Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Expert please help with this question. Good Earth Products produces orange juice and candied orange peels. A 1,000-pound batch of oranges, costing $500, is transformed

Expert please help with this question.

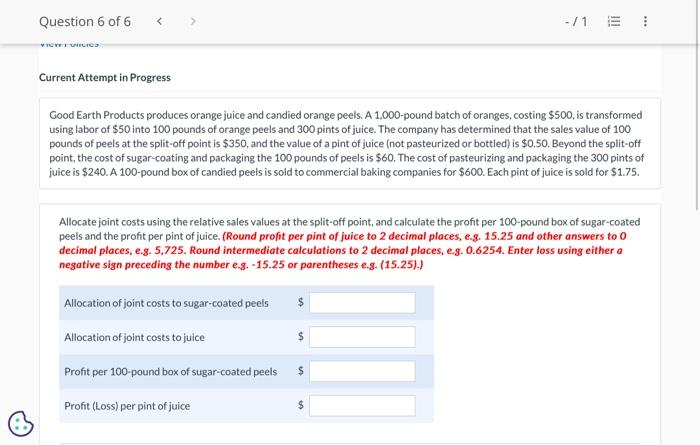

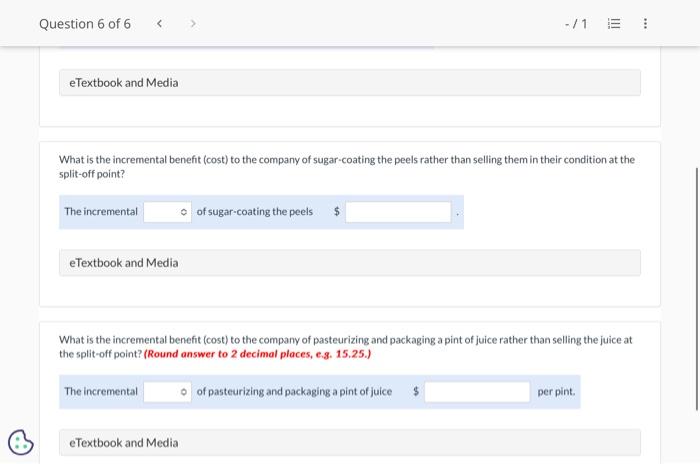

Good Earth Products produces orange juice and candied orange peels. A 1,000-pound batch of oranges, costing $500, is transformed using labor of $50 into 100 pounds of orange peels and 300 pints of juice. The company has determined that the sales value of 100 pounds of peels at the split-off point is $350, and the value of a pint of juice (not pasteurized or bottled) is $0.50. Beyond the split-off point, the cost of sugar-coating and packaging the 100 pounds of peels is $60. The cost of pasteurizing and packaging the 300 pints of juice is $240. A 100 -pound box of candied peels is sold to commercial baking companies for $600. Each pint of juice is sold for $1.75. Allocate joint costs using the relative sales values at the split-off point, and calculate the profit per 100-pound box of sugar-coated peels and the profit per pint of juice. (Round profit per pint of juice to 2 decimal places, e.g. 15.25 and other answers to 0 decimal places, e.g. 5,725. Round intermediate calculations to 2 decimal places, e.g. 0.6254. Enter loss using either a negative sign preceding the number e.g. 15.25 or parentheses e.g. (15.25).) eTextbook and Media What is the incremental benefit (cost) to the company of sugar-coating the peels rather than selling them in their condition at the split-off point? The incremental of sugar-coating the peels eTextbook and Media What is the incremental benefit (cost) to the company of pasteurizing and packaging a pint of juice rather than selling the juice at the split-off point? (Round answer to 2 decimal places, e.g. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started