Question

Explain changes in GROSS PROFIT MARGIN for Disney FROM YEAR TO YEAR using the concepts and theories listed below (choose concepts/theories from list below). Make

Explain changes in GROSS PROFIT MARGIN for Disney FROM YEAR TO YEAR using the concepts and theories listed below (choose concepts/theories from list below). Make sure you consider the mergers and acquisitions that Disney made and alliances that Disney entered. How did they affect Disneys performance from year to year? Bullet points are preferred.

You must explain the changes year by year. Please use format below:

2012- explain changes in gross profit margin using concepts/theories AND mention mergers/acquisitions (Lucasfilm)

2013- explain changes in gross profit margin using concepts/theories

2014- explain changes in gross profit margin using concepts/theories AND mention mergers/acquisitions (Maker Studios)

2015- explain changes in gross profit margin using concepts/theories

2016- explain changes in gross profit margin using concepts/theories

Mergers and Acquisitions

2012- Lucasfilm (film and television production company) in the amount of $4.05 billion

2014- Maker Studios (global digital media brand and the original creator network) in the amount of $500 million

Concepts/Theories

Competitive Attack

First-mover

Late-Mover

Horizontal Merger and Acquisition

Vertical Integration Strategies

Outsourcing

Porter's Diamond of National Competitive Advantage

Exchange rate shifts

Impact of Government Policies and Economic Conditions in Host Countries

Cross-country cultural or market conditions

Entering and Competing in International Markets

International Multi-domestic strategy

International Global Strategy

International Transnational Strategy

Using location to build competitive advantage

Profit Sanctuaries and Cross-Border strategic moves

Business Diversification

Building Shareholder

Business Diversification

Ethical Universalism

Ethical Relativism

Ethical standards for strategy

Corporate Social Responsibility

Environmental Sustainability

Strategic Vision

Competitive Weapons

Competitive Pressure

Company's competitively important resources and capabilities

Competitive deficiencies

Company internal strengths

Value chain activities/competitiveness

Low cost provider competitive strategy

Broad differentiation competitive strategy

Focused low cost competitive strategy

Focused differentiation competitive strategy

Best cost provider competitive strategy

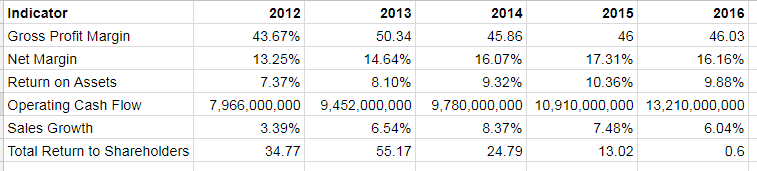

Indicator Gross Profit Margin Net Margin Return on Assets Operating Cash Flow Sales Growth Total Return to Shareholders 2016 46.03 16.16% 9.88% 7,966,000,000 9,452,000,000 9.780,000,000 10,910,00,000 13,210,000,000 6.04% 0.6 2012 43.67% 13.25% 7 37% 2013 50.34 14.64% 81 0% 2014 45.86 16.07% 9.32% 2015 46 17.31% 10.36% 3.39% 6.54% 8.37% 7.48% 34.77 55.17 24.79 13.02 Indicator Gross Profit Margin Net Margin Return on Assets Operating Cash Flow Sales Growth Total Return to Shareholders 2016 46.03 16.16% 9.88% 7,966,000,000 9,452,000,000 9.780,000,000 10,910,00,000 13,210,000,000 6.04% 0.6 2012 43.67% 13.25% 7 37% 2013 50.34 14.64% 81 0% 2014 45.86 16.07% 9.32% 2015 46 17.31% 10.36% 3.39% 6.54% 8.37% 7.48% 34.77 55.17 24.79 13.02Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started