Answered step by step

Verified Expert Solution

Question

1 Approved Answer

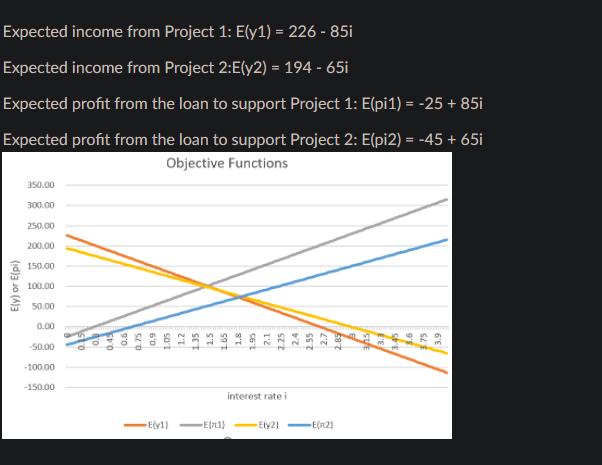

Expected income from Project 1: E(y1) = 226 - 85i Expected income from Project 2:E(y2) = 194 - 65i Expected profit from the loan

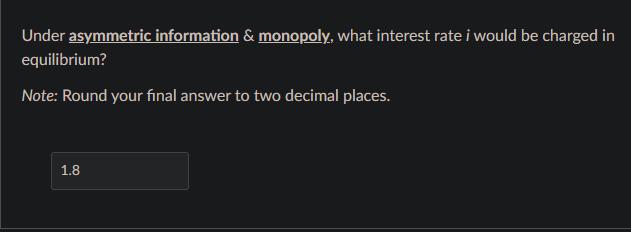

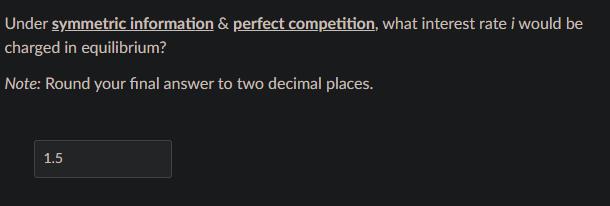

Expected income from Project 1: E(y1) = 226 - 85i Expected income from Project 2:E(y2) = 194 - 65i Expected profit from the loan to support Project 1: E(pi1) = -25 +85i Expected profit from the loan to support Project 2: E(pi2) = -45 + 65i Objective Functions E(y) or E(pi) 350.00 300.00 250.00 200.00 150.00 100.00 50.00 0.00 -50.00 -100.00 -150.00 0.75 60 sort -E(v1) 1.2 E(71) interest rate i -Ely21 2.55 -E(21 Under asymmetric information & monopoly, what interest rate i would be charged in equilibrium? Note: Round your final answer to two decimal places. 1.8 Under symmetric information & monopoly, what interest rate i would be charged in equilibrium? Note: Round your final answer to two decimal places. 1.5 Under symmetric information & perfect competition, what interest rate i would be charged in equilibrium? Note: Round your final answer to two decimal places. 1.5

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started