Answered step by step

Verified Expert Solution

Question

1 Approved Answer

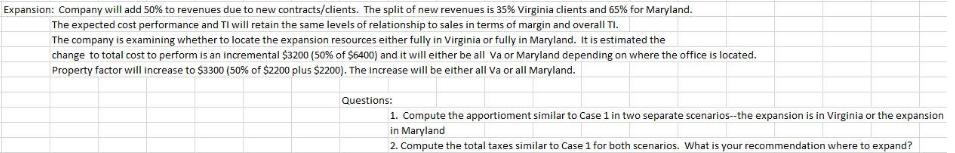

Expansion: Company will add 50% to revenues due to new contracts/clients. The split of new revenues is 35% Virginia clients and 65% for Maryland.

Expansion: Company will add 50% to revenues due to new contracts/clients. The split of new revenues is 35% Virginia clients and 65% for Maryland. The expected cost performance and TI will retain the same levels of relationship to sales in terms of margin and overall TI. The company is examining whether to locate the expansion resources either fully in Virginia or fully in Maryland. It is estimated the change to total cost to perform is an incremental $3200 (50% of $6400) and it will either be all Va or Maryland depending on where the office is located. Property factor will increase to $3300 (50% of $2200 plus $2200). The increase will be either all Va or all Maryland. Questions: 1. Compute the apportioment similar to Case 1 in two separate scenarios--the expansion is in Virginia or the expansion in Maryland 2. Compute the total taxes similar to Case 1 for both scenarios. What is your recommendation where to expand? sales cost to perform TI payroll property (average) total 16000 6400 1200 2200 virginia maryland 8000 8000 5000 7000 1900 1400 1000 300 Attached is the next assignment. You are asked to analyze a variety of case patterns to see impact of service income being apportioned on either cost of performance or Sourced to market (i.e. customer), 3 factor apportionment v. 1 factor, and, impact of unitary or consolidated rules. This is a new case so

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Apportionment Scenario A Expansion in Virginia Total sales 16000 New revenues 50 of 16000 8000 New Virginia revenues 35 of 8000 2800 New Mary...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started