Expert tutors??.......its complete help me

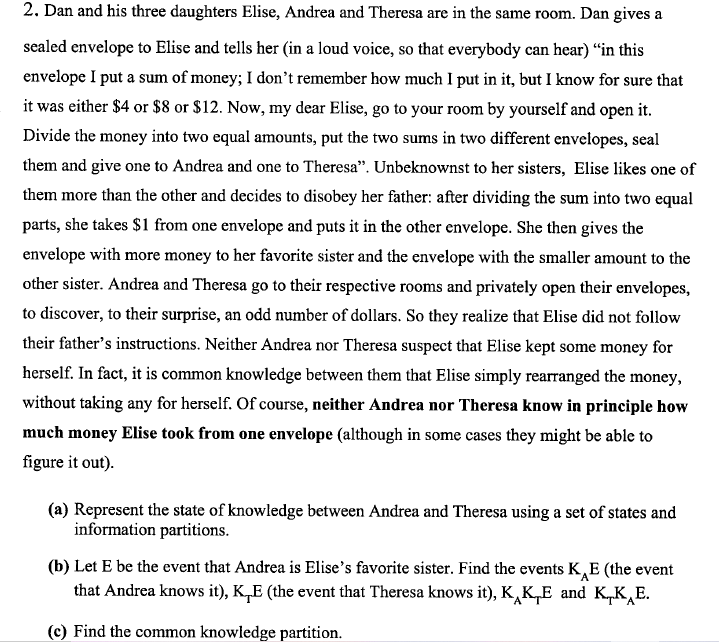

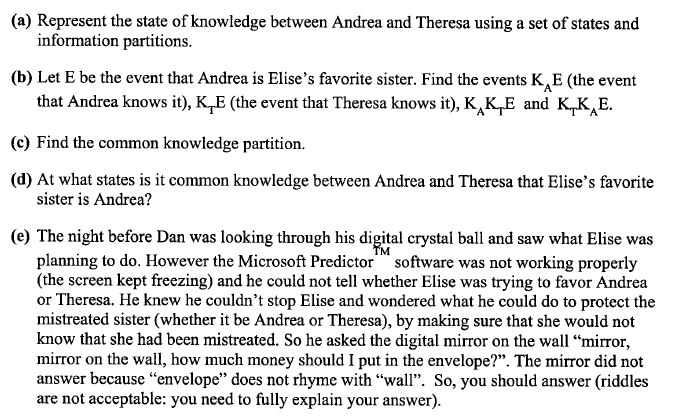

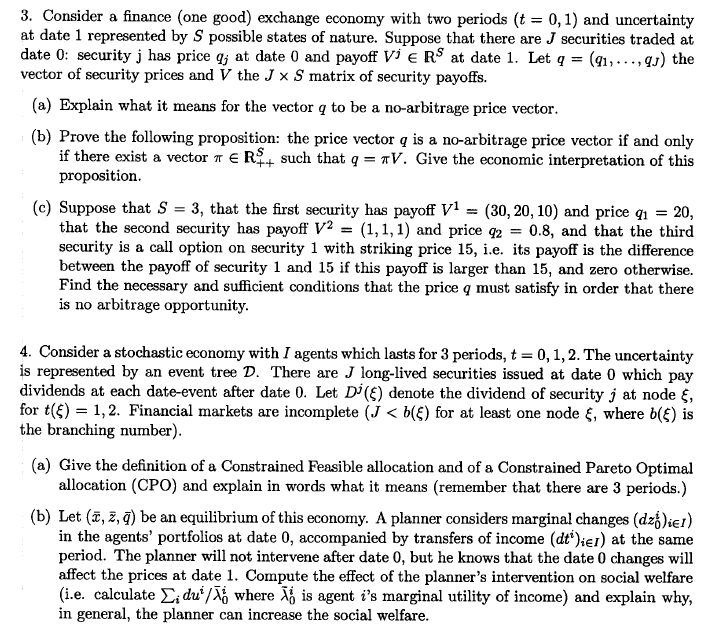

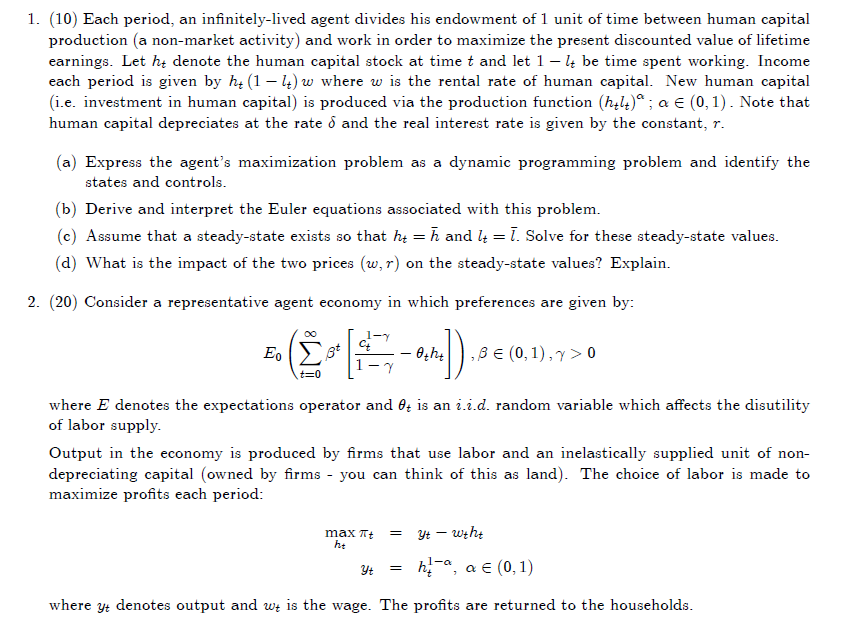

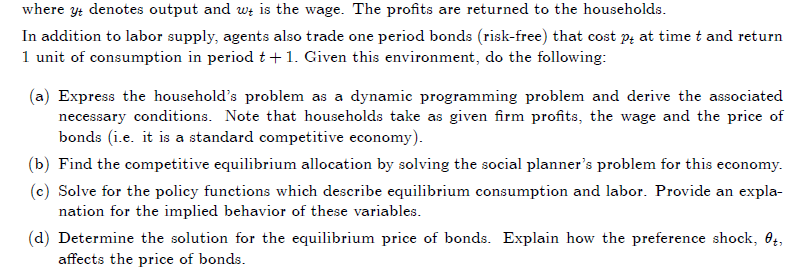

2. Dan and his three daughters Elise, Andrea and Theresa are in the same room. Dan gives a sealed envelope to Elise and tells her (in a loud voice, so that everybody can hear} \"in this envelope I put a stun of money; I don't remember how much I put in it, but I know for sure that it was either $4 or $8 or $12. blow, my dear Elise, go to your room by yourself and open it. Divide the money into two equal amounts, put the two sums in two different envelopes, seal them and give one to Andrea and one to Theresa". Unbeknownst to her sisters, Elise likes one of them more than the other and decides to disobey her father: after dividing the sent into two equal parts, she takes $1 from one envelope and puts it in the other envelope. She then gives the envelope with more money to her favorite sister and the envelope with the smaller amount to the other sister. Andrea and Theresa go to their respective rooms and privately open their envelopes, to discover, to their surprise, an odd number of dollars. So they realize tat Elise did not follow their father's instructions. Neither Andrea nor Theresa suspect that Elise kept some money for herself. In fact, it is conunon knowledge between them that Elise simply rearranged the money, without taking any for herself. Of course, neither Andrea nor Theresa know in principle how much money Elise took [rent one envelope {although in some cases they might be able to gure it out}. {a} Represent the state of knowledge between Andrea and Theresa using a set of states and information partitions. (h) Let E be the event that Andrea is Elise's favorite sister. Find the events KAE {the event that Andrea knows it}, KTE {the event that Theresa knows it), KKTE and K1KhE. (c) Find the cornmon knowledge partition. {a} Represent the state of knowledge between Andrea and Theresa using a set of states and information partitions. {h} Let E be the event that Andrea is Elise's favorite sister. Find the events KE {the event that Andrea knows it}, KTE (the event that Theresa knows it), KKTE and KIKAE. {c} Find the common knowledge partition. (d) At what states is it common knowledge between Andrea and Theresa that Elise's favorite sister is Andrea? {e} The night before Dan was looking through his digital crystal ball and saw what Elise was planning to do. However the Microsoft Predictor software was not working properly.r (the screen kept freezing) and he could not tell whether Elise was trying to favor Andrea or Theresa. He knew he couldn't stop Elise and wondered what he could do to protect the mistreated sister {whether it be Andrea or Theresa), by making sure that she would not know that she had been mistreated. So he asked the digital mirror on the wall \"mirror, mirror on the well, how much money should I put in the envelope?". The mirror did not answer because \"envelope\" does not rhyme with \"wall\". So, you should answer (riddles are not acceptable: you need to fully explain your answer}. 3. Consider a nance [one good) exchange economy with two periods {t = [1,1] and uncertainty at date 1 represented by S possible states of nature. Suppose that there are J securities traded at date : securityj has price a; at date [I and payoff W E RS at date 1. Let r; = [m,....oy:l the vector of security pricm and V the J x 5' matrix of security payoffs. {a} Explain what it means for the vector 9 to be a no-arbitrage price vector. {h} Prove the following proposition: the price vector a is a nor-arbitrage price vector if and only if there exist a vector at E 111+ such that q = 111'. Give the economic interpretation of this proposition. {c} Suppose that S = 3. that the rst security has payoff V1 = {3D,2, 10) and price in = 2|], that the second security has paw' V3 a: [1.1.1] and price a: = 0.8, and that the third security is a call option on security 1 with striking price 15, i.e. its payo is the di'erence between the payoff of security 1 and 15 if this payoff is larger than 15, and zero otherwise. Find the necmsary and suicient conditions that the price 1;! must satisfy in order that there is no arbitrage opportunity. 4. Consider a stochastic economy with I agents which lasts for 3 periods1 t = , 1, 2. The uncertainty is represented by an event tree 17'. There are J long-lived securities issued at date {1 which pay dividends at each date-event after date I]. Let Dips] denote the dividend of security 3' at node 15, for obi} = 1, 2. Financial markets are incomplete (J :2 ME) for at least one node E, where HE) is the branching number). [a] Give the denition of a Constrained Feasible allocation and of a Constrained Pareto Optimal allocation (CPU) and explain in words what it means [remember that there are 3 periods.) (b) Let {:E, 2, o] be an equilibrium of this economy. A planner considers marginal changes [der in the agents' portfolios at date III, accompanied by transfers of income [dt'JIrE at the same period. The planner will not intervene after date i], but he knows that the date I} changes will affect the pricm at date 1. Compute the effect oi the planner's intervention on social welfare (Le. calculate :5 dn'fi where if] is agent i's marginal utility of income} and explain why. in general, the planner can increase the social welfare. 1. [10) Each periodT an innitelylived agent divides his endowment of 1 unit of time between human capital production [:a nonmarket activity) and work in order to maximize the present discounted value of lifetime earnings. Let h; denote the human capital stock at time t and let 1 It be time spent working. Income each period is given by h: (1 it] m where w is the rental rate of human capital. New human capital [i.e. investment in human capital} is produced via the production function (hilt? ; o: E (D, 1} - Note that human capital depreciates at the rate 5 and the real interest rate is given by the constant, T- [a} Express the agent's maximization problem as a dynamic programming problem and identify the states and controls- [b] Derive and interpret the Euler equations associated with this problem- {c} Assume that a steadystate exists so that h; = fl and I; = 1. Solve for these steadystate values. [d] What is the impact of the two prices [11:- r} on the steadystate values? Explain- 2. [20) Consider a representative agent economy in which preferences are given by: no 11Ir El: (23* [firml) .3 E {tum} 0 i=0 where E denotes the expectations operator and 6': is an \"Li-d. random variable which affects the disutility of labor supply. Output in the economy is produced by rms that use labor and an inelastically supplied unit of non depreciating capital [owned by rms you can think of this as land). The choice of labor is made to maximize prots each period: areash: maxm yt : hiR: Cl: E (031} where gt denotes output and m is the wage- The prots are returned to the households. where gt denotes output and to; is the wage. The prots are returned to the households. In addition to labor supply, agents also trade one period bonds [riskfree} that cost p; at time t and return 1 unit of consumption in period t | 1. Given this environment, do the following: {a} Express the household's problem as a dynamic programming problem and derive the associated necessary conditions. Note that households take as given rm prots1 the wage and the price of bonds {i.e. it is a standard competitive economy}. (b) Find the competitive equilibrium allocation by solving the social plannerls problem for this economy. (c) Solve for the policy functions which describe equilibrium consumption and labor. Provide an expla- nation for the implied behavior of these variables. (:1) Determine the solution for the equilibrium price of bonds. Explain how the preference shock. t, affects the price of bonds