. Exon's tax rate is 35 percent and the firm can borrow at 9 percent. CowTown Leasing Company has offered to lease the drilling equipment to Exon for payments of 2M per year. CowTown's policy is to require its lesses to may payments at the start of the year. a. What is the NAL for Exon? Should the equipment be leased or purchased? (6 marks) What would the lease payment have to be for both lessor and lessee to be indifferent to the lease? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Advantage to Leasing NAL we need to compare the net cost of leasing to the net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started