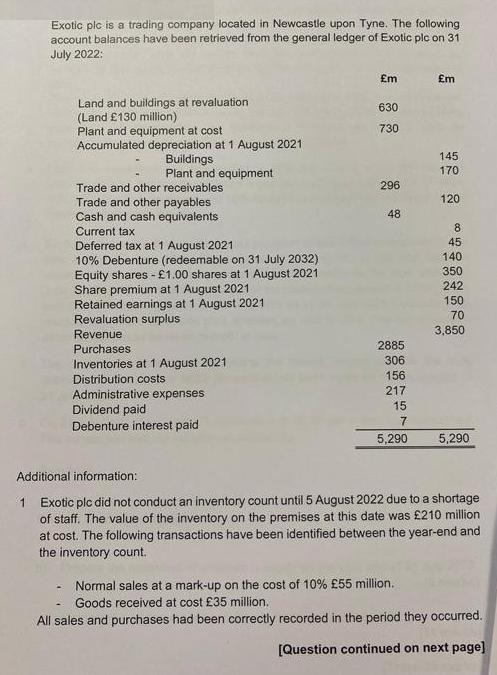

Exotic plc is a trading company located in Newcastle upon Tyne. The following account balances have been retrieved from the general ledger of Exotic

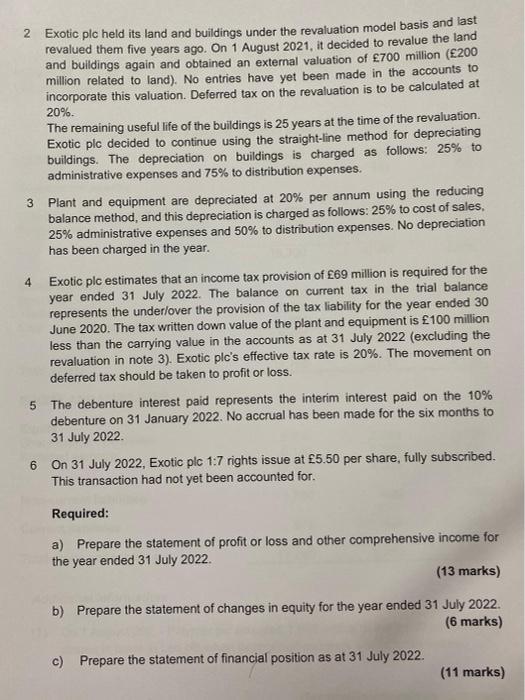

Exotic plc is a trading company located in Newcastle upon Tyne. The following account balances have been retrieved from the general ledger of Exotic plc on 311 July 2022: Land and buildings at revaluation (Land 130 million) Plant and equipment at cost Accumulated depreciation at 1 August 2021 Buildings Plant and equipment Trade and other receivables Trade and other payables Cash and cash equivalents tax Deferred tax at 1 August 2021 10% Debenture (redeemable on 31 July 2032) Equity shares - 1.00 shares at 1 August 2021 Share premium at 1 August 2021 Retained earnings at 1 August 2021 Revaluation surplus Revenue Purchases Inventories at 1 August 2021 Distribution costs Administrative expenses Dividend paid Debenture interest paid m 630 730 296 48 2885 306 156 217 15 7 5,290 m 145 170 120 8 45 140 350 242 150 70 3,850 5,290 Additional information: 1 Exotic plc did not conduct an inventory count until 5 August 2022 due to a shortage of staff. The value of the inventory on the premises at this date was 210 million at cost. The following transactions have been identified between the year-end and the inventory count. Normal sales at a mark-up on the cost of 10% 55 million. Goods received at cost 35 million. All sales and purchases had been correctly recorded in the period they occurred. [Question continued on next page] 2 Exotic plc held its land and buildings under the revaluation model basis and last revalued them five years ago. On 1 August 2021, it decided to revalue the land and buildings again and obtained an external valuation of 700 million (200 million related to land). No entries have yet been made in the accounts to incorporate this valuation. Deferred tax on the revaluation is to be calculated at 20%. 3 4 The remaining useful life of the buildings is 25 years at the time of the revaluation. Exotic plc decided to continue using the straight-line method for depreciating buildings. The depreciation on buildings is charged as follows: 25% to administrative expenses and 75% to distribution expenses. Plant and equipment are depreciated at 20% per annum using the reducing balance method, and this depreciation is charged as follows: 25% to cost of sales, 25% administrative expenses and 50% to distribution expenses. No depreciation has been charged in the year. Exotic plc estimates that an income tax provision of 69 million is required for the year ended 31 July 2022. The balance on current tax in the trial balance represents the under/over the provision of the tax liability for the year ended 30 June 2020. The tax written down value of the plant and equipment is 100 million less than the carrying value in the accounts as at 31 July 2022 (excluding the revaluation in note 3). Exotic plc's effective tax rate is 20%. The movement on deferred tax should be taken to profit or loss. 5 The debenture interest paid represents the interim interest paid on the 10% debenture on 31 January 2022. No accrual has been made for the six months to 31 July 2022. 6 On 31 July 2022, Exotic plc 1:7 rights issue at 5.50 per share, fully subscribed. This transaction had not yet been accounted for. Required: a) Prepare the statement of profit or loss and other comprehensive income for the year ended 31 July 2022. (13 marks) b) Prepare the statement of changes in equity for the year ended 31 July 2022. (6 marks) c) Prepare the statement of financial position as at 31 July 2022. (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Financial Position Particular Assets Non Current Asset Land and building Accumulate...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started