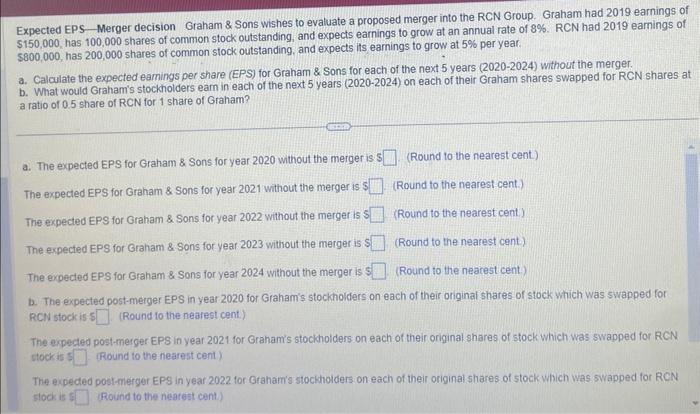

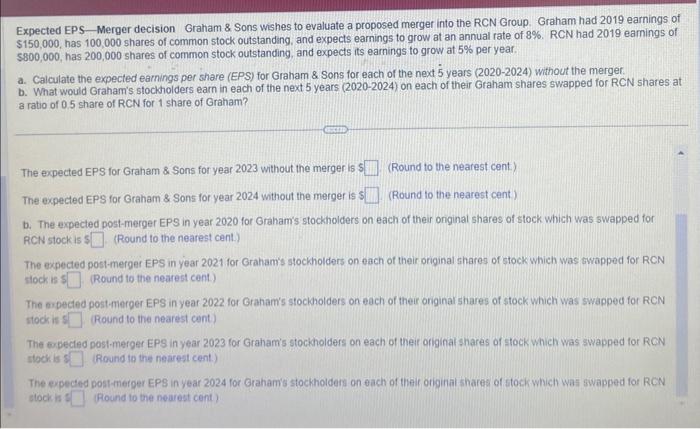

Expected EPS Merger decision Graham \& Sons wishes to evaluate a proposed merger into the RCN Group. Graham had 2019 earnings o $150,000, has 100,000 shares of common stock outstanding, and expects earnings to grow at an annual rate of 8%. RCN had 2019 earnings of $800,000, has 200,000 shares of common stock outstanding, and expects its earnings to grow at 5% per year. a. Calculate the expected eamings per share (EPS) for Graham \& Sons for each of the next 5 years (2020-2024) without the merger. b. What would Graham's stockholders earn in each of the next 5 years (2020-2024) on each of their Graham shares swapped for RCN shares at a ratio of 0.5 share of RCN for 1 share of Graham? a. The expected EPS for Graham \& Sons for year 2020 without the merger is \$ (Round to the nearest cent) The expected EPS for Graham \& Sons for year 2021 without the merger is \$ (Round to the nearest cent.) The expected EPS for Graham \& Sons for year 2022 without the merger is 5 (Round to the nearest cent.) The expected EPS for Graham \& Sons for year 2023 without the merger is \$ (Round to the nearest cent) The expected EPS for Graham \& Sons for year 2024 without the merger is S (Round to the nearest cent.) b. The expected post-merger EPS in year 2020 for Graham's stockholders on each of their original shares of stock which was swapped for RCN stock is (Round to the nearest cent.) The expected post-merger EPS in year 2021 for Graham's stocihoiders on each of their original shares of stock which was swapped for RCN stock is 1 (Round to the nearest cent) The expeded posi-merger EPS in year 2022 for Graham's stocktolders on each of their original shares of stock which was swapped for RCN slock is : Round to the nearest cent.) Expected EPS Merger decision Graham \& Sons wishes to evaluate a proposed merger into the RCN Group. Graham had 2019 earnings of $150,000, has 100,000 shares of common stock outstanding, and expects earnings to grow at an annual rate of 8%. RCN had 2019 eamings of $800,000, has 200,000 shares of common stock outstanding, and expects its earnings to grow at 5% per year. a. Calculate the expected earnings per share (EPS) for Graham \& Sons for each of the next 5 years (2020-2024) without the merger b. What would Graham's stockholders earn in each of the next 5 years (2020-2024) on each of their Graham shares swapped for RCN shares at a ratio of 0.5 share of RCN for 1 share of Graham? The expected EPS for Graham \& Sons for year 2023 without the merger is $ (Round to the nearest cent.) The expected EPS for Graham \& Sons for year 2024 without the merger is \$ (Round to the nearest cent) b. The expected post-merger EPS in year 2020 for Graham's stockholders on each of their onginal shares of stock which was swapped for RCN stockis 5 (Round to the nearest cent.) The expected post-merger EPS in year 2021 for Graham's stockholders on each of their original shares of stock which was swapped for RCN slock is 1 (Round to the nearest cent.) The erpected post-merger EPS in year 2022 for Graham's stockholders on each of their original shares of stock which was swapped for RCN stockis 1 Round to the nearest cent) The 6rpected post-merger EPS in year 2023 for Graham's stockholders on each of their originat shares of stock which was swapped tor RCN stock is 1 (Round to the nearest cent.) The expeded post-merger EPS in year 2024 for Graham's stockholders on each of their originai shares of stock which was swapped fot RCN stock is 1 (Round to the nearest cent