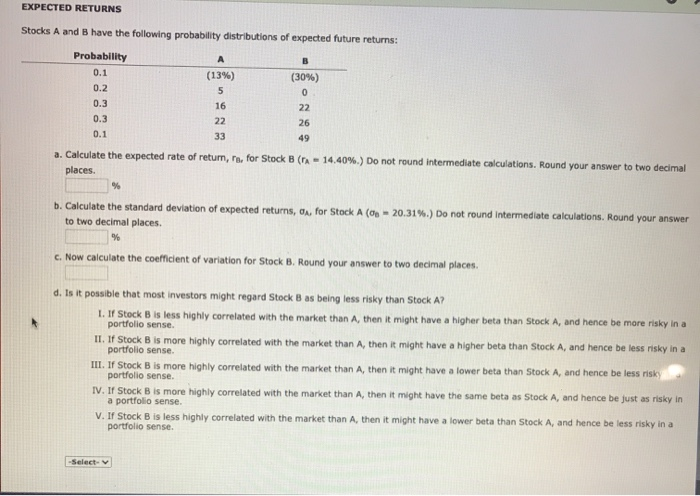

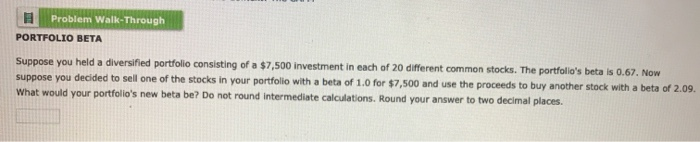

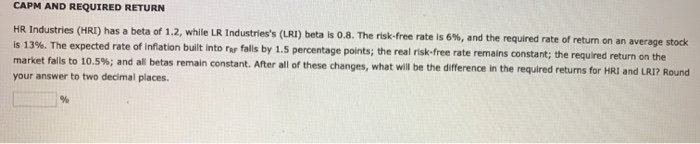

EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: Probability B 0.1 (13%) (30%) 0.2 5 0 0.3 16 22 0.3 22 26 0.1 33 49 a. Calculate the expected rate of return, re,for Stock B (A-14,40%.) Do not round intermediate calculations. Round your answer to two decimal places. b. Calculate the standard deviation of expected returns, os, for Stock A (0-20.31%.) Do not round Intermediate calculations. Round your answer to two decimal places. % c. Now calculate the coefficient of variation for Stock B. Round your answer to two decimal places. d. Is it possible that most investors might regard Stock B as being less risky than Stock A? 1. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. II. If Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense III. If Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky portfolio sense. IV. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. V. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. -Select- Problem Walk-Through PORTFOLIO BETA Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio's beta is 0.67. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 2.09. What would your portfolio's new beta be? Do not round Intermediate calculations. Round your answer to two decimal places. CAPM AND REQUIRED RETURN HR Industries (HRT) has a beta of 1.2, while LR Industries's (LRI) beta is 0.8. The risk-free rate is 6%, and the required rate of return on an average stock is 13%. The expected rate of inflation built into rap falls by 1.5 percentage points; the real risk-free rate remains constant; the required return on the market falls to 10.5%; and all betas remain constant. After all of these changes, what will be the difference in the required returns for HRI and LRI? Round your answer to two decimal places. % EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: Probability B 0.1 (13%) (30%) 0.2 5 0 0.3 16 22 0.3 22 26 0.1 33 49 a. Calculate the expected rate of return, re,for Stock B (A-14,40%.) Do not round intermediate calculations. Round your answer to two decimal places. b. Calculate the standard deviation of expected returns, os, for Stock A (0-20.31%.) Do not round Intermediate calculations. Round your answer to two decimal places. % c. Now calculate the coefficient of variation for Stock B. Round your answer to two decimal places. d. Is it possible that most investors might regard Stock B as being less risky than Stock A? 1. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. II. If Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense III. If Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky portfolio sense. IV. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. V. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. -Select- Problem Walk-Through PORTFOLIO BETA Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio's beta is 0.67. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 2.09. What would your portfolio's new beta be? Do not round Intermediate calculations. Round your answer to two decimal places. CAPM AND REQUIRED RETURN HR Industries (HRT) has a beta of 1.2, while LR Industries's (LRI) beta is 0.8. The risk-free rate is 6%, and the required rate of return on an average stock is 13%. The expected rate of inflation built into rap falls by 1.5 percentage points; the real risk-free rate remains constant; the required return on the market falls to 10.5%; and all betas remain constant. After all of these changes, what will be the difference in the required returns for HRI and LRI? Round your answer to two decimal places. %