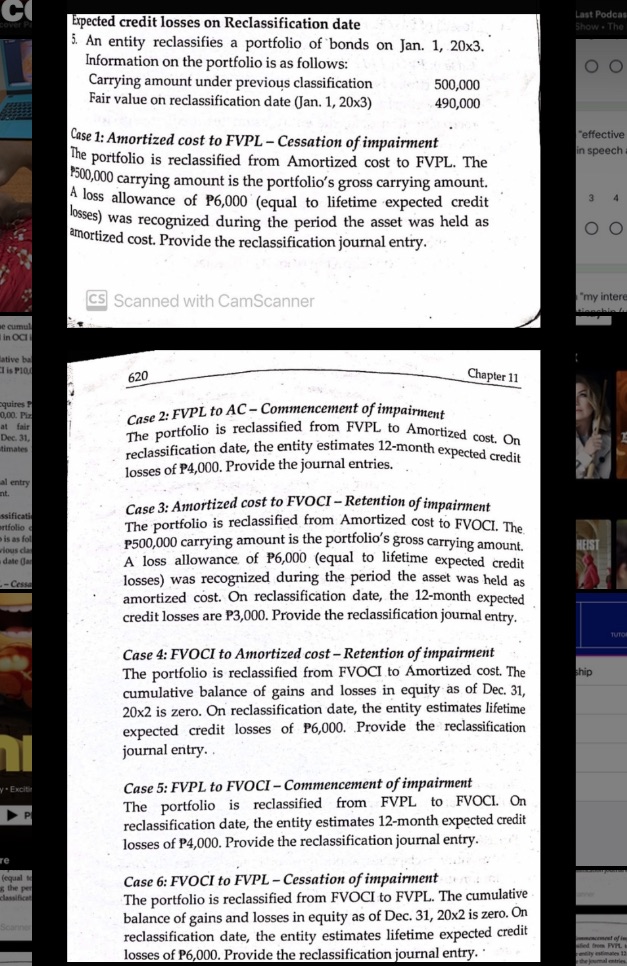

Expected credit losses on Reclassification date Last Podcar Show . The 5. An entity reclassifies a portfolio of bonds on Jan. 1, 20x3. Information on the portfolio is as follows: o o Carrying amount under previous classification 500,000 Fair value on reclassification date (Jan. 1, 20x3) 490,000 Case 1: Amortized cost to FVPL - Cessation of impairment effective The portfolio is reclassified from Amortized cost to FVPL. The in speech 500,000 carrying amount is the portfolio's gross carrying amount. A loss allowance of P6,000 (equal to lifetime expected credit 3 losses) was recognized during the period the asset was held as amortized cost. Provide the reclassification journal entry. OO CS Scanned with CamScanner "my inter e cumul in OCI ative b I is PIO 620 Chapter 11 squires P 0,00. Pir Case 2: FVPL to AC - Commencement of impairment at fair Dec. 31, The portfolio is reclassified from FVPL to Amortized cost. On timates reclassification date, the entity estimates 12-month expected credit losses of P4,000. Provide the journal entries. . entry nt. sificati Case 3: Amortized cost to FVOCI - Retention of impairment atfolio The portfolio is reclassified from Amortized cost to FVOCI. The is as fol vious cla P500,000 carrying amount is the portfolio's gross carrying amount. HEIST date Ja A loss allowance of P6,000 (equal to lifetime expected credit losses) was recognized during the period the asset was held as amortized cost. On reclassification date, the 12-month expected credit losses are P3,000. Provide the reclassification journal entry. Case 4: FVOCI to Amortized cost - Retention of impairment The portfolio is reclassified from FVOCI to Amortized cost. The hip cumulative balance of gains and losses in equity as of Dec. 31, 20x2 is zero. On reclassification date, the entity estimates lifetime expected credit losses of P6,000. Provide the reclassification journal entry. . " Excitin Case 5: FVPL to FVOCI - Commencement of impairment The portfolio is reclassified from FVPL to FVOCI. On reclassification date, the entity estimates 12-month expected credit losses of P4,000. Provide the reclassification journal entry. Case 6: FVOCI to FVPL - Cessation of impairment The portfolio is reclassified from FVOCI to FVPL. The cumulative balance of gains and losses in equity as of Dec. 31, 20x2 is zero. On reclassification date, the entity estimates lifetime expected credit what of i losses of P6,000. Provide the reclassification journal entry. "