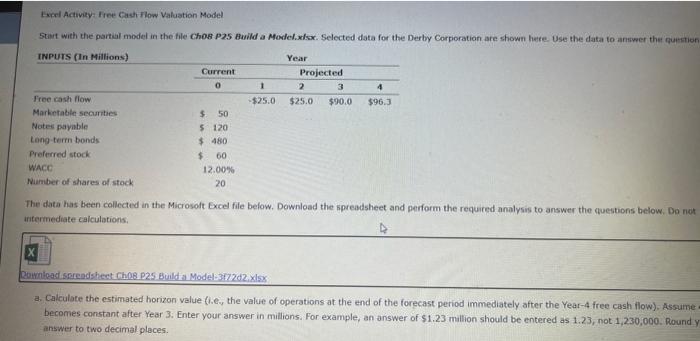

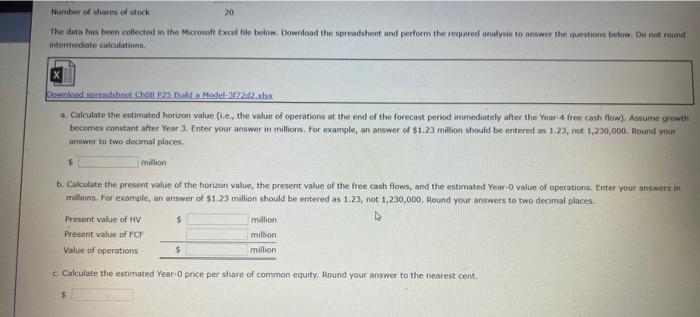

Expel Activey: Free Cast flow Valuation Model Stait with the partial model in the file chos P2S Build a Moslel.xisx. Selected data for the Derby Corporation are shown here. Use the data to ansiper the puprion The data has been collected in the Microsolt Excel file below. Download the spreadsheet and perform the required analysis to answer the tquestions below. Do not ntermediate calculations. a. Calculate the estimated horizon value (i.e ey the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume becomes constant after Year 3. Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round y answer to two decimal places. Nuimber of shares of stock 20 Ther data has been collected in the Mrcrosoft Exod file below. Downlood the spreaduheet and perform the requared analysis ro answer the querstions belin, Do not round intermentate calculabone. a. Calculate the estimated horizon value (L,e., the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume qronth becomes constant after Year 3. Enter your answer in millions, For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000, Round your answer to two decimal places. F. milion b. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 value of operations, Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000, Round your answers to two decimal places. Calculefe the estimated Year-0 price per share of common equity. Round your answer to the nearest cent. 5 Expel Activey: Free Cast flow Valuation Model Stait with the partial model in the file chos P2S Build a Moslel.xisx. Selected data for the Derby Corporation are shown here. Use the data to ansiper the puprion The data has been collected in the Microsolt Excel file below. Download the spreadsheet and perform the required analysis to answer the tquestions below. Do not ntermediate calculations. a. Calculate the estimated horizon value (i.e ey the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume becomes constant after Year 3. Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round y answer to two decimal places. Nuimber of shares of stock 20 Ther data has been collected in the Mrcrosoft Exod file below. Downlood the spreaduheet and perform the requared analysis ro answer the querstions belin, Do not round intermentate calculabone. a. Calculate the estimated horizon value (L,e., the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume qronth becomes constant after Year 3. Enter your answer in millions, For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000, Round your answer to two decimal places. F. milion b. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 value of operations, Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000, Round your answers to two decimal places. Calculefe the estimated Year-0 price per share of common equity. Round your answer to the nearest cent. 5