Experiencing rapid growths, Fawcett Enterprise was in need of fresh capital in early 2010. company considered taking out long-term bank loans but was deterred

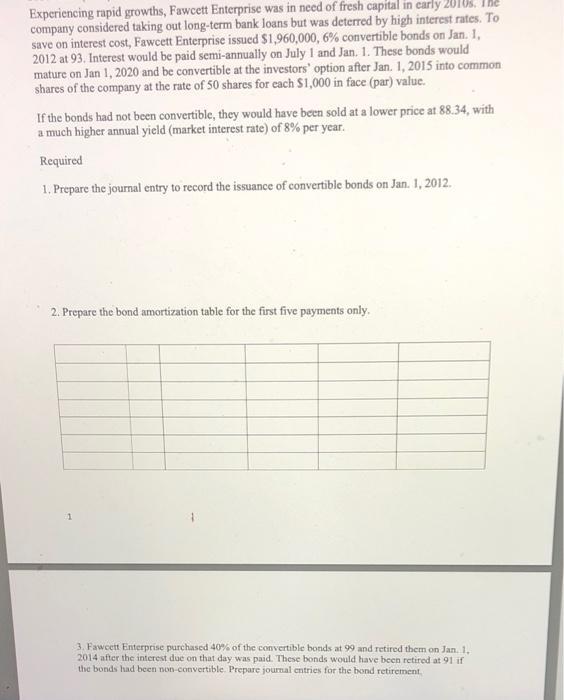

Experiencing rapid growths, Fawcett Enterprise was in need of fresh capital in early 2010. company considered taking out long-term bank loans but was deterred by high interest rates. To save on interest cost, Fawcett Enterprise issued $1,960,000, 6% convertible bonds on Jan. 1, 2012 at 93. Interest would be paid semi-annually on July 1 and Jan. 1. These bonds would mature on Jan 1, 2020 and be convertible at the investors' option after Jan. 1, 2015 into common shares of the company at the rate of 50 shares for each $1,000 in face (par) value. If the bonds had not been convertible, they would have been sold at a lower price at 88.34, with a much higher annual yield (market interest rate) of 8% per year. Required 1. Prepare the journal entry to record the issuance of convertible bonds on Jan. 1, 2012. 2. Prepare the bond amortization table for the first five payments only. 1 3. Fawcett Enterprise purchased 40% of the convertible bonds at 99 and retired them on Jan. 1, 2014 after the interest due on that day was paid. These bonds would have been retired at 91 if the bonds had been non-convertible. Prepare journal entries for the bond retirement,

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Option C is correct In synchronous machine when the armature terminal are shorted the fiel...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started