Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Expedition Company worked on five jobs during May: Jobs A 1 0 , B 2 0 , C 3 0 , D 4 0 ,

Expedition Company worked on five jobs during May: Jobs A B C D and E At the end of May, the job cost sheets for these five jobs contained the following data:tableJob AJob BJob CJob DJob EBeginning balance,$$$$$

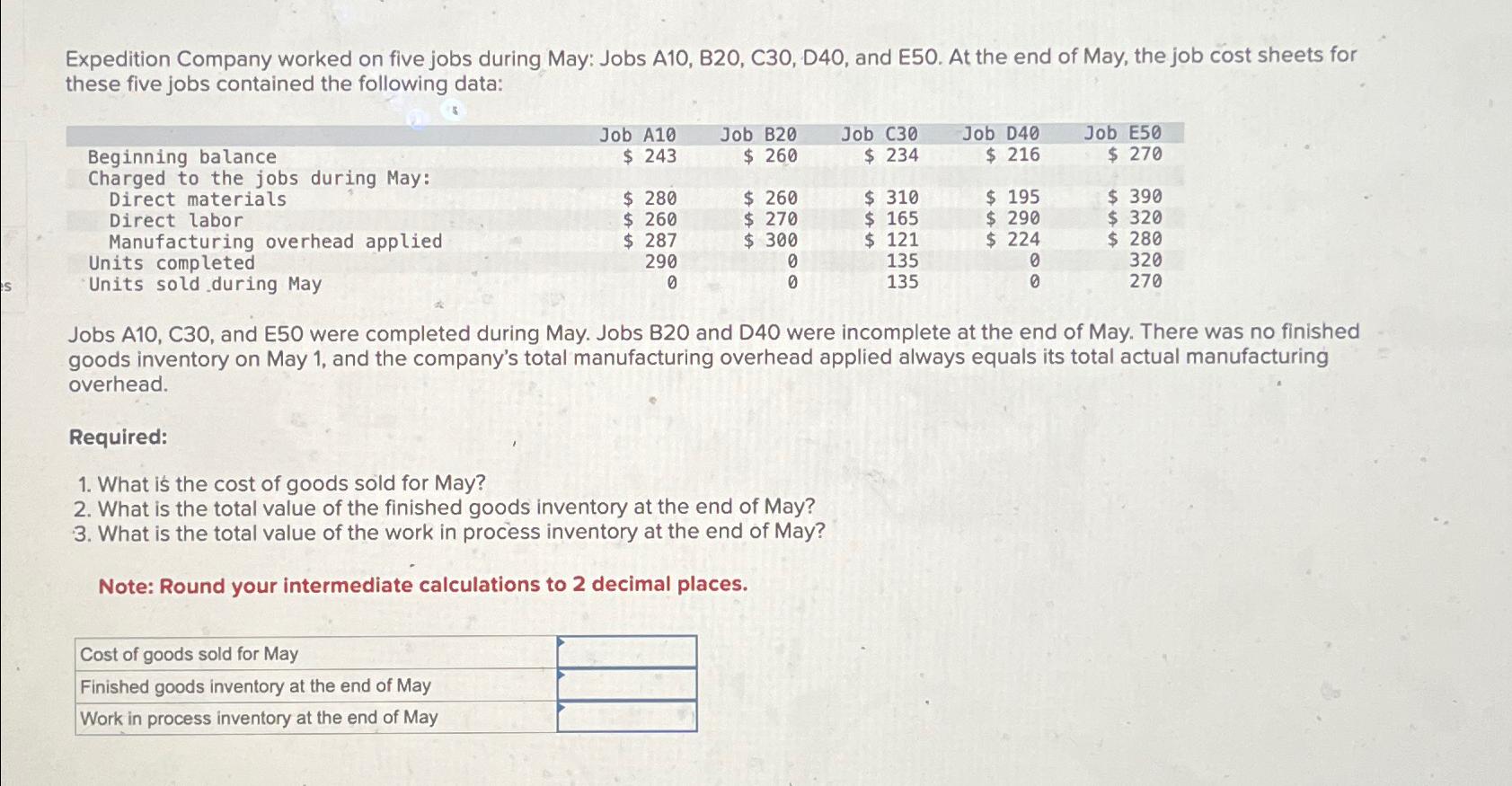

Expedition Company worked on five jobs during May: Jobs A10, B20, C30, D40, and E50. At the end of May, the job cost sheets for these five jobs contained the following data: Beginning balance Job A10 $ 243 Job B20 $ 260 Job C30 Job D40 Job E50 $ 234 $ 216 $ 270 Charged to the jobs during May: Direct materials $ 280 $ 260 $ 310 $ 195 $ 390 Direct labor $ 260 $ 270 $ 165 $ 290 $ 320 Manufacturing overhead applied $ 287 $ 300 $ 121 $ 224 $ 280 Units completed Units sold during May 290 0 0 0 135 135 0 0 320 270 Jobs A10, C30, and E50 were completed during May. Jobs B20 and D40 were incomplete at the end of May. There was no finished goods inventory on May 1, and the company's total manufacturing overhead applied always equals its total actual manufacturing overhead. Required: 1. What is the cost of goods sold for May? 2. What is the total value of the finished goods inventory at the end of May? 3. What is the total value of the work in process inventory at the end of May? Note: Round your intermediate calculations to 2 decimal places. Cost of goods sold for May Finished goods inventory at the end of May Work in process inventory at the end of May

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Expedition Company May Job Costing We can use the provided data to calculate the cost of goods sold ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started